Investors with a lot of money to spend have taken a bullish stance on TJX Companies TJX.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TJX, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for TJX Companies.

This isn't normal.

The overall sentiment of these big-money traders is split between 54% bullish and 45%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $84,000, and 10, calls, for a total amount of $473,304.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $125.0 for TJX Companies over the last 3 months.

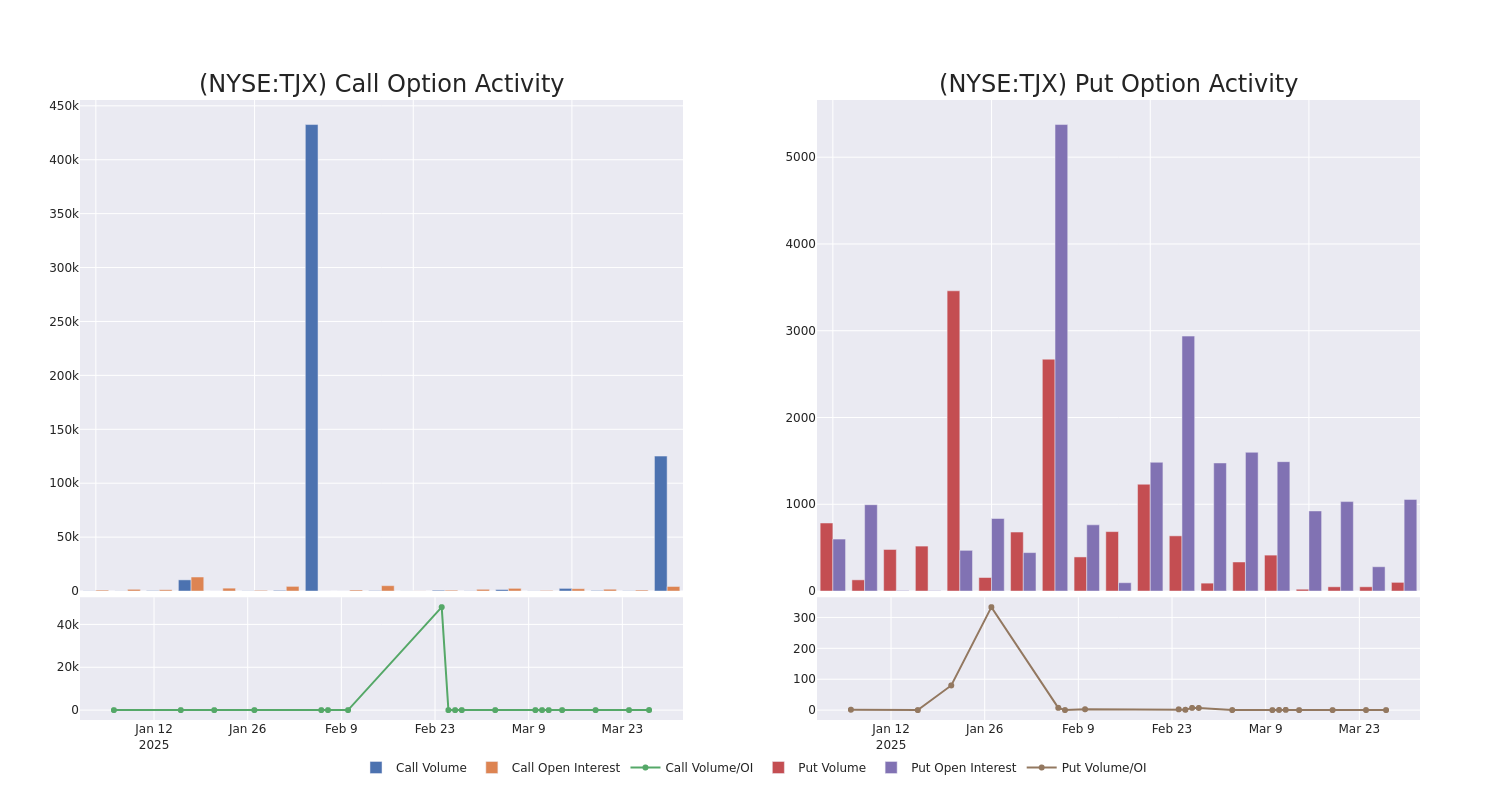

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in TJX Companies's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to TJX Companies's substantial trades, within a strike price spectrum from $120.0 to $125.0 over the preceding 30 days.

TJX Companies Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TJX | PUT | SWEEP | BEARISH | 01/16/26 | $8.4 | $8.0 | $8.4 | $120.00 | $84.0K | 1.0K | 100 |

| TJX | CALL | TRADE | BULLISH | 04/17/25 | $0.66 | $0.65 | $0.66 | $125.00 | $66.0K | 3.7K | 12.5K |

| TJX | CALL | TRADE | BEARISH | 04/17/25 | $0.7 | $0.66 | $0.66 | $125.00 | $66.0K | 3.7K | 11.4K |

| TJX | CALL | TRADE | BULLISH | 04/17/25 | $0.65 | $0.64 | $0.65 | $125.00 | $65.0K | 3.7K | 12.4K |

| TJX | CALL | SWEEP | BEARISH | 09/19/25 | $8.8 | $8.6 | $8.6 | $120.00 | $61.0K | 467 | 77 |

About TJX Companies

TJX Companies is the leading off-price retailer of apparel, accessories, and home merchandise in the United States. The firm leverages its more than 20,000 global vendor relationships to procure and sell brand-name merchandise at prices 20%-60% cheaper than conventional retail channels. TJX opportunistically purchases excess inventory that stems from manufacturing overruns and retail closeout sales. The retailer disperses its vast and disparate merchandise across its 5,000 global stores, creating a treasure-hunt shopping experience for consumers. Over three quarters of TJX's sales are derived from the United States, primarily via the T.J. Maxx, Marshalls, and HomeGoods banners. About 10% of sales are from Canada and 12% from Europe and Australia.

Having examined the options trading patterns of TJX Companies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of TJX Companies

- Currently trading with a volume of 2,027,456, the TJX's price is up by 1.04%, now at $120.95.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 55 days.

Expert Opinions on TJX Companies

In the last month, 4 experts released ratings on this stock with an average target price of $141.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Baird persists with their Outperform rating on TJX Companies, maintaining a target price of $140. * An analyst from Telsey Advisory Group persists with their Outperform rating on TJX Companies, maintaining a target price of $145. * Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on TJX Companies with a target price of $145. * Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for TJX Companies, targeting a price of $137.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for TJX Companies, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.