During the last three months, 4 analysts shared their evaluations of Darling Ingredients DAR, revealing diverse outlooks from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

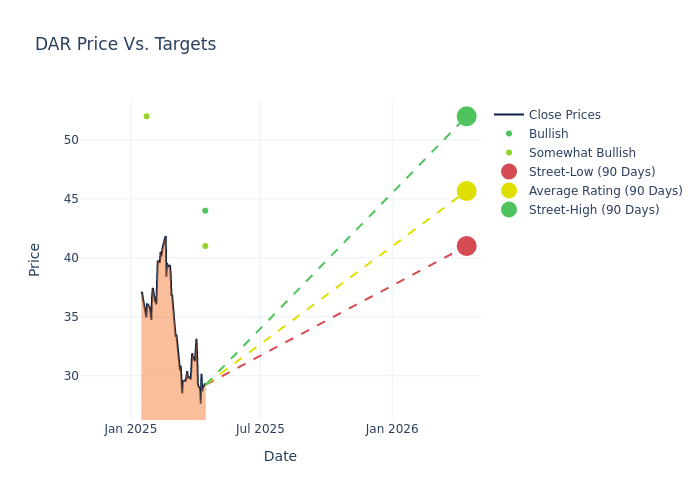

Analysts have recently evaluated Darling Ingredients and provided 12-month price targets. The average target is $45.25, accompanied by a high estimate of $52.00 and a low estimate of $41.00. Observing a downward trend, the current average is 4.39% lower than the prior average price target of $47.33.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Darling Ingredients by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Thomas Palmer |Citigroup |Lowers |Buy | $44.00|$45.00 | |Ben Kallo |Baird |Lowers |Outperform | $41.00|$51.00 | |Thomas Palmer |Citigroup |Lowers |Buy | $44.00|$46.00 | |Pooran Sharma |Stephens & Co. |Announces |Overweight | $52.00|- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Darling Ingredients. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Darling Ingredients compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Darling Ingredients's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Darling Ingredients's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Darling Ingredients analyst ratings.

Delving into Darling Ingredients's Background

Darling Ingredients Inc develops and manufactures sustainable ingredients for customers in the pharmaceutical, food, pet food, fuel, and fertilizer industries. It collects and transforms all aspects of animal by-product streams into ingredients, including gelatin, fats, proteins, pet food ingredients, fertilizers. Also, the company recovers and converts used cooking oil and bakery remnants into feed and fuel ingredients. Darling has three primary business segments which are feed ingredients contributing the majority of revenue, food ingredients, and fuel ingredients. It provides grease trap services for food businesses and sells various equipment for collecting and delivering cooking oil. The company derives the majority of its revenue from customers in North America.

Darling Ingredients's Economic Impact: An Analysis

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Decline in Revenue: Over the 3M period, Darling Ingredients faced challenges, resulting in a decline of approximately -12.17% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Darling Ingredients's net margin excels beyond industry benchmarks, reaching 7.19%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.28%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Darling Ingredients's ROA excels beyond industry benchmarks, reaching 0.99%. This signifies efficient management of assets and strong financial health.

Debt Management: Darling Ingredients's debt-to-equity ratio stands notably higher than the industry average, reaching 0.97. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.