Across the recent three months, 6 analysts have shared their insights on Ecolab ECL, expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

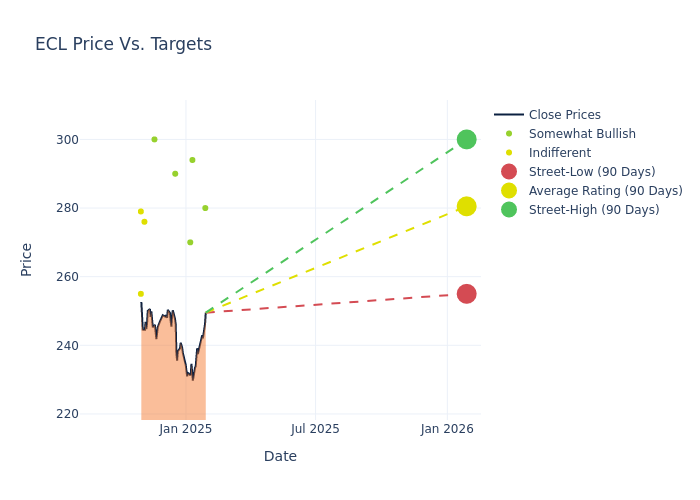

Analysts have set 12-month price targets for Ecolab, revealing an average target of $285.0, a high estimate of $300.00, and a low estimate of $270.00. Surpassing the previous average price target of $281.50, the current average has increased by 1.24%.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Ecolab. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vincent Andrews | Morgan Stanley | Raises | Overweight | $280.00 | $263.00 |

| Ashish Sabadra | RBC Capital | Lowers | Outperform | $294.00 | $306.00 |

| Charles Neivert | Piper Sandler | Lowers | Overweight | $270.00 | $305.00 |

| John McNulty | BMO Capital | Raises | Outperform | $290.00 | $279.00 |

| Manav Patnaik | Barclays | Raises | Overweight | $300.00 | $260.00 |

| Joshua Spector | UBS | Maintains | Neutral | $276.00 | $276.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ecolab. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ecolab compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Ecolab's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Ecolab's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Ecolab analyst ratings.

Delving into Ecolab's Background

Ecolab produces and markets cleaning and sanitation products for the industrial manufacturing, hospitality, healthcare, and life sciences markets. The firm is the global market share leader in this category with a wide array of products and services, including dish and laundry washing systems, pest control, and infection control products. Additionally, Ecolab sells customized water management solutions across its end markets. The company has a strong hold on the US market and is growing its presence abroad.

Financial Insights: Ecolab

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Ecolab's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 1.02%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Ecolab's net margin excels beyond industry benchmarks, reaching 18.42%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Ecolab's ROE excels beyond industry benchmarks, reaching 8.75%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Ecolab's ROA excels beyond industry benchmarks, reaching 3.38%. This signifies efficient management of assets and strong financial health.

Debt Management: Ecolab's debt-to-equity ratio is below the industry average. With a ratio of 0.97, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.