What if shareholders of American Realty Capital Properties Inc ARCP woke up one day to find that ARCP had deleveraged its balance sheet significantly; or had received a $12 per share buy-out offer from net-lease sector stalwart Realty Income Corp O?

Those are two scenarios that Capital One analysts have suggested as possibilities in a March 24, research note: "Big Issues Resolved: Upgrading to Overweight."

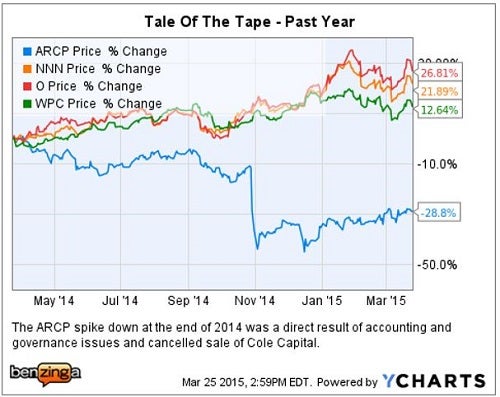

Net Lease REIT Major Players

Along with $11.8 billion cap Realty Income, Capital One utilized $5.5 billion National Retail Properties, Inc. NNN and $7.3 billion W.P. Carey, Inc. WPC as yardsticks to compare how a "pro-forma" ARCP would measure up.

Based upon both its relatively large market cap and existing portfolio composition, Realty Income could easily be viewed as the most logical acquirer of ARCP.

Tasks Accomplished

New CEO Named: ARCP has taken an important first step in naming Glenn Rufrano as CEO, "a known and respected leader with a reputation for fixing broken companies and recovering value."

This goes a long way toward filling the C-Suite vacancies created by the highly publicized resignations of former Executive Chairman Nick Schorsch, CEO David Kay and COO/President Lisa Beeson last December.

Tasks Underway

Board Changes: Capital One noted, "at least two of the five independent directors are slated to resign…" This is part of the process to clean up ARCP corporate governance issues which have been an overhang on the stock.

Tasks Assumed Accomplished

Balance Sheet:

- Capital One assumed "pro-forma valuations on ARCP shares that adjust certain items to mirror the metrics of top level peers (O and NNN)."

- Capital One "assumed the issuance of 575MM shares at a net price of $9 (6.75% fully diluted implied cap), generating proceeds of $5.175B to repay debt."

- For earnings estimates, Capital One assumed the proceeds were used to repay the $3.2B in credit facility debt and other maturities as they come.

- Capital One increased the cost of unsecured debt from 100 bps, its "view as to what the long-term debt cost would look like for a de-levered ARCP balance sheet based upon the average long-term debt costs for O, NNN, and WPC."

- While these may not be the precise path that ARCP management takes, Capital One believes "these are conservative adjustments and therefore provide some comfort on the following valuation estimates."

Net Asset Value (NAV):

- Under the above assumptions, [Capital One] "NAV estimate drops from $10.59 to $10.06 but reduces the debt level to 28.5%, consistent with top peers."

- Capital One believes "that O and NNN trade at a 20% premium to [its] NAV estimates.

- "Applying a 20% premium to [the] pro-forma NAV estimate for ARCP yields a $12.07 valuation."

Dividend yield:

- Assuming a $0.50 per share annual dividend, that yields an $11.96 value estimate, "applying the $0.50 distribution rate against O and NNN's average yield of 4.18%."

EV/EBITDA analysis:

- Based upon Capital One models, "O and NNN trade at an average EV/FFQ EBITDA multiple of 19.3x." Utilizing that multiple for ARCP yields a $12.67 valuation estimate, which Capital One discounted by 5 percent to arrive at an $11.84 valuation.

M&A analysis:

- While Capital One feels that this is unlikely to occur, its merger model "assumes that Cole and its AUM are sold for $250MM or 6x PCM FFQ EBITDA. Based upon a stock for stock deal at ~$52.50 for O shares along with a follow-on equity offering at a ~15% discount on O shares to de-lever the combined companies, we estimate that O could pay roughly $12/sh and still be accretive to earnings before G&A synergies and balance sheet refinancing opportunities."

Risks:

- Capital One noted "numerous risks and unknowns that remain including litigation settlements, restatement expenses, Cole Capital's fund raising capabilities, and ARCP distribution rate, but in our view the upside potential from here more than compensates investors."

- Additionally, "ARCP will not be S-3 shelf eligible until spring of 2016, which is a handicap in the REIT capital markets, but there are alternatives to the public capital markets and our equity issuance scenario, including asset sales and mortgage financing to pay down debt."

Investor Takeaway

There is quite a bit of heavy lifting which needs to be accomplished by incoming CEO Rufrano.

The Capital One took a "pro-forma" approach to arrive at its $12 price target, and utilized a broad set of assumptions.

The ARCP saga will continue to unfold at its own pace, burdened by litigation, government investigations and uncertainty regarding the strategy the new CEO and board will implement moving forward.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.