High-rolling investors have positioned themselves bullish on Vertiv Hldgs VRT, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in VRT often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 28 options trades for Vertiv Hldgs. This is not a typical pattern.

The sentiment among these major traders is split, with 78% bullish and 17% bearish. Among all the options we identified, there was one put, amounting to $30,355, and 27 calls, totaling $1,409,576.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $120.0 for Vertiv Hldgs, spanning the last three months.

Analyzing Volume & Open Interest

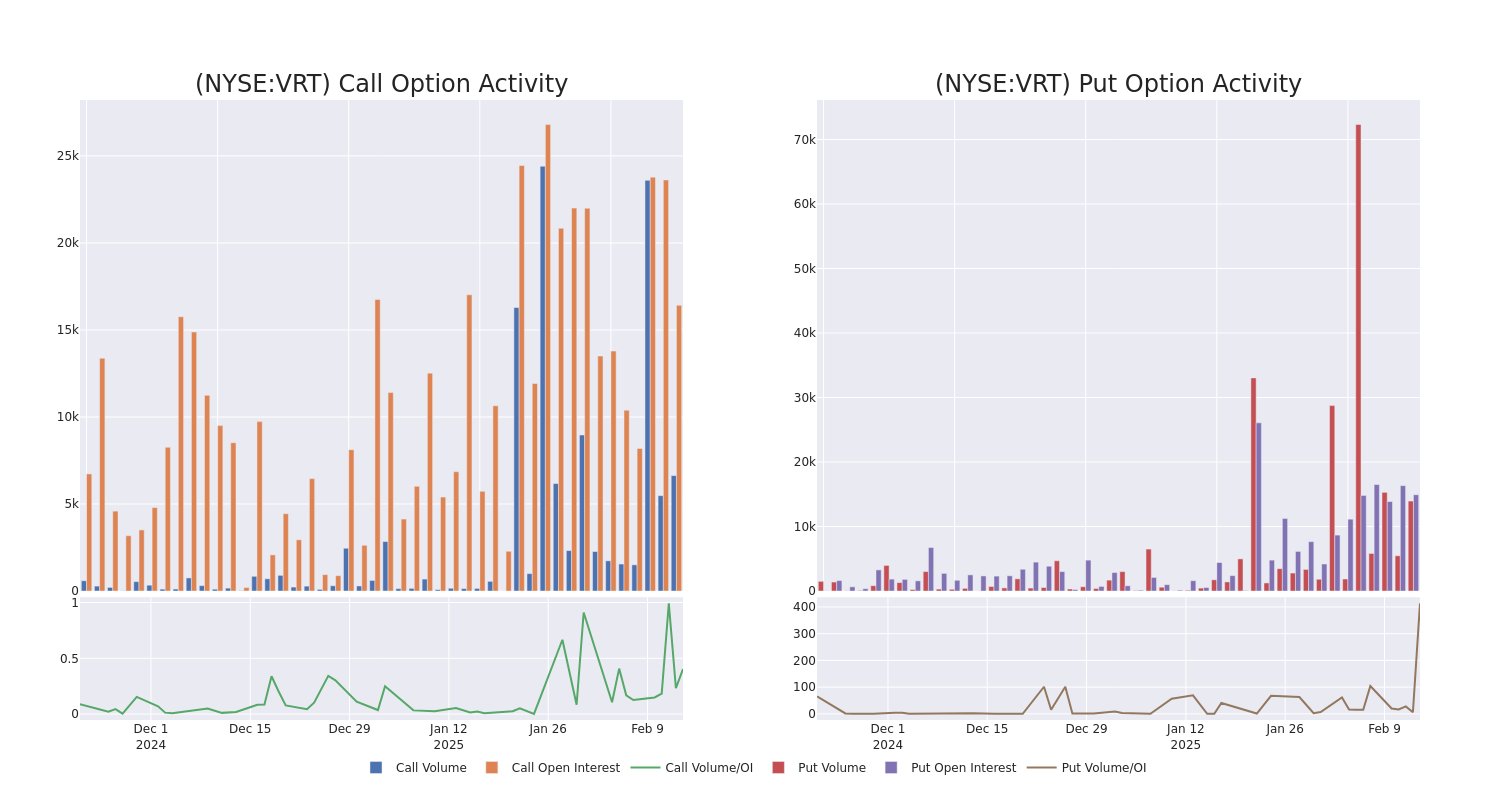

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vertiv Hldgs's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vertiv Hldgs's significant trades, within a strike price range of $80.0 to $120.0, over the past month.

Vertiv Hldgs Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | TRADE | NEUTRAL | 01/16/26 | $33.55 | $30.95 | $32.22 | $100.00 | $235.2K | 1.3K | 86 |

| VRT | CALL | TRADE | BEARISH | 01/16/26 | $23.25 | $23.0 | $23.0 | $120.00 | $115.0K | 792 | 101 |

| VRT | CALL | TRADE | BULLISH | 06/20/25 | $37.2 | $35.5 | $36.55 | $80.00 | $109.6K | 617 | 50 |

| VRT | CALL | SWEEP | BULLISH | 02/28/25 | $7.5 | $7.25 | $7.5 | $108.00 | $75.0K | 554 | 23 |

| VRT | CALL | TRADE | BULLISH | 02/28/25 | $7.45 | $7.15 | $7.35 | $108.00 | $73.5K | 554 | 324 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Having examined the options trading patterns of Vertiv Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Vertiv Hldgs's Current Market Status

- Trading volume stands at 1,558,552, with VRT's price up by 3.76%, positioned at $112.11.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 64 days.

Expert Opinions on Vertiv Hldgs

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $128.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Barclays has decided to maintain their Equal-Weight rating on Vertiv Hldgs, which currently sits at a price target of $131. * In a cautious move, an analyst from Melius Research downgraded its rating to Hold, setting a price target of $125.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.