McDonald's Corporation MCD is not one of Glenview Capital Management's top ten holdings.

Nonetheless, the fund's CEO, Larry Robbins, devoted a considerable part of his annual investor letter detailing a five-point plan intended to increase MCD shareholder value.

The cornerstone of the Glenview plan depends on spinning out McDonald's real estate assets into a REIT to unlock the value of its vast real estate holdings.

"Shares Now Offered on the Value Menu: McDonald's (MCD: $96)"

Source: Glenview Capital Management letter

Line-items 1. "Operational Turnaround," and 2. "SG&A Rationalization," are a bit "fuzzy," and arguably might be harder for management to tackle and achieve concrete results per share.

Clearly, line-item 3. "Refranchising" represents a significant operational change.

Line-item 4. "Additional Leverage," appears to be simply philosophical in nature, (and would dovetail nicely with the implementation of a REIT spin strategy).

Line-item 5. "Real Estate" is the "Big Coke, Best Value" part of the plan, representing $25 of the Glenview theoretical $73 potential gain per share. Notably, it could be implemented as a stand-alone initiative, without significant operational consequences.

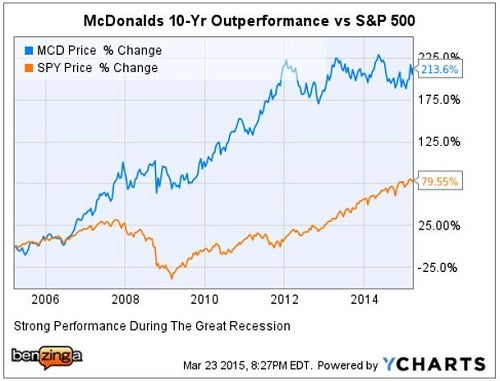

Strong MCD Performance - During Great Recession

The SPDR S&P 500 ETF SPY is a good approximation for the broader market.

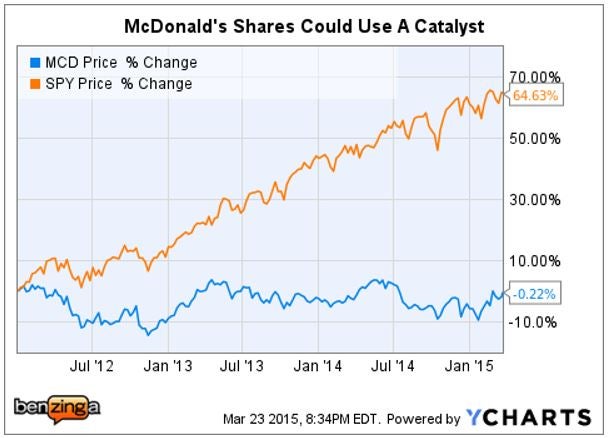

McDonald's Shares - 2012 to Present

How Real Estate Could Boost Value

McDonald's currently has a market cap of $95 billion, so it can be difficult for any single initiative to move the needle. However, McDonald's has 36,000 stores worldwide, and owns 45 percent of the land and 70 percent of the structures.

Here is Robbins' back of the envelope calculation:

"Utilizing the current rental rates McDonald's charges its franchisees, we believe the earnings power of these real estate assets as a standalone entity would be equivalent to approximately 50% of current consolidated EBITDA. Given that REITs are trading at almost 20x EBITDA, we do not believe this is reflected in McDonald's current 12x EBITDA valuation, and we believe management efforts to monetize or illuminate this could unlock at least $20 billion of value."

Why Does McDonald's Own So Much Real Estate?

The majority of McDonald's restaurants are operated by franchisees that pay approximately 4 percent of sales in royalties. Additionally, where McDonald's also owns the real estate, Robbins estimated that the company receives 9 percent of sales as rent from the franchisees.

However, ~19 percent of McDonald stores are company owned. McDonald's peers currently operate with a 100 percent franchise store model.

This is a capital-light strategy with predictable income streams, which Robbins believes Mr. Market would reward with a higher valuation.

Balance Sheet Flexibility

Glenview line-item 4. "Additional Leverage" refers to the "happy problem" of McDonalds having a balance sheet that Robbins views as too conservative. "When considering the high quality, stable and defensive nature of the business and a material real estate portfolio that is still presently owned," the letter explained.

By spinning out the McDonald's real estate assets into an OpCo/PropCo type of structure, the real estate could support a significant amount of debt. This in turn would generate cash for the MCD OpCo, which could be used to expand operations, buyback shares, or be distributed to shareholders as dividends.

REIT Alchemy

Companies that qualify as real estate investment trust (REIT), under the IRS code, do not pay tax on qualified REIT income at the corporate level. In return, a REIT must distribute a minimum of 90 percent of its taxable income in the form of dividends to shareholders.

That is the logic behind a REIT trading at higher multiples than a C-Corp.

Since McDonald's is an investment-grade tenant, the usual objections to a REIT owning a portfolio of assets leased to one tenant are mitigated. Over time, a McREIT could package tranches of its McDonald store portfolio for sale or JV and use those proceeds to diversify its portfolio of real estate assets.

Image credit: Public Domain

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.