Every morning I wake up now I'm reminded that summer is essentially over, and we're entering the shoulder season here in the northeast. Some in Vermont call it stick season because soon the leaves will turn vibrant colors and fall to the ground, leaving only bare branches.

On this particular morning while considering what I could write about I began to reminisce about the summer months - and the companies discussed here in Small Cap Investor Daily. So I decided to revisit prior suggestions, and check out their returns since I wrote about these companies.

And I've got to say, I'm pretty pleased with the results. Of course, it's

always easy for those of us who recommend stocks for a living to cherry pick

the best results and only present those - while letting the 'losers' drift

from our minds.

But I assure you, I haven't done so in this case. I just went back through the article archives to some of my favorite daily articles and pulled five articles published since mid-July. These articles had 7 companies in them, and the average gain?

Pretty good, we're up 14 percent through yesterday's close. Not too shabby for half a summers work.

Check out the chart of the S&P 600 Small Cap Index since July 20th, the date of my first article featuring today's revisited stocks. As you can see, the index, which covers 600 small cap stocks, has risen about 4 percent.

So what are the stocks that have done well for us over the last two and a half months?

Let's go in chronological order and look back at Callaway Golf ELY. I covered this company in A Pattern of 18 Percent Average Gains and from publishing to yesterday's close the stock is up 14.5 percent.

Callaway is one of the top golf companies in the world. The company makes and sells high-quality irons, drivers, golf balls, golf bags, GPS range finders, and other accessories. The premise for buying Callaway was a strong pattern of seasonality in the stock. Explaining this, I wrote:

"Historically, as Callaway reports strong earnings in the first half of the year, analysts raise estimates and the stock price trends higher. With demand for products down and few attention-grabbing events for the rest of the year, earnings reports are weaker in the fourth quarter and the stock price tends to move lower".

Moving on to Cash In On The X-Games which was published on July 30th we've got QuickSilver Inc ZQK and Hansen's Natural Corporation HANS. We're down 13.9 percent on laggard QuickSilver but are up 10.2 percent on Hanson.

Remember that Quicksilver is in the process of cleaning up its balance sheet as it works through a financial restructuring plan. Regarding the company's future I wrote:

If this company can get its balance sheet in order, the stock could be a strong performer. Sales growth is essentially projected to be flat for the next two years, but analysts expect earnings per share to grow by 200 percent next quarter, by 350 percent next year, and by 56 percent in 2011.

Well, shares have lagged - but in our current economy where consumer spending is not that strong company's like QuickSilver are just treading water, trying to stay afloat as they position themselves for better days.

Hansen, the maker of Monster Energy Drink, has lived up to my expectations. I

wrote,

"Monster has had success competing with the veteran energy drink Red Bull. In 2008 Hansen's made great strides by partnering with Coco-Cola to distribute its product internationally, and has since inked deals with Pepsi to distribute in even more countries, most notably Red Bull's home turf of Europe... From a technical perspective, the stock is a great buy at $40 (if it breaks below this look for dip to $37 and change). However, I wouldn't be surprised to see the stock move higher ahead of earnings..."

After we left the X-Games in California, we moved on to the wheat ban in Russia in One Stock That Will Benefit from the Wheat Ban. This article featured Terra Nitrogen Company TNH on August 9th, a stock that is down a modest 1.9 percent since.

The stock rallied hard after Russia's Prime Minister, Vladimir Putin, announced that Russia would ban all grain exports for the rest of 2010. The announcement came after wildfires swept across the country and destroyed a large amount of the country's crop. The crop was extremely susceptible to fire since Russia experienced severe droughts.

We departed Russia to land back on domestic soil in Two Brewing Stocks to Whet Your Appetite on August 16th. Our craft beer tour began in Boston, MA at the Boston Beer Co. Inc. SAM producer of the popular Samuel Adam's Lager and Twisted Tea. Regarding the stock, which is up 4.6 percent since the article, I wrote,

"Boston Beer is growing fast enough that it may soon outgrow craft beer status. The brewer expects to sell more than 2 million barrels by 2012. But just because the company may outgrow the 'craft brewer' definition doesn't mean it isn't a compelling investment. It may just be in the sweet spot - small enough to gain greater popularity as a top-quality brewer but large enough to gain distribution efficiencies and greater shelf space."

From Boston we hopped (no pun intended) a flight to Portland, Oregon where we enjoyed the offerings from Craft Brewers Alliance, Inc. HOOK. This company brews 31 high-quality regional craft beers including Redhook Ale and Goose Island - some are gaining attention at the national level.

I've been bullish on the craft brewers, and expressed my outlook as follows in that article,

"The homegrown element of craft beers is also something that's very appealing to the growing number of consumers who subscribe to the local food movement. If these people like to purchase food that's grown closer to home, it's rationale to assume they like to do the same with beer. Of course, buying a 'local' beer that brewed on the other side of the country isn't exactly in-line with the localvore food movement, but the idea is pretty much the same - and it's easier to bottle and ship a craft brew than a dozen cherry tomatoes."

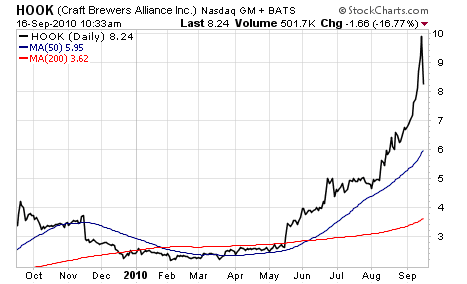

And clearly I'm not the only one bullish on Craft Brewers Alliance. Since my article was published the company was up a whopping 70% through yesterday! But is the ride over?

Check out this chart, which shows one of the strongest momentum moves on high volume I've seen in quite some time - clearly somebody out there is accumulating shares. But this morning the stock is falling sharply, down over 15 percent.

However, even with this pullback, investors would be up 55 percent since my article, and no stock should move higher in a straight line. That said, this stock has been moving higher so fast, and so consistently, that it's not the least bit surprising to see a major pullback. Keep watching for a good entry (not at current levels) - I think that Craft Brewers could be a strong consumer stock over the next couple of years, if it remains independent.

But be careful, like other popular stocks before it (remember Crocs CROX and Krispy Kreme Doughnuts KKD), Craft Brewers displays the characteristics of a high flyer that could move too far too fast.

After the brewery tour ended, we finished our summer tour with accessory manufacturer ZAGG Incorporated ZAGG in When Apple's Sales Rise, This Company Profits. Since publication the company, which makes protective coverings for electronic devices including iPods, iPhones, iPads, and global positioning systems, has seen its stock move 14.9 percent higher.

Regarding this little company's prospects I wrote,

"If the trend toward mobile devices continues, as I believe it will (and most research supports this position), soon the majority of people with mobile devices will be flocking to ZAGG's products to protect their investment. It could even be a takeover target, although at this point that is pure speculation."

So far, investors at least appear to be flocking to the

company's stock.

So there's a little tour down memory lane since mid-summer. With these stocks, investors could have made an average gain of 14 percent through yesterday, with big gains possible with Craft Brewers Alliance, ZAGG, Callaway, and Hansen Natural.

***I also follow a number of high potential small cap stocks in the Small Cap Investor PRO portfolio. Right now we're sitting on gains like 6 percent, 17 percent, and 20 percent - all on stocks added in the last couple of months. We even have a high yielding small cap that pays a dividend over 9 percent, and a gold mining company that has seen shares surge 10 percent this week.

To learn more about this gold miner, click here and receive the special report. When you do you'll be able to gain access to all the stocks in our portfolio and see if they're right for your portfolio too.

Did you buy shares in any of the companies discussed above? If so, shoot me a message, I love to hear your success stories. My address is: editorial@smallcapinvestor.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.