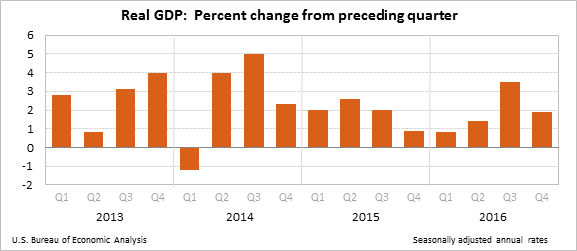

The U.S. economy under Barack Obama seems to have faltered as the former president hit the homestretch. Advance estimates released by the Bureau of Economic Analysis report on Friday showed that the U.S. economy slowed more than expected in the fourth quarter, rendering the annual GDP growth pace to the slowest since 2011.

Exports were the sore spot, weighing heavily on growth. However, economists feel the 3 percent increase in final sales of gross domestic product, which is GDP less net exports and inventory, suggests that the economy is not facing the danger of falling off the cliff. Now, it is over to President Donald Trump and his expansionist policies for giving a shot in the arm for the economy.

Headline Number

Fourth-quarter GDP rose 1.9 percent sequentially, slower than the 2.2 percent expansion expected by the economists. In the third quarter, the economy grew a robust 3.5 percent.

Commenting on the data, Allianz's Mohamed El-Erian said the soft Q4 number is a reminder of the structural headwinds still facing the economy.

The BEA blamed the slowdown on a downturn in exports, an acceleration in imports, a deceleration in personal consumption expenditure and a downturn in federal government spending. Mitigating the weakness was higher residential fixed investment, an increase in private inventory investment, higher state and local government spending and an increase in non-residential fixed investment.

Annual GDP Growth Below New Normal

The GDP for 2016 rose 1.6 percent, a marked slowdown from the 2.6 percent in 2015. The performance in 2016 marked the slowest pace of expansion since 2011. The economy has been seeing sub-3 percent growth for eleven straight years now, a slowdown from the 3+ percent growth seen in the mid- to late-1990s.

According to a BLS release in 2013, the economy is transitioning to an era of slower GDP growth, with the slower growth becoming the new normal, given the ravages of the Great Recession and a host of other hurdles, including shift in demographics, fiscal issues and lower federal spending. The new norm was quantified around 2.6 percent.

Inflation Picking Up

The GDP price index, an inflation gauge, rose 2 percent in the fourth quarter, up from 1.5 percent in the third quarter.

Breaking Down The Number

- Personal consumption expenditure, which contributed to 1.7 percentage points to total growth, rose 2.5 percent, a slowdown from the 3 percent rate in Q3. Softness in spending on durable goods and services led to the weakness.

- Non-residential investment and residential investment contributed to growth, with gross private domestic investment rising 10.7 percent in Q4, up from 3 percent in Q3.

- Exports deducted 1.70 percentage points from growth, as exports fell 4.3 percent even as imports climbed 8.3 percent.

Commenting on the composition of growth, Joseph Brusuelas, chief economists at RSM, said, "The detail underneath the topline 1.9 percent growth is somewhat encouraging with gross domestic purchases increasing by 3.5 percent, final sales to domestic purchasers increasing 2.5 percent and final sales to private domestic purchasers rising by 2.8 percent."

"The topline growth is above the long term trend of 1.5 percent and the fact that net exports exerted a drag of 1.7 percent on overall growth, which is a reversal of one time gains in the third quarter, implies that growth will continue along the current soggy trend until the impact of regulatory rollbacks and lower taxes take place quite possible at the end of 2017," Brusuelas added.

Trump Bump In The Economy?

The anemic growth that has come to characterize the current economic recovery has led to concerns all around on whether the economy is losing steam. El-Erian avers that Trump's early initiatives will spur meaningful growth.

"Through the careful design and implementation of de-regulation, tax reform and infrastructure, the structural reform measures signaled by President Trump can spur higher growth," El-Erian said.

When asked when the pace of growth will pick up pace, El-Erian said, "The short-term qualifiers relate to the policy formulation process and passage through Congress, together with the absence of large-scale trade disruptions. The longer-term qualification involves whether the rest of the world — and Europe, China and Japan in particular — also shift to more comprehensive pro-growth policies."

Image Credit: By Air Force Staff Sgt. Sean Martin [Public domain], via Wikimedia Commons

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.