For the most part, Wall Street analysts are showing signs of concerns over Alphabet Inc GOOG GOOGL's YouTube ad scandal but disagree on what impact this would have on the stock

For instance, Brian Nowak of Morgan Stanley commented in a research report that the ad scandal is a "real issue" but the analyst maintained an Overweight rating and $1,000 on Alphabet's stock. On the other hand, Brian Wieser of Pivotal Research Group downgraded Alphabet's stock to Hold from Buy with a price target lowered to $950 from a previous $970.

Statista: Crisis Has Taken Its Toll

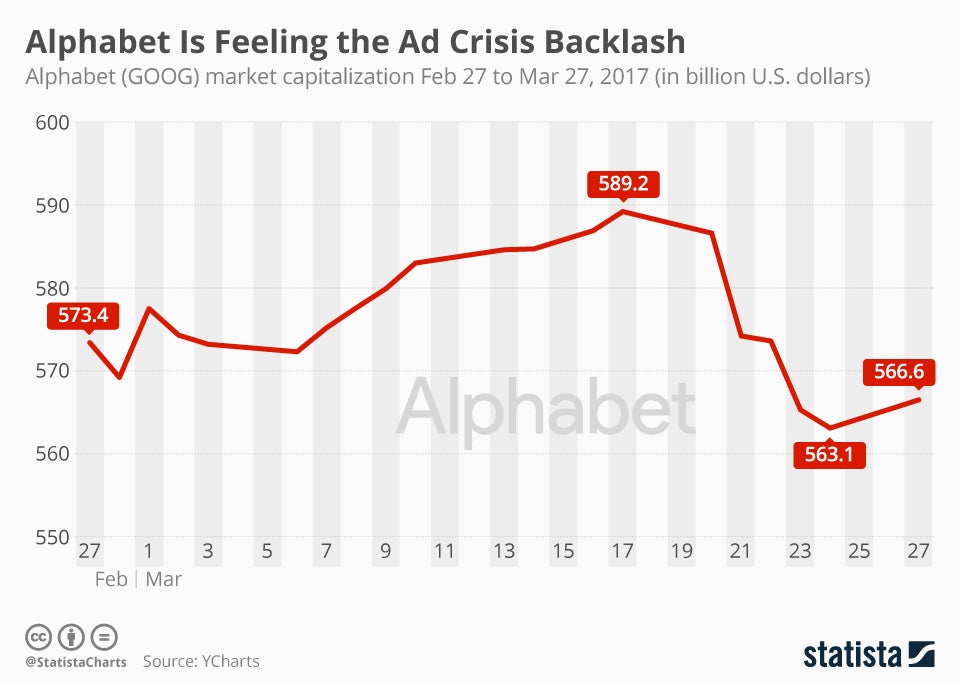

While the Wall Street community will continue to debate any short and long-term impact to Alphabet in the coming days and weeks, Statista pointed out that the ad scandal has already taken its toll on Alphabet's stock.

According to Statista, despite a rebound in Alphabet's stock on Monday, the market capitalization has fallen by more than $20 billion since the scandal broke out.

"The whole episode has certainly been felt by parent company Alphabet and its shareholders," Statista noted.

At the end of February, Alphabet's (GOOG) market capitalization stood at $573.4 billion. It rose over the following days to $589.2 billion on March 17, the day when reports of the scandal started to surface. Alphabet's market cap for the time being bottomed at $563.1 billion on March 24.

As of Tuesday morning, Alphabet's stock was trading at a market capitalization of $574.23 billion.

Related Links:

Companies Continue To Weigh Whether Their Brands Are Safe In The Hands Of Google

Here's Every Major Corporation That's Pulled Ads From YouTube

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.