February was a volatile month for interest rates and asset classes traditionally linked to machinations in the bond markets. The CBOE Interest Rate 10 Year Note TNX spiked from a low of 1.67 percent to a high of 2.00 percent last month amid a strong bid for stocks.

This spike higher in rates led to a selloff in the iShares Barclays 20+ Yr Treas.Bond (ETF) TLT, Vanguard REIT Index Fund VNQ and even the Utility Select Sector SPDR ETF (Utilities SPDR (ETF)) XLU. However, the asset class that shrugged off this macro-economic headwind and continued to new highs is preferred stocks.

What Are Preferred Stocks?

Preferred stocks are known as a hybrid instrument that carry qualities of both equity and debt securities. These shares are higher on the capital structure than common stock owners and typically pay a hefty yield, which is where their sensitivity to interest rates is upheld.

iShares U.S. Preferred Stock ETF

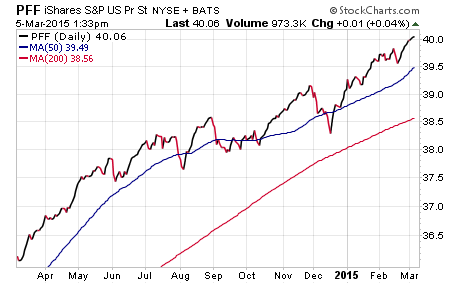

The iShares S&P US Pref Stock Idx Fnd (ETF) PFF is the largest ETF in this space with over $12.7 billion in total assets. PFF invests in a diversified basket of over 300 preferred stocks, which are primarily focused in the financial, banking and real estate sectors.

PFF has gained 11 percent in total return over the last year and just recently touched new 52-week highs. This ETF also sports a 30-day SEC yield of 5.61 percent and dividends are paid monthly to shareholders.

PowerShares Preferred Portfolio

Another strong contender in this category is the PowerShares Preferred Portfolio(ETF) PGX. This ETF focuses on a more concentrated mix of 213 preferred stocks, of which 88 percent are financial-based companies. The current yield on PGX is 5.90 percent.

PFF carries an expense ratio of 0.47 percent, while PGX is slightly higher at 0.50 percent.

What Makes Preferred Stock ETFs Unique

One of the distinct qualities of preferred stock ETFs is that their returns don’t mirror a traditional equity or bond index. PFF, for example, has a beta to the S&P 500 Index SPX of just 0.24. This may be an attractive quality for income-seekers looking to diversify their portfolio in non-correlated asset classes.

Disclosure: At the time this article was written, David Fabian and clients of FMD Capital Management owned PFF.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.