By Dian L. Chu, Economic Forecasts & Opinions

With just over 1.3 billion people (as of mid-2008), China accounts for about 20 percent of the world population and needless to say, is the world's largest and most populous country. Although the country's population growth has been somewhat slowed by the one child policy (in effect since 1979), its internet population has been growing leaps and bounds over the last ten years. (Figure 1)

As of June 2010, China's netizenship climbed to 420 million, more than the population of the entire United States. However, the penetration rate of internet users remains low at only 31.8 percent, compared with a more mature U.S. market of near 70 percent.

Some believe the growth rate of China's internet users will slow along with its economy as the rate went from 53 percent yearly growth in 2007 down to about 29 percent in 2009 and is trending to be probably under 20 percent in 2010.

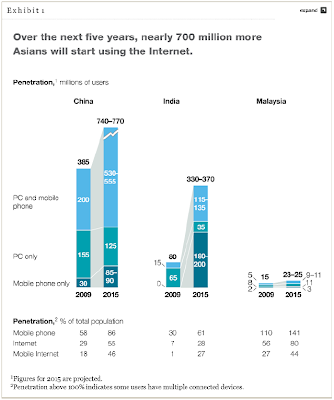

Now, McKinsey Quarterly just released a new forecast this week based on a survey conducted across China, India, and Malaysia. According to McKinsy, Asia's internet users will reach more than 1.1 billion on by 2015 (Exhibit 1). Furthermore, within five years, this market may generate revenues of more than $80 billion in internet commerce, access fees, device sales, etc. (Exhibit 2)

The McKinsey study also highlights the differences in the usage pattern and content preference among the three countries. But although they are at very different stages of their digital evolution, all three have one trend in common-- the increasing use of digital media such as instant messaging, social networks, gaming, and streaming video.

This has vast implications in future marketing efforts for companies targeting the increasingly affluent Asian/Chinese consumers. It also means tremendous growth opportunity for the technology sector such as communication infrastructure, content and web services providers, E-commerce platforms and high tech mobile devices.

However, China--the biggest digital market of Asia--has proven quite elusive for foreign companies, mostly due to market specific factors including policies, and cultural difference. Homegrowns –such as Taobao.com (淘寶網) and Baidu (百度)--without a doubt rule China with dominant market share advantage, while the de facto exits of Google and eBay serve as two business case studies of “How To Fumble in China”.

For instance, Taobao, owned by Alibaba Group (1688:HK), has over 80% of China's online shopping market, trailed far behind by Tencent's Paipai and eBay/Eachnet. there is already speculation about an IPO of Taobao amid strong growth. Baidu (BIDU), on the other hand, boasts search market revenue share in China of 70 percent for the first time as of Q2 2010, while Google's market share had languished from 31% to 24% in the same period.

The good news is that things are expected to change with Beijing slowly starting to relax restrictions to let in foreign companies. Nevertheless, domestic companies like Alibaba and Baidu will likely share the bulk of the monetization potential of 770 million internet users in the next five year, while foreign companies learn and adapt to the treacherous market of China.

China already has one of the world's largest optic transmitting network, and is spending billions to build up even more infrastructure. While the developed countries race to catch up, a fastly growing broadband population could bring an "Eastern shift" of technology innovation making China "the cool kid on the block", where the rest of the world look for the hottest devices and apps, very much like the U.S. and Europe today.

Meanwhile, investors interested in riding the digital dragon of Asia could invest through companies already with foothold in the region, and/or technology focused exchange-traded funds (ETFs).

Infrastructure companies such as Alcatel-Lucent (ALU), China Telecom (CHA), and China Mobile(CHL), niche mobile devices like iPhone and iPad by Apple (AAPL), in addition to Baidu (BIDU), are a few examples of individual stocks.

ETF choices include Global X China Technology ETF (CHIB), Claymore China Technology ETF (CQQQ), iShares China ETF (FXI), while iShares MSCI Taiwan Index Fund (EWT) gives exposure to “The Other China” that's more digitally advanced.

Note: Full report of the McKinsy Quarterly is available here (free registration)

Disclosure: No Positions

Dian L. Chu, Sept. 24, 2010

Market News and Data brought to you by Benzinga APIsWith just over 1.3 billion people (as of mid-2008), China accounts for about 20 percent of the world population and needless to say, is the world's largest and most populous country. Although the country's population growth has been somewhat slowed by the one child policy (in effect since 1979), its internet population has been growing leaps and bounds over the last ten years. (Figure 1)

As of June 2010, China's netizenship climbed to 420 million, more than the population of the entire United States. However, the penetration rate of internet users remains low at only 31.8 percent, compared with a more mature U.S. market of near 70 percent.

Some believe the growth rate of China's internet users will slow along with its economy as the rate went from 53 percent yearly growth in 2007 down to about 29 percent in 2009 and is trending to be probably under 20 percent in 2010.

Now, McKinsey Quarterly just released a new forecast this week based on a survey conducted across China, India, and Malaysia. According to McKinsy, Asia's internet users will reach more than 1.1 billion on by 2015 (Exhibit 1). Furthermore, within five years, this market may generate revenues of more than $80 billion in internet commerce, access fees, device sales, etc. (Exhibit 2)

Based on McKinsey's projection, over the next five years, while China's internet users will double in size hitting 55 percent of the population, India's netizenship is posed to increase near five-fold to 28 percent of its population. However, due to market size and income levels, the revenue growth potential clearly resides with China, growing around 38 percent per year through 2015 (Exhibit 2).

.

This has vast implications in future marketing efforts for companies targeting the increasingly affluent Asian/Chinese consumers. It also means tremendous growth opportunity for the technology sector such as communication infrastructure, content and web services providers, E-commerce platforms and high tech mobile devices.

However, China--the biggest digital market of Asia--has proven quite elusive for foreign companies, mostly due to market specific factors including policies, and cultural difference. Homegrowns –such as Taobao.com (淘寶網) and Baidu (百度)--without a doubt rule China with dominant market share advantage, while the de facto exits of Google and eBay serve as two business case studies of “How To Fumble in China”.

For instance, Taobao, owned by Alibaba Group (1688:HK), has over 80% of China's online shopping market, trailed far behind by Tencent's Paipai and eBay/Eachnet. there is already speculation about an IPO of Taobao amid strong growth. Baidu (BIDU), on the other hand, boasts search market revenue share in China of 70 percent for the first time as of Q2 2010, while Google's market share had languished from 31% to 24% in the same period.

The good news is that things are expected to change with Beijing slowly starting to relax restrictions to let in foreign companies. Nevertheless, domestic companies like Alibaba and Baidu will likely share the bulk of the monetization potential of 770 million internet users in the next five year, while foreign companies learn and adapt to the treacherous market of China.

China already has one of the world's largest optic transmitting network, and is spending billions to build up even more infrastructure. While the developed countries race to catch up, a fastly growing broadband population could bring an "Eastern shift" of technology innovation making China "the cool kid on the block", where the rest of the world look for the hottest devices and apps, very much like the U.S. and Europe today.

Meanwhile, investors interested in riding the digital dragon of Asia could invest through companies already with foothold in the region, and/or technology focused exchange-traded funds (ETFs).

Infrastructure companies such as Alcatel-Lucent (ALU), China Telecom (CHA), and China Mobile(CHL), niche mobile devices like iPhone and iPad by Apple (AAPL), in addition to Baidu (BIDU), are a few examples of individual stocks.

ETF choices include Global X China Technology ETF (CHIB), Claymore China Technology ETF (CQQQ), iShares China ETF (FXI), while iShares MSCI Taiwan Index Fund (EWT) gives exposure to “The Other China” that's more digitally advanced.

Note: Full report of the McKinsy Quarterly is available here (free registration)

Disclosure: No Positions

Dian L. Chu, Sept. 24, 2010

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In: Communications EquipmentComputer HardwareInformation TechnologyIntegrated Telecommunication ServicesInternet Software & ServicesTelecommunication ServicesWireless Telecommunication Services

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in