After Tuesday's trading session, the bulls appear to have regained control of the markets.

What a difference a few days can make in this business, right? Just about a week ago, traders were freaking out in response to David Tepper's suggestion that hedge funds shouldn't have the pedal to the metal at this time.

Just like that, two days of hard-earned gains were reversed, the momentum stocks were back in the tank and it looked like the bears were about to win the day.

The big correction traders began looking for never came: Russia didn't annex Ukraine, the ECB began serious talks to improve the economy in Europe and economic data in the US continued to beat expectations.

Related: Can The Bull Market Survive A Momentum Meltdown?

On that note, the final GDP growth rate for Q1 is likely to come in below zero. But, the good news is that it can be blamed on the weather. And the general consensus seems to be that Q2's growth rate for the economy might have a four-handle on it.

As such, investors are starting to realize that growth in the U.S. might not be dead after all. The bottom line is that with improving economic expectations comes higher stock prices - especially when expectations are low.

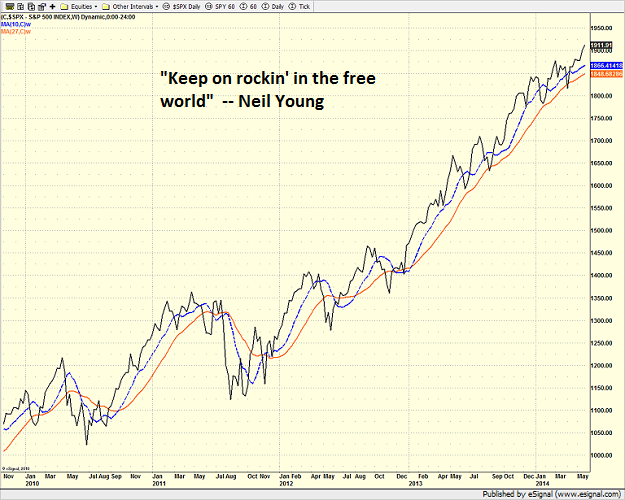

S&P 500 Weekly

Based on the weekly chart of the S&P 500, one couldn't be blamed for wondering what all the fuss has been about lately.

The action over the past few days has been very important. It is crucial to run through the charts because, as they say, a picture can indeed be worth a thousand words.

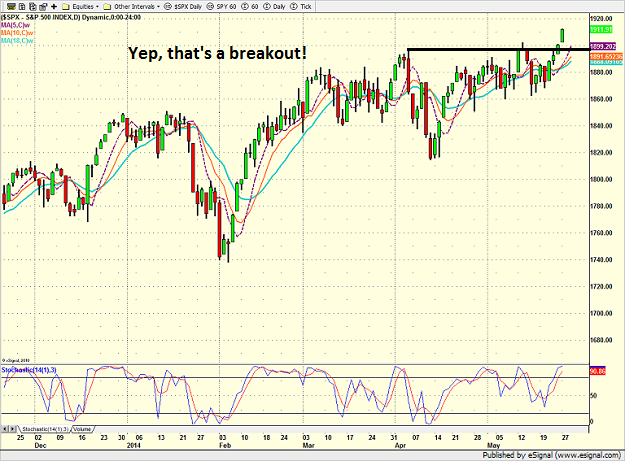

S&P 500 Daily

After Friday, the key question was whether or not the S&P 500 had actually broken out of the recent resistance zone. Yes, the index did close at an all-time high, but a magnifying glass was needed to see it on a chart.

Given that follow-through has been exceptionally tough to come by this year, well, a lot of folks had their doubts about Friday's rally.

However, with Monday's gain tacked on, it is fairly clear that the S&P 500 has broken out to the upside. Therefore, the bulls will now be looking to defend their gains during the next bout of selling. The bottom line is that as long as the S&P 500 stays above 1900, the bulls are still in control of the markets.

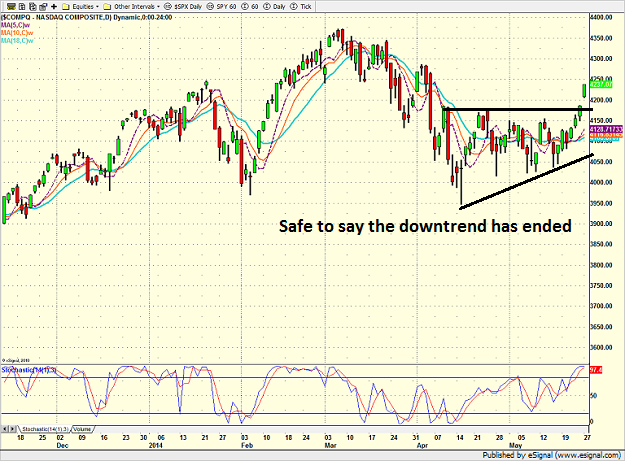

NASDAQ Daily

Some will argue that the chart of the NASDAQ isn't nearly as compelling. Those seeing the glass as half empty will contend that the tech-heavy index is a long way from confirming the S&P's new high and as such, represents a technical divergence.

Related: Does The S&P Have Anywhere To Move?

In the opposing dugout, those adorned in rose-colored glasses may argue that the NASDAQ doesn't have to "confirm" anything at this stage. No, the idea here is that the downtrend that had been in place for about two months appears to have ended.

Yes, the NASDAQ has resistance overhead to deal with. Yes, this could certainly be problematic at some point - perhaps soon. But the key is that stocks appear to be trending higher at the moment. And since just about everybody on the planet was expecting the bears to be in control of the markets, well, the fact that there are uptrends to be found on many charts is certainly a positive development.

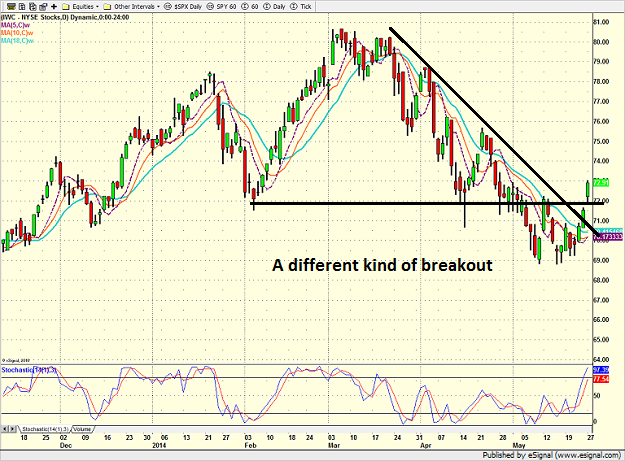

The Micro-Caps, which is where the real damage occurred during the mo-mo meltdown, appear to have stabilized to some extent.

iShares Micro-Cap ETF (IWC) Daily

To be sure, the chart of the iShares Micro-Cap ETF IWC is ugly. But remember, history has shown that if stocks involved with a momentum meltdown are able to stabilize, then the overall market needn't have to experience a serious decline.

The thinking is fairly straightforward here. Up until the biotech, internet and social media darlings started to tank in earnest, the stock market was in pretty good shape. But when the leaders get hit - and get hit hard - a 'mo-mo meltdown' can weigh on investor sentiment. Oftentimes, the meltdown can cause investors to lose faith in the overall market, which, in turn, produces more selling and a decent sized correction.

However, IF the overall market can survive the meltdown and IF the mo-mo names don't drag down the rest of the market with them, the market has shown several times in the past that it can avoid calamity.

So, IF the S&P can remain above 1900 for a while, IF the NASDAQ can stay above 4150 and IF the low in the IWC can hold up, then the bulls might be able to begin yet another leg higher in what continues to be a most impressive bull market run.

Positions in stocks mentioned: SPY,

Click Here to Receive the full "Daily State of the Markets" report each morning before the opening bell. Dave's full report includes a list of the current market drivers, trend analysis, key technical levels, six momentum indicators, two early warning indicators, the weekly State of the Market Model, pre-open analysis, and a thought for the day.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.