Those who awaited US April CPI data hoping for a summary execution of the inflation narrative walked away from Wednesday’s release disappointed. But the reality is that inflation, although falling, is not doing so quite at the rate most were expecting. For the time being, traders will need to balance both of those factors as they trade the US dollar.

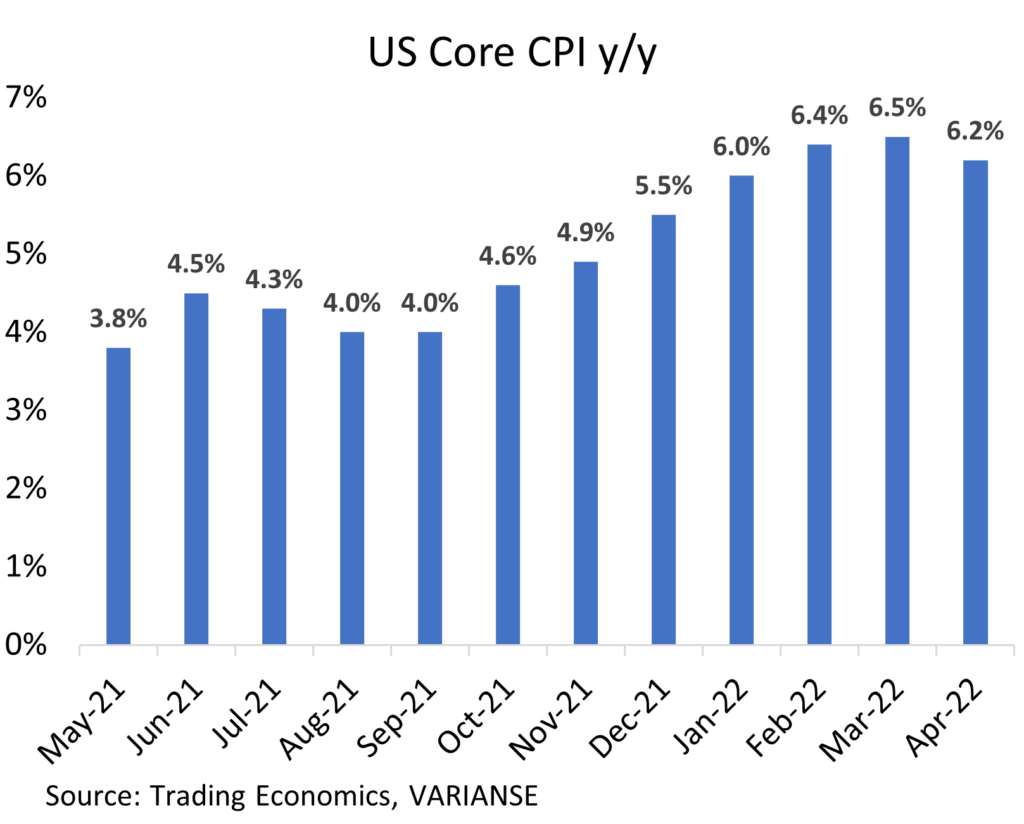

What Wednesday’s CPI data did show is that inflation can at least fall on an annualised and monthly basis in one form or another. Headline CPI in April dropped to 8.3% from 8.5% even though it was above the 8.1% economists were predicting. Likewise, the core inflation rate, which excludes food and energy prices, fell to 6.2% from 6.5% prior, missing expectations of a 6.0% drop.

That, alongside expectations of further disinflationary pressures, still point to a further drop in CPI as the year progresses. The unexpected degree of acceleration in both m/m figures, however, undermines those expectations. Headline CPI accelerated by 0.6% m/m versus an expected 0.4% (prev. 1.2%), while the core figure rose by 0.6% m/m versus 0.4% (prev 0.3%).

Analysts, moreover, have been quick to point out that several components of CPI still point to underlying inflation worries. For one, services ex-energy component, rather than fall, rose by 0.7% m/m. In addition, rents rose by 0.5% as did owner’s equivalent rents. In fact, rents were one key reason why April’s core CPI rose by more than many were expecting.

Still, high inflation has been the market narrative for some time. The initial move higher in the DXY to today’s inflation data were quick to respond to an above consensus print. Meanwhile, the subsequent retracement in gains means there is some capitulation to the idea that inflation is falling, and Fed rate hiking expectations may be close to their peak. The market is just waiting for the proof in the pudding.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.