While the situation in Iraq continues to intensify on both the political and military fronts, Tuesday's out-of-the-blue decline in the stock market took many investors by surprise.

The retreat in prices ended a string of relatively weak advances, and has a lot of folks once again calling for the start of the meaningful correction that just about everyone on the planet has been looking for.

Why The Dive?

The pullback appeared to be triggered initially by a punk two-year note auction, as the first big wave of sell algos were aligned with the release of the auction results. From there, the algos took over and a "key reversal" day was manufactured by the big banks/hedge funds and their computers.

Regardless of the excuse provided by the media for the nastiness, the bottom line is such a move was due. Stocks came into Tuesday with an overbought condition, sentiment readings that had reached extreme levels, waning momentum and a very high level of complacency. In other words, the table had been set for the bears to have a day or three in the sun.

It's Not a Breakout...

The question, of course, is whether Tuesday afternoon's tank-job was another in a long string of one- or two-day wonders, or the start of something serious -- meaning a decline of five to 10 percent.

Related: What History Tells Us About Markets And Middle East Crises

On this subject, a Wall Street cliché may be applicable. Although the phrase, "It's not a breakout if you're the one breaking it out" refers to upside breakouts, the reverse may work here.

Tuesday's triple-digit decline in the DJIA wasn't accompanied by any obvious catalyst. No, this appeared to be a case of the big boys and girls playing with their computer toys. An "ignition algo" is run to try and get the trend-following algos' attention. Then, once a significant trend develops on an intraday basis, everybody jumps into the pool, so to speak. From there, the algos chase each other in one direction until either a reversal occurs or the closing bell rings. Boom: there's instant volatility.

In short, this appears to be what happened Tuesday, as the reversal day looked to be "manufactured" by a series of sell programs and algos chasing their tails.

Something Meaningful?

In order to try and determine whether or not Tuesday's dance to the downside was something to be concerned about, or just a case of hedge fund folly, turn to the charts. One can't always tell exactly what's going on in the markets from looking at charts, but it is usually a good place to start.

First up is the S&P 500...

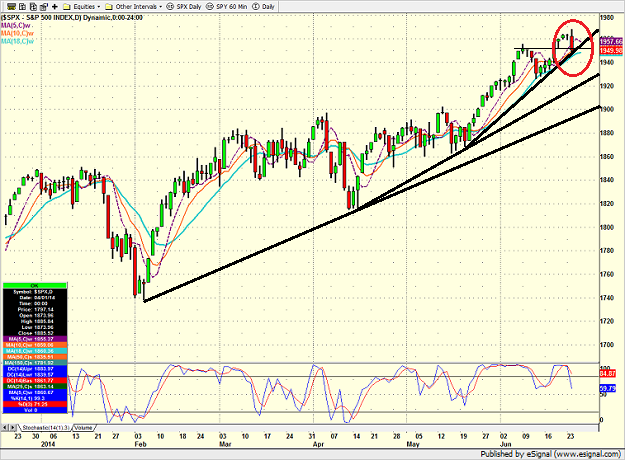

S&P 500 - Daily

There are four lines drawn on this chart. There is the long-term uptrend line which began in February, the intermediate-term uptrend line which began in April and the shorter-term uptrend line that began in mid-May. The first point is that all three trendlines remain intact on the S&P.

Related: Is Investor Sentiment Flashing A Warning?

The next point to make is the venerable S&P finished at a very important juncture Tuesday, as denoted by the red oval on the chart.

In short, the S&P closed right on the near-term uptrend line as well as the old high at around 1950. Therefore, both the uptrend and the breakout are currently at risk and the near-term action should reveal a lot.

Now take a peek at the rest of the major indices in order to get a feel for whether or not the bulls are still in control...

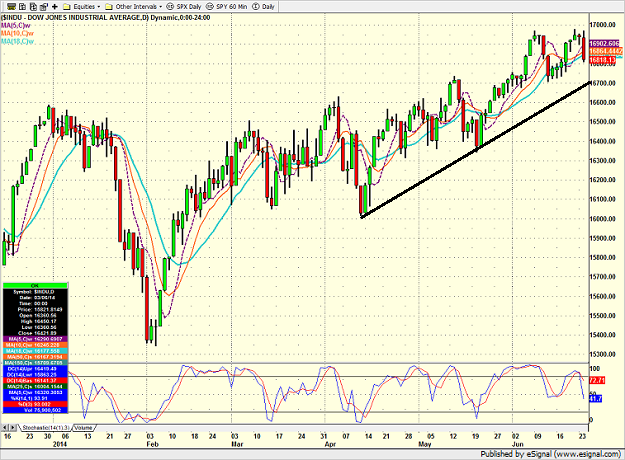

DJIA - Daily

While the S&P chart is in pretty good shape, the chart of the Dow is less so. From a short-term perspective, it appears that a double-top has been formed. This would be confirmed by a meaningful close below 16,700 or so. As it happens, that would also put the intermediate-term uptrend at risk. Thus, the 16,700 area is a very important line in the sand for the DJIA.

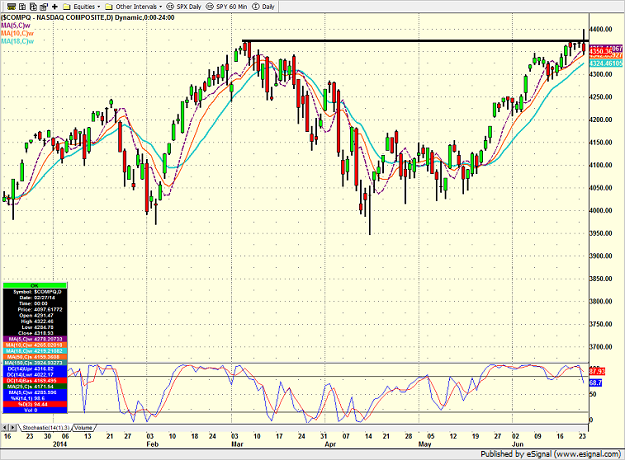

NASDAQ Composite - Daily

Although the chart of the NASDAQ remains in an uptrend from a short- and intermediate-term perspective, there also appears to be a longer-term, potential double top forming.

Traders should watch to see if the bears can create a "lower low" on the chart and view the 4285 level as very important. A break below this level may indicate that the bears have gained the upper hand.

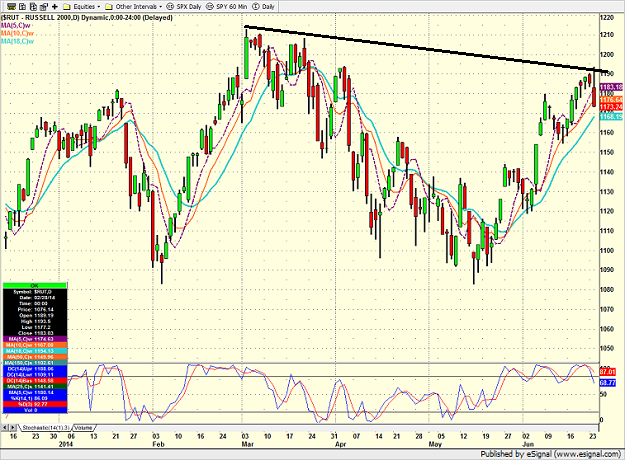

Russell 2000 - Daily

Finally, there is the chart of the Russell 2000 small-caps. Recall that this is where the majority of the damage from the "momentum meltdown" occurred. As such, this remains an important battle ground.

In looking at the chart, it becomes clear that an intermediate- to longer-term downtrend remains in play. Therefore, the important areas to watch are Tuesday's high and 1154. The key is that a break in either direction would be telling, and be a clear indication of which team was in control of the action.

In sum, while the charts definitely don't "tell all," they can give clues about what to expect next and to help identify what moves/levels are important.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.