In what is being dubbed as the worst start to a new year in ages, oil, Russia, and Greece are capturing most of the headlines.

However, there may another factor lurking which could be causing some investors to fret. Namely, the state of the U.S. economy.

Coming into 2015, the consensus view was that the economy of the good 'ol USofA was doing just fine, thank you. This was reinforced by the final revision to the Q3 GDP report, which surprised just about everyone with a reading of 5.0 percent.

The annualized growth rate for the U.S. was far better than the expectations for a rate of 4.3 percent, above last quarter's stellar rate of 4.6 percent (which many argued would not be topped any time soon), and the best rate of growth for the U.S. economy since the third quarter of 2003.

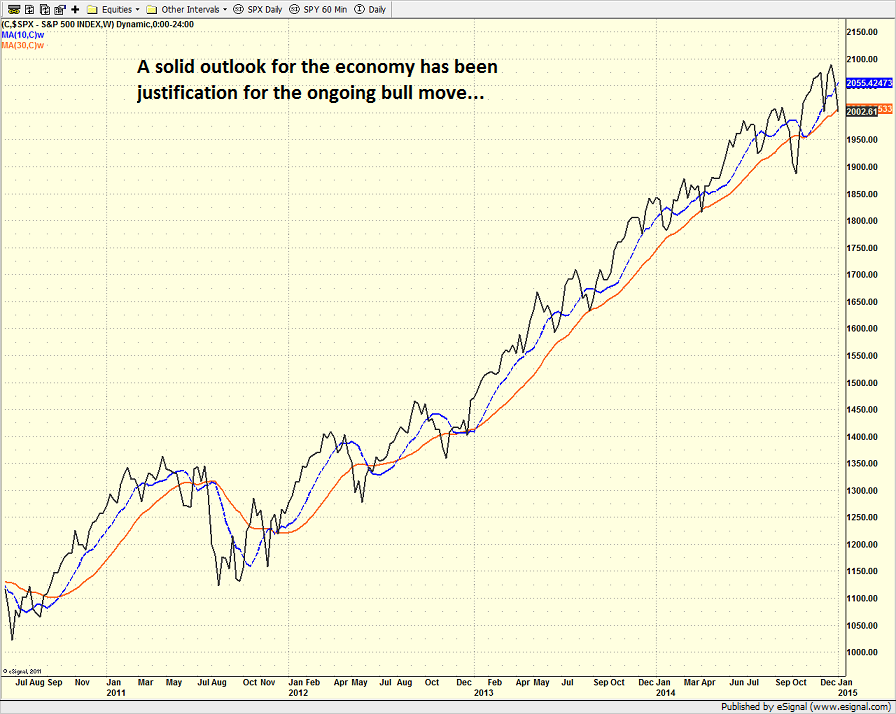

So, as investors looked ahead to the new calendar year, it is safe to say that a great many saw the solid economic growth to be supportive of the ongoing bull market - and perhaps even a reason to believe that the bulls could continue to romp into 2015.

S&P 500 SPY - Weekly

The better-than-expected economic growth seen in the U.S. was also used by the bull camp as a reason to ignore the #growthslowing issues in places like Europe and China. Investors were reminded at every turn recently that the U.S. is a "closed economy" and since the consumer represents 70 percent of GDP growth, well, things were looking pretty good.

The Fly in the Ointment

One of the interesting aspects of the stock market game is that by the time "everyone" sees a reason for stocks to continue to climb, that "reason" tends to already be priced in. And the bottom line here is that this just might be the case at the present time.

You see, the economic data seen since the fantabulous GDP print has been a fly in the ointment of the bull argument. The simple fact is that most of the numbers have come in below expectations. Thus, the bears are suggesting that the U.S. is beginning to be dragged down by falling oil and the slowdowns of Europe and China.

Consider the following as Exhibits A through J in the bear case... (For clarification, the reports will be shown in chronological order, starting with Tuesday's reports.)

ISM Non-Manufacturing (Services Sector): The index was reported at 56.2 which was below the expectations for a reading of 58.0 and a far cry from November's reading of 59.3. It is also worth noting that the index has declined in 3 of the last 4 months and the December drop was the biggest in 6 years (November, 2008).

Factory Orders: The report showed orders fell by -0.7 percent in November, which was below the consensus and the fourth consecutive monthly decline.

Construction Spending: The Commerce Department reported that Construction Spending fell 0.3 percent in November. This was well below the expectations for an increase of +0.4 percent and down from October's read of 1.2 percent.

ISM Manufacturing Index: The all-important gauge of the U.S. manufacturing sector disappointed in December, coming in with a reading of 55.5. This was below the estimate for 57.5, below last month's reading of 58.7 and the weakest read since May. In addition, the New Orders component index also came in at the lowest level in seven months (57.3 vs. 66.0 in November).

Eurozone Manufacturing PMIs: While the December readings did perk up a bit in the Eurozone and Germany, the report showed that the main economies of Europe were stagnant at the end of the year as the Manufacturing PMIs were much weaker than the year ago readings (50.6 vs. 54.0). According to Markit's Chief Economist, "The overall weakness of the eurozone PMI supports the case for more stimulus."

Chicago PMI: The index fell to a reading of 58.3 in December, which was below the consensus for 60.0 as well as last month's reading of 60.8. According to the report, "The slowdown in the pace of activity exhibited since October's one year high of 66.2 has been marked." And the Chief Economist noted, "It was a disappointing end to the year with the pulse rate of our business panel slowing noticeably in December."

Weekly Jobless Claims (Week Ending 12/27): The weekly report on initial claims for unemployment insurance showed an unexpected increase, with claims once again bumping up against the 300K level.

China HSBC PMI: The HSBC China Manufacturing PMI reading for December fell into the contraction zone for the first time in seven months. The final reading of the PMI was reported at 49.6. The reading was also below the November level of 50.3. From the report: "As seen in the flash reading earlier, domestic demand led the slowdown as new orders contracted for the first time since April 2014. Price contraction deepened. Today's data confirmed the further slowdown in the manufacturing sector towards year end."

New Home Sales: According to the Commerce Department, New Home Sales pulled back by 3.7 percent last month. The annualized rate of sales for November was reported at 438K. The reading was below the consensus for 458K and 17K below last month's revised level of 455K. On a year-over-year basis, new-home sales were down 1.6 percent.

Orders For Durable Goods: The Commerce Department reported that orders for Durable Goods (items expected to last longer than a year) pulled back 0.7 percent in November and have now declined in three of the last four months.

To be sure, there were some good data seen during the past few weeks as well. Consumer Confidence in particular has been strong.

However, the key takeaway here is that a surprisingly large number of the reports were weaker than expected. And in reading through the executive summaries provided above, a clear trend appears to be developing.

But... The Big Kahuna Could Change Everything

Finally it is important to recognize that the Big Kahuna of monthly economic data - the Jobs Report - will be released on Friday. And the bottom line is if the report is stronger than expected, then the weakness from the reports shown above could easily be swept under the rug. And in a market that could easily be VERY oversold by then, a strong report could also produce some fireworks to the upside.

Yet to be fair, a report that disappoints could just as easily allow the bears to maintain possession of the ball. So, be sure to be awake and ready to play on Friday morning at 8:30 am eastern standard time.

So, is it time to worry about growth in the U.S.? The answer to this question is, as always, in the eyes of the beholder. However, if the recent trend of weaker than expected data continues, you can rest assured that Ms. Market will take notice.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.