During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

Bristol-Myers Squibb Company BMY

- Dividend Yield: 4.00%

- Citigroup analyst Andrew Baum maintained a Neutral rating and raised the price target from $55 to $60 on Nov. 12. This analyst has an accuracy rate of 72%.

- Leerink Partners analyst David Risinger upgraded the stock from Market Perform to Outperform and raised the price target from $55 to $73 on Nov. 12. This analyst has an accuracy rate of 74%.

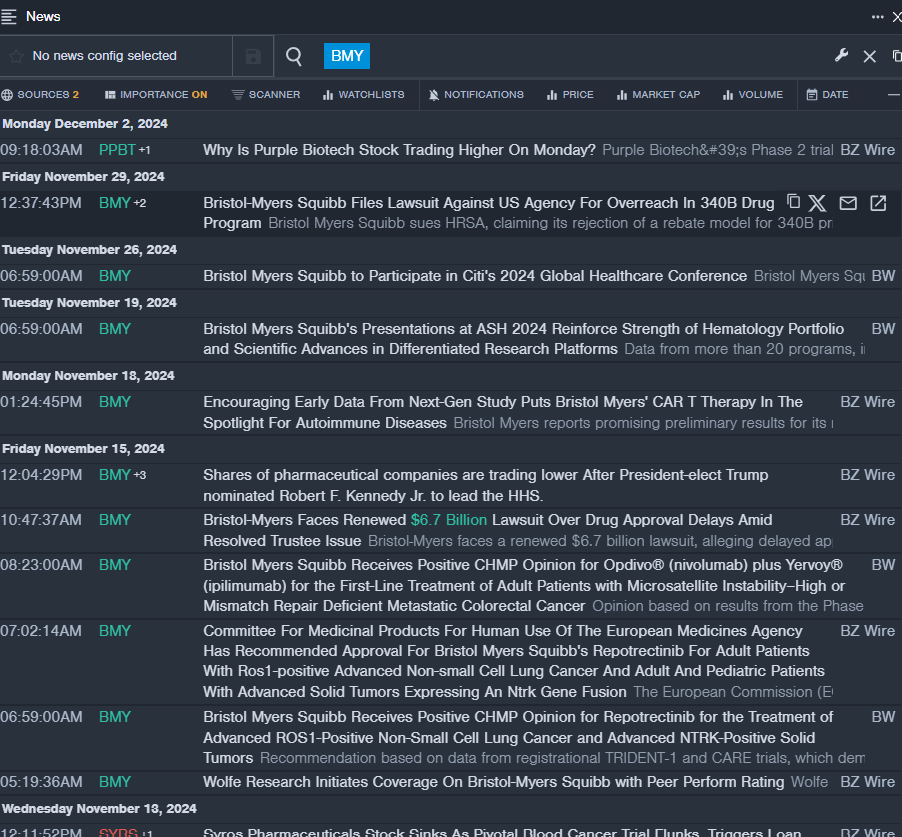

- Recent News: Bristol-Myers Squibb filed a lawsuit last week against the U.S. Health Resources and Services Administration (HRSA) and the U.S. Department of Health and Human Services (HHS), alleging that HRSA’s rejection of its proposed rebate model for the 340B Drug Pricing Program violates federal law.

- Benzinga Pro's real-time newsfeed alerted to latest BMY news

AbbVie Inc. ABBV

- Dividend Yield: 3.61%

- Leerink Partners analyst David Risinger upgraded the stock from Market Perform to Outperform with a price target of $206 on Nov. 22. This analyst has an accuracy rate of 74%.

- Citigroup analyst Geoff Meacham maintained a Buy rating and cut the price target from $226 to $215 on Nov. 12. This analyst has an accuracy rate of 62%.

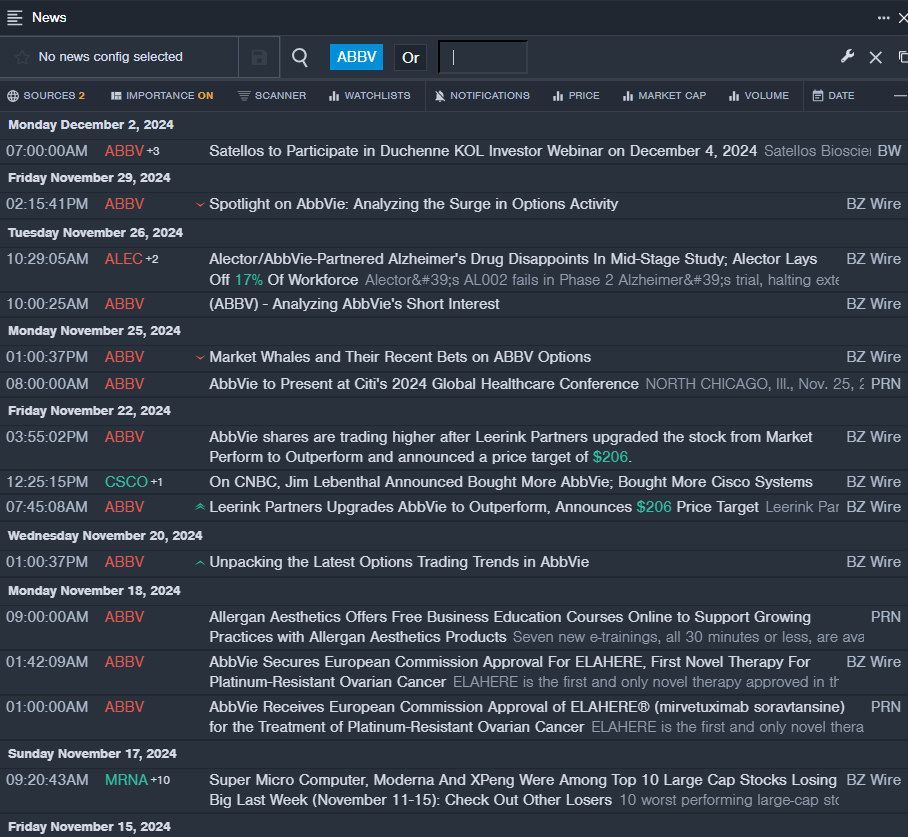

- Recent News: On Nov. 18, AbbVie secured European Commission approval for ELAHERE, first novel therapy for platinum-resistant ovarian cancer.

- Benzinga Pro's real-time newsfeed alerted to latest ABBV news

Patterson Companies, Inc. PDCO

- Dividend Yield: 4.75%

- Baird analyst Jeff Johnson maintained a Neutral rating and cut the price target from $30 to $28 on Aug. 29. This analyst has an accuracy rate of 80%.

- Morgan Stanley analyst Erin Wright maintained an Equal-Weight rating and lowered the price target from $35 to $28 on June 20. This analyst has an accuracy rate of 77%.

- Recent News: Patterson Companies will hold its fiscal 2025 second-quarter conference call on Thursday, Dec. 5.

- Benzinga Pro’s charting tool helped identify the trend in PDCO stock.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.