Private equity titans like The Blackstone Group LP BX, KKR & Co. KKR, The Carlyle Group CG and Apollo Global Management APO are involved in so many different lines of business and operate at such a large scale, that it can be difficult for average investors to understand how they operate and make money.

On October 16, The Blackstone Group released earnings and hosted an investor conference call to discuss results for the quarter ended September 30.

While it is useful to understand how recent performance compares with expectations and prior guidance; when it comes to private equity giants, it is equally important for investors to keep in mind the "big picture."

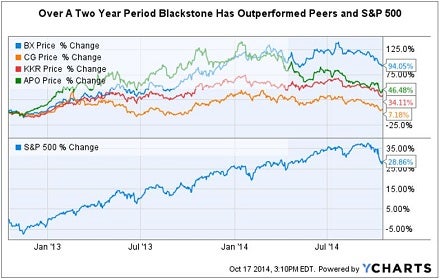

Two Year Snapshot

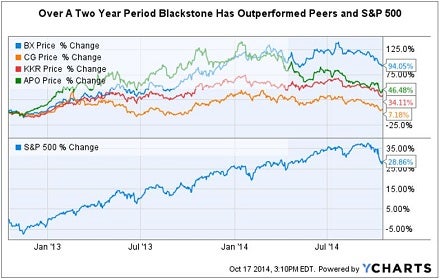

Blackstone investors have seen returns exceeding the S&P 500 by over a factor of three times during the past two years.

Performance YTD

However, year-to-date this sector has struggled underperformed the broader market.

Blackstone investors have seen returns exceeding the S&P 500 by over a factor of three times during the past two years.

Performance YTD

However, year-to-date this sector has struggled underperformed the broader market.

Private Equity - Conundrum For Investors?

Publicly traded alternative asset management firms can be more volatile than the broader market and more traditional financial service sectors. The underlying investments they manage, which include: global real estate, hedge funds, private equity, and leveraged buy-outs are not structured with quarter-over-quarter or even year-over-year performance in mind.

These firms are looking to take advantage of market dislocations, asset mispricing, lack of liquidity in a given asset class, and a host of other strategies that may play out over several years rather than any particular 90 day time interval.

Investors should keep in mind that the patient capital raised by private equity funds is usually focused on compounded annual growth rates (CAGRs) over a much longer time horizon -- typically five to seven years.

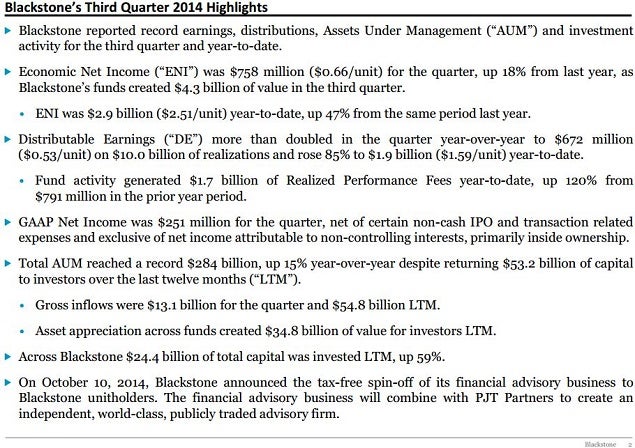

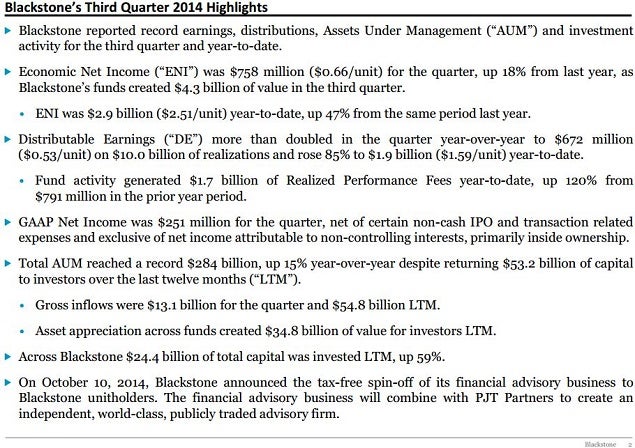

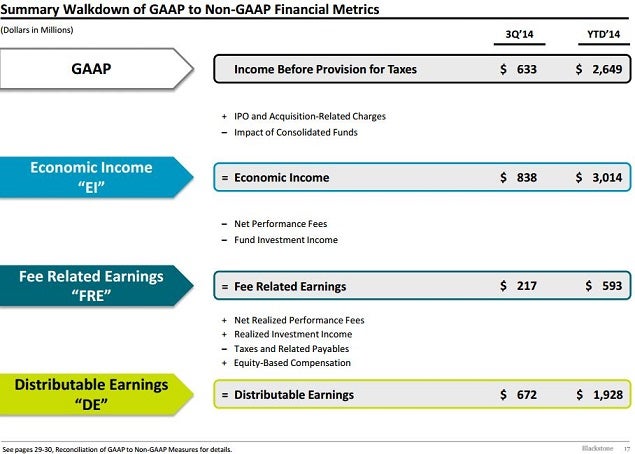

Blackstone Reported Another Strong Quarter

Private Equity - Conundrum For Investors?

Publicly traded alternative asset management firms can be more volatile than the broader market and more traditional financial service sectors. The underlying investments they manage, which include: global real estate, hedge funds, private equity, and leveraged buy-outs are not structured with quarter-over-quarter or even year-over-year performance in mind.

These firms are looking to take advantage of market dislocations, asset mispricing, lack of liquidity in a given asset class, and a host of other strategies that may play out over several years rather than any particular 90 day time interval.

Investors should keep in mind that the patient capital raised by private equity funds is usually focused on compounded annual growth rates (CAGRs) over a much longer time horizon -- typically five to seven years.

Blackstone Reported Another Strong Quarter

A Structural Change Intended To Unlock Value

One key takeaway from the Blackstone Q3 investor call was the announced tax-free spin-out of its financial advisors business segment into an independent publicly traded advisory firm -- slated to trade under the NYSE ticker PJT. Combining its advisory business with PJT Partners allows Blackstone access to the same pool of talent, as well as benefit from the leadership and additional opportunities provided by Wall Street veteran Paul J. Taubman.

One advantage for Blackstone shareholders is that the independent advisory business will be free to grow without many of the conflicts of interest which result from being imbedded within Blackstone. Management also hopes that an independent advisory business will be valued at a higher earnings multiple when it trades as a standalone public company.

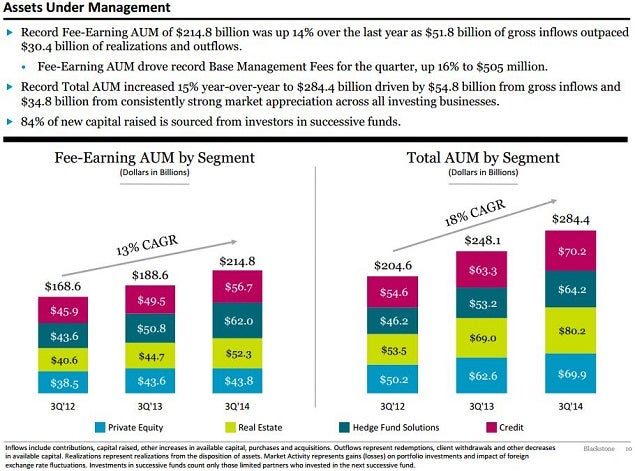

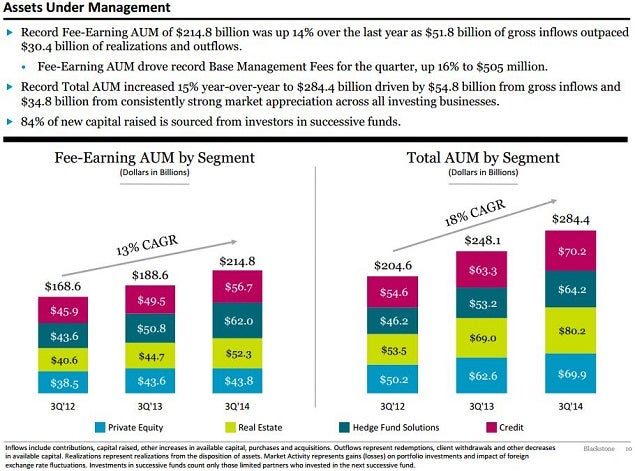

Assets Under Management (AUM)

Blackstone is the largest alternative asset manager as measured by AUM. During Q3 Blackstone benefited from strong net inflows and asset appreciation compared with the same periods Y/Y.

A Structural Change Intended To Unlock Value

One key takeaway from the Blackstone Q3 investor call was the announced tax-free spin-out of its financial advisors business segment into an independent publicly traded advisory firm -- slated to trade under the NYSE ticker PJT. Combining its advisory business with PJT Partners allows Blackstone access to the same pool of talent, as well as benefit from the leadership and additional opportunities provided by Wall Street veteran Paul J. Taubman.

One advantage for Blackstone shareholders is that the independent advisory business will be free to grow without many of the conflicts of interest which result from being imbedded within Blackstone. Management also hopes that an independent advisory business will be valued at a higher earnings multiple when it trades as a standalone public company.

Assets Under Management (AUM)

Blackstone is the largest alternative asset manager as measured by AUM. During Q3 Blackstone benefited from strong net inflows and asset appreciation compared with the same periods Y/Y.

The company breaks out revenues and fees by major business segments: Private Equity, Real Estate, Hedge Fund Solutions and Credit.

The company breaks out revenues and fees by major business segments: Private Equity, Real Estate, Hedge Fund Solutions and Credit.

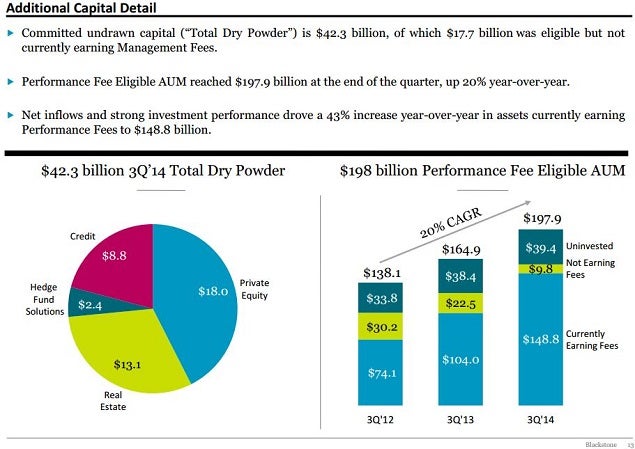

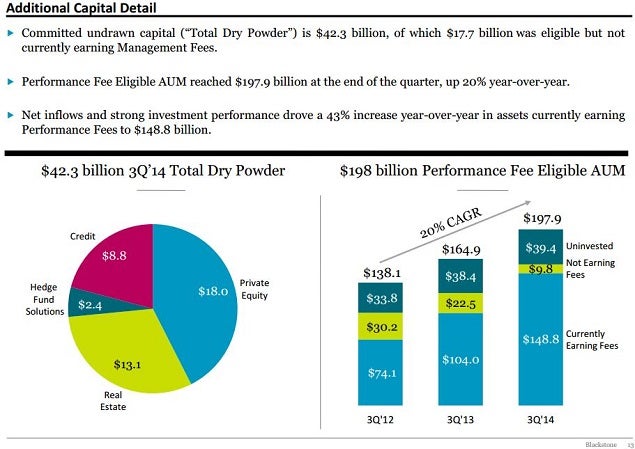

Plenty Of Capital Ready To Invest

As world events continue to evolve Blackstone has plenty of equity capital ready to deploy immediately. Of course, at the margin, Blackstone's earning growth is also dependent upon the rate of future fund raising.

However, during the conference call management pointed out that during the past four years, Blackstone's growth had been limited only by how much capital it can manage efficiently, not by how much capital investors have been willing to provide.

Plenty Of Capital Ready To Invest

As world events continue to evolve Blackstone has plenty of equity capital ready to deploy immediately. Of course, at the margin, Blackstone's earning growth is also dependent upon the rate of future fund raising.

However, during the conference call management pointed out that during the past four years, Blackstone's growth had been limited only by how much capital it can manage efficiently, not by how much capital investors have been willing to provide.

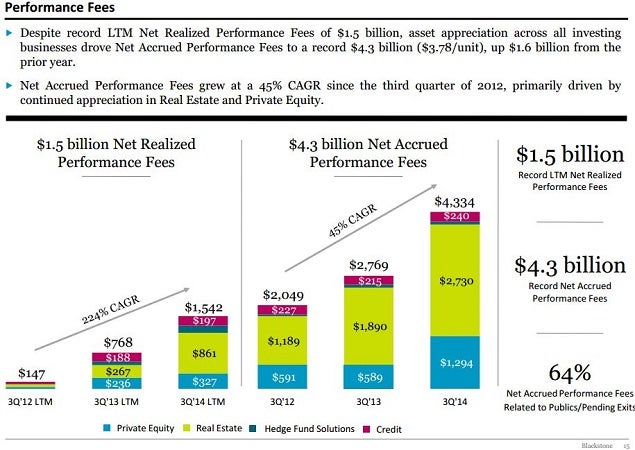

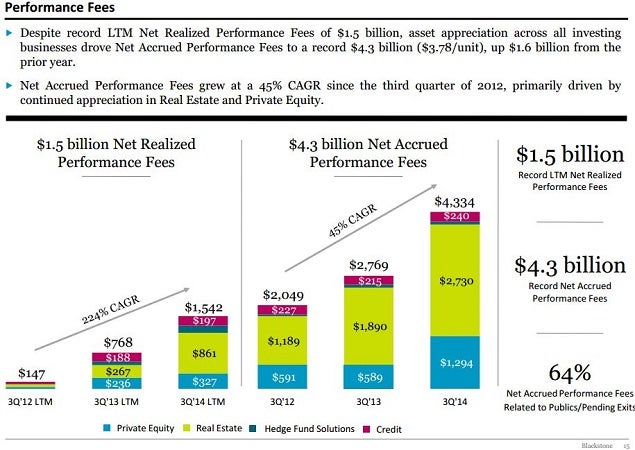

Realization Timing Can Be Lumpy

Blackstone asset management fees are earned based upon performance and paid from asset realizations, so the timing of future distributable earnings can be hard to predict. However, unrealized gains from portfolio companies and AUM still continue to accrue earnings and fees.

Realization Timing Can Be Lumpy

Blackstone asset management fees are earned based upon performance and paid from asset realizations, so the timing of future distributable earnings can be hard to predict. However, unrealized gains from portfolio companies and AUM still continue to accrue earnings and fees.

CFO Lawrence Tosi explained during the earnings call that YTD realizations were derived from more than 150 deals, split fairly evenly, about half public sales such as IPO's, and the other half coming from private sales, re-financing and operating earnings.

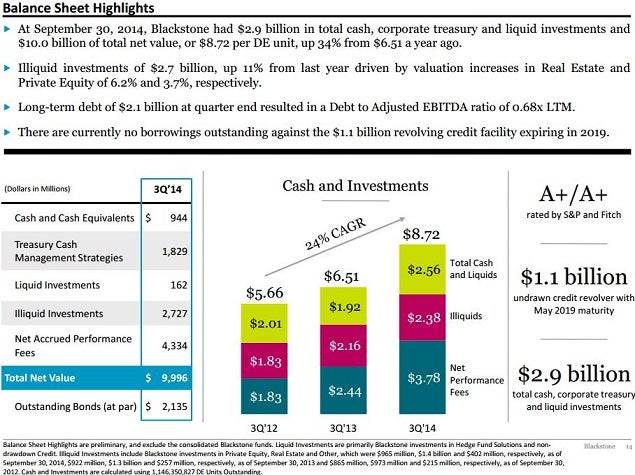

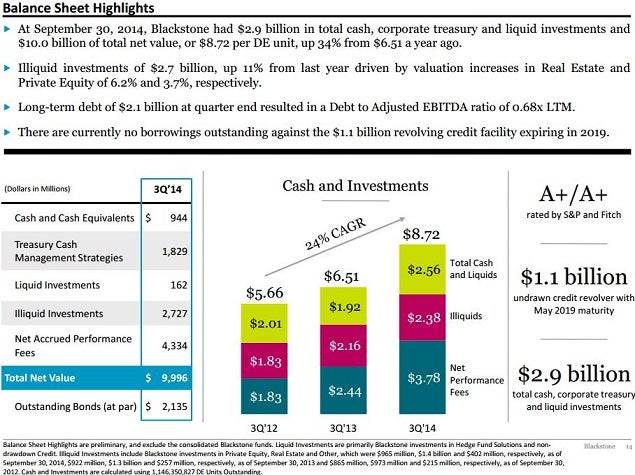

Fortress Balance Sheet

Management made it clear that Blackstone is never forced to sell, and is prepared to wait until the most opportune time to realized gains.

CFO Lawrence Tosi explained during the earnings call that YTD realizations were derived from more than 150 deals, split fairly evenly, about half public sales such as IPO's, and the other half coming from private sales, re-financing and operating earnings.

Fortress Balance Sheet

Management made it clear that Blackstone is never forced to sell, and is prepared to wait until the most opportune time to realized gains.

Earnings Call Takeaways

Since the end of Q3, public markets have clearly deteriorated with a sharp increase in volatility.

In addition to discussing record Q3 results, Blackstone management commented upon the global economy, observations regarding world markets, and the future demand for alternative asset investments:

• Blackstone is seeing decreased liquidity and widening spreads in capital markets.

• Some hedge funds have been unwinding positions, sometimes involuntarily.

• U.S. economy is growing nicely and Blackstone was surprised on the upside with results in both real estate and private equity.

• Low interest rates and declining oil prices are positive for most countries.

• Blackstone had not been optimistic about European growth, so they were not disappointed with recent events.

• Sovereign wealth funds and foreign investors remain woefully under allocated to alternative investments -- a plus for Blackstone moving forward.

Final Thoughts

While CFO Tosi made it clear that "dynamics have never been stronger for Blackstone," he was also quick to point out that "what drives Blackstone and drives Blackstone stock price are two entirely different and somewhat unrelated dynamics."

Earnings Call Takeaways

Since the end of Q3, public markets have clearly deteriorated with a sharp increase in volatility.

In addition to discussing record Q3 results, Blackstone management commented upon the global economy, observations regarding world markets, and the future demand for alternative asset investments:

• Blackstone is seeing decreased liquidity and widening spreads in capital markets.

• Some hedge funds have been unwinding positions, sometimes involuntarily.

• U.S. economy is growing nicely and Blackstone was surprised on the upside with results in both real estate and private equity.

• Low interest rates and declining oil prices are positive for most countries.

• Blackstone had not been optimistic about European growth, so they were not disappointed with recent events.

• Sovereign wealth funds and foreign investors remain woefully under allocated to alternative investments -- a plus for Blackstone moving forward.

Final Thoughts

While CFO Tosi made it clear that "dynamics have never been stronger for Blackstone," he was also quick to point out that "what drives Blackstone and drives Blackstone stock price are two entirely different and somewhat unrelated dynamics."

Blackstone investors have seen returns exceeding the S&P 500 by over a factor of three times during the past two years.

Performance YTD

However, year-to-date this sector has struggled underperformed the broader market.

Blackstone investors have seen returns exceeding the S&P 500 by over a factor of three times during the past two years.

Performance YTD

However, year-to-date this sector has struggled underperformed the broader market.

Private Equity - Conundrum For Investors?

Publicly traded alternative asset management firms can be more volatile than the broader market and more traditional financial service sectors. The underlying investments they manage, which include: global real estate, hedge funds, private equity, and leveraged buy-outs are not structured with quarter-over-quarter or even year-over-year performance in mind.

These firms are looking to take advantage of market dislocations, asset mispricing, lack of liquidity in a given asset class, and a host of other strategies that may play out over several years rather than any particular 90 day time interval.

Investors should keep in mind that the patient capital raised by private equity funds is usually focused on compounded annual growth rates (CAGRs) over a much longer time horizon -- typically five to seven years.

Blackstone Reported Another Strong Quarter

Private Equity - Conundrum For Investors?

Publicly traded alternative asset management firms can be more volatile than the broader market and more traditional financial service sectors. The underlying investments they manage, which include: global real estate, hedge funds, private equity, and leveraged buy-outs are not structured with quarter-over-quarter or even year-over-year performance in mind.

These firms are looking to take advantage of market dislocations, asset mispricing, lack of liquidity in a given asset class, and a host of other strategies that may play out over several years rather than any particular 90 day time interval.

Investors should keep in mind that the patient capital raised by private equity funds is usually focused on compounded annual growth rates (CAGRs) over a much longer time horizon -- typically five to seven years.

Blackstone Reported Another Strong Quarter

A Structural Change Intended To Unlock Value

One key takeaway from the Blackstone Q3 investor call was the announced tax-free spin-out of its financial advisors business segment into an independent publicly traded advisory firm -- slated to trade under the NYSE ticker PJT. Combining its advisory business with PJT Partners allows Blackstone access to the same pool of talent, as well as benefit from the leadership and additional opportunities provided by Wall Street veteran Paul J. Taubman.

One advantage for Blackstone shareholders is that the independent advisory business will be free to grow without many of the conflicts of interest which result from being imbedded within Blackstone. Management also hopes that an independent advisory business will be valued at a higher earnings multiple when it trades as a standalone public company.

Assets Under Management (AUM)

Blackstone is the largest alternative asset manager as measured by AUM. During Q3 Blackstone benefited from strong net inflows and asset appreciation compared with the same periods Y/Y.

A Structural Change Intended To Unlock Value

One key takeaway from the Blackstone Q3 investor call was the announced tax-free spin-out of its financial advisors business segment into an independent publicly traded advisory firm -- slated to trade under the NYSE ticker PJT. Combining its advisory business with PJT Partners allows Blackstone access to the same pool of talent, as well as benefit from the leadership and additional opportunities provided by Wall Street veteran Paul J. Taubman.

One advantage for Blackstone shareholders is that the independent advisory business will be free to grow without many of the conflicts of interest which result from being imbedded within Blackstone. Management also hopes that an independent advisory business will be valued at a higher earnings multiple when it trades as a standalone public company.

Assets Under Management (AUM)

Blackstone is the largest alternative asset manager as measured by AUM. During Q3 Blackstone benefited from strong net inflows and asset appreciation compared with the same periods Y/Y.

The company breaks out revenues and fees by major business segments: Private Equity, Real Estate, Hedge Fund Solutions and Credit.

The company breaks out revenues and fees by major business segments: Private Equity, Real Estate, Hedge Fund Solutions and Credit.

Plenty Of Capital Ready To Invest

As world events continue to evolve Blackstone has plenty of equity capital ready to deploy immediately. Of course, at the margin, Blackstone's earning growth is also dependent upon the rate of future fund raising.

However, during the conference call management pointed out that during the past four years, Blackstone's growth had been limited only by how much capital it can manage efficiently, not by how much capital investors have been willing to provide.

Plenty Of Capital Ready To Invest

As world events continue to evolve Blackstone has plenty of equity capital ready to deploy immediately. Of course, at the margin, Blackstone's earning growth is also dependent upon the rate of future fund raising.

However, during the conference call management pointed out that during the past four years, Blackstone's growth had been limited only by how much capital it can manage efficiently, not by how much capital investors have been willing to provide.

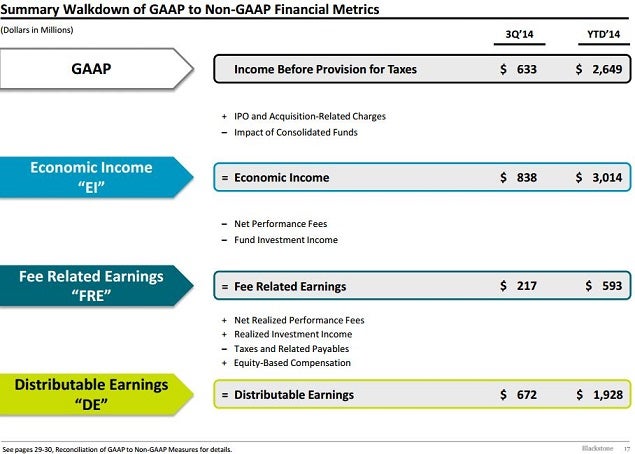

Realization Timing Can Be Lumpy

Blackstone asset management fees are earned based upon performance and paid from asset realizations, so the timing of future distributable earnings can be hard to predict. However, unrealized gains from portfolio companies and AUM still continue to accrue earnings and fees.

Realization Timing Can Be Lumpy

Blackstone asset management fees are earned based upon performance and paid from asset realizations, so the timing of future distributable earnings can be hard to predict. However, unrealized gains from portfolio companies and AUM still continue to accrue earnings and fees.

CFO Lawrence Tosi explained during the earnings call that YTD realizations were derived from more than 150 deals, split fairly evenly, about half public sales such as IPO's, and the other half coming from private sales, re-financing and operating earnings.

Fortress Balance Sheet

Management made it clear that Blackstone is never forced to sell, and is prepared to wait until the most opportune time to realized gains.

CFO Lawrence Tosi explained during the earnings call that YTD realizations were derived from more than 150 deals, split fairly evenly, about half public sales such as IPO's, and the other half coming from private sales, re-financing and operating earnings.

Fortress Balance Sheet

Management made it clear that Blackstone is never forced to sell, and is prepared to wait until the most opportune time to realized gains.

Earnings Call Takeaways

Since the end of Q3, public markets have clearly deteriorated with a sharp increase in volatility.

In addition to discussing record Q3 results, Blackstone management commented upon the global economy, observations regarding world markets, and the future demand for alternative asset investments:

• Blackstone is seeing decreased liquidity and widening spreads in capital markets.

• Some hedge funds have been unwinding positions, sometimes involuntarily.

• U.S. economy is growing nicely and Blackstone was surprised on the upside with results in both real estate and private equity.

• Low interest rates and declining oil prices are positive for most countries.

• Blackstone had not been optimistic about European growth, so they were not disappointed with recent events.

• Sovereign wealth funds and foreign investors remain woefully under allocated to alternative investments -- a plus for Blackstone moving forward.

Final Thoughts

While CFO Tosi made it clear that "dynamics have never been stronger for Blackstone," he was also quick to point out that "what drives Blackstone and drives Blackstone stock price are two entirely different and somewhat unrelated dynamics."

Earnings Call Takeaways

Since the end of Q3, public markets have clearly deteriorated with a sharp increase in volatility.

In addition to discussing record Q3 results, Blackstone management commented upon the global economy, observations regarding world markets, and the future demand for alternative asset investments:

• Blackstone is seeing decreased liquidity and widening spreads in capital markets.

• Some hedge funds have been unwinding positions, sometimes involuntarily.

• U.S. economy is growing nicely and Blackstone was surprised on the upside with results in both real estate and private equity.

• Low interest rates and declining oil prices are positive for most countries.

• Blackstone had not been optimistic about European growth, so they were not disappointed with recent events.

• Sovereign wealth funds and foreign investors remain woefully under allocated to alternative investments -- a plus for Blackstone moving forward.

Final Thoughts

While CFO Tosi made it clear that "dynamics have never been stronger for Blackstone," he was also quick to point out that "what drives Blackstone and drives Blackstone stock price are two entirely different and somewhat unrelated dynamics."

APOApollo Global Management Inc

$122.23-4.84%

Edge Rankings

Momentum

76.49

Growth

39.56

Quality

38.82

Value

54.11

Price Trend

Short

Medium

Long

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in