Analysis of the REIT Sector for Sizemore Capital Portfolios

Given the host of issues surrounding the real estate investment trust (“REIT”) sector, we believed a thorough review of the sector was appropriate. Sizemore Capital’s Strategic Portfolios apply a passive rebalancing strategy and do not attempt to time the market or make directional bets (these are the roles of the actively-managed Tactical Portfolio). But given the potential risks facing the commercial property sector and commercial mortgage-backed securities, we considered making an exception to this general rule. If we genuinely believed that commercial real estate were at risk of suffering the same fate as the residential housing sector, then it would be irresponsible of us to allocate new monies to REITS.

Upon comprehensive review, we conclude that REITS are modestly undervalued, that REIT prices at current levels allow for mild declines in book value, and that the sector is adequately capitalized to avoid “fire sale” forced selling of assets in the event of further declines in commercial real estate prices or a renewed crisis in the banking sector.

Our view on the REIT sector is neutral. We will continue to rebalance and allocate new monies to REITS in the Strategic Portfolios, though we would avoid overweighting or outright speculation in the sector at this time.

COMMENTS AND ANALYSIS

VALUATION

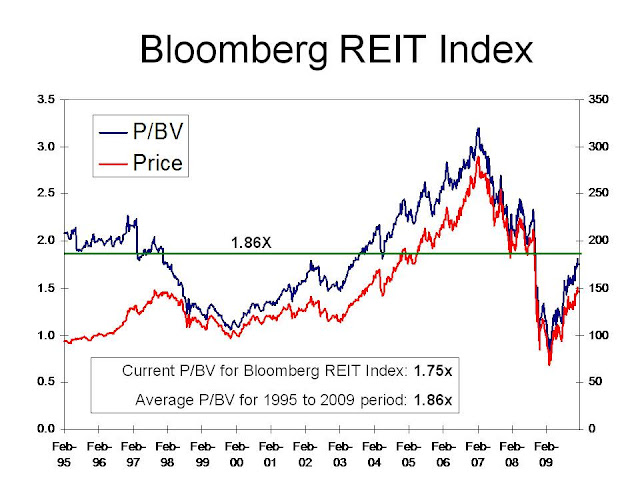

We will begin by considering REIT valuation with respect to the price/book value ratio (“P/BV”). Figure 1 charts the price and the P/BV of the Bloomberg REIT Index from February 1995 to the present. We see that in the mid-2000s, equity REITS experienced what we would consider a mild bubble. Prices reached a multiple of more than three times an inflated book value. In comparison, the average P/BV for the period was 1.86, and during the late 1990s and early 2000s REITS sold at multiples only slightly over book value. At a current multiple of 1.75x, the P/BV is slightly below the average of the past 15 years. This is not cheap, by any means. In fact, given the tepid demand for commercial real estate at the moment, it may be mildly expensive. “Mildly expensive” does not constitute a high risk to us, however. Based on the P/BV, our outlook on the sector is neutral.

Figure 1: Bloomberg REIT Index

Interestingly, the average P/BV of our REIT investment of choice—the Vanguard REIT Index ETF (VNQ)—is considerably lower at 1.39x, as reported by Yahoo Finance. Without further examination, we cannot know for sure why this is. We suspect that Yahoo Finance is using a simple average while Bloomberg is using a weighted average. This gives the larger REITS a larger weighting, and the larger REITS also happen to be more expensive. For example, Simon Properties, the largest REIT by market cap, has an astronomical ratio of 5.14x. Regardless, we do not see this discrepancy as cause for concern and view further examination as unnecessary.

DIVIDEND YIELD

We take a traditional view that the primary source of returns for REITS is and should be the dividend yield. Real estate is traditionally a straight-forward cash-flow investment: the landlord owns the building and collects the rent. We were disturbed by the shift in orientation from income to speculative capital gains during the mid-to-late-2000s. REITS such as Vornado Realty Trust began to be viewed as growth stocks—something we find to be anathema and symptomatic of the emphasis on property “flipping” that became endemic during the real estate boom. The dividend payout ratio (dividend / funds from operations) fell from 90% in the mid-1990s to below 70% by 2007. The ratio fell to 64% by 2009, though this was due primarily to REITS hoarding capital in an attempt to deleverage their balance sheets—something we actually applaud.

The current yield on VNQ is 5.48%. This is down significantly from the early 1990s, when yields were above 10%, though well above the paltry yields during the bubble years of 2006 and 2007, when they fell as low as 3.5%.

To give perspective, the dividend yield of REITS tends to track to 10-year Treasury. According to NAREIT, the average yield spread since 1990s has been 1.06% over the Treasury yield. Today’s spread is just under 1%, more or less in line with the long-term average and significantly higher than during the bubble years when yield spreads reached absurd lows below -1%—actually yielding less than Treasuries! (Remember, REITS were considered “growth” investments then and had dividend yields not much better than the S&P 500.)

A rise in Treasury yields could be a significant risk to REIT valuations. This risk could be mitigated, however, by an increase in REIT dividends that would raise their yield without lowering their price. Given the currently low payout ratio of 64% of funds from operations, we believe that REITS should have the flexibility to do so. Due to fresh capital from recent stock offerings and the disciplined deleveraging of the past two years, debt/equity ratios are back to a respectable 49% according to NAREIT, and interest coverage ratios are at a healthy 2.19x. On balance, we consider the risk to REITS from rising Treasury yields to be on the mildly negative side of neutral.

CONCLUSIONS

We are comfortable rebalancing and allocating to the REIT sector at current valuations. REITS in our view are roughly fairly valued, though not cheap by historical standards. At the very least, we can say that the excesses of the real estate and debt bubble have been wrung out of the sector. It is our view that equity REITS will be able to successfully roll over their maturing debts in 2010 and that asset liquidations will not occur. The “blow up” of another bank, hedge fund, or other large holder of commercial mortgage backed securities is always a possibility. The fallout from such an event would likely cause substantial volatility in the REIT sector. We would view any such volatility as being temporary, however, and of no significant risk to Sizemore Capital Management’s Strategic Portfolios.

Respectfully,

Charles Lewis Sizemore, CFA

Chief Investment Officer, Sizemore Capital Management LLC

Sizemore Capital Management LLC is a registered investment advisor specializing in money management and financial planning for individuals. Please visit us on the web for more information: www.sizemorecapital.com

Check out Charles's new book, available on Amazon.com: Boom or Bust: Understanding and Profiting from a Changing Consumer Economy

Disclaimer: Information provided on this website is not intended as specific investment advice and should not be viewed as such. Investment ideas or specific securities mentioned on this site may not be appropriate for individual investor objectives or risk tolerance. Information provided on this site is compiled from information believed to be accurate at the time of publication but no guarantee as to the accuracy of information displayed on this website is given, intended or implied. Principals may or may not have a financial interest in the securities discussed herein.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.