Sharp deviations have been witnessed in the exchange-traded funds tracking Michael Saylor‘s MicroStrategy Inc. MSTR, likely stemming from the exposure to its volatile swaps and options.

What Happened: The T-Rex 2X Long MSTR Daily Target ETF MSTU launched on Sept. 18, 2024, and Defiance Daily Target 2x Long MSTR ETF MSTX launched on Aug. 14, 2024, are the two U.S.-listed leveraged ETFs which aim to provide twice the daily returns of MicroStrategy.

However, these ETFs have shown significant tracking errors to their underlying asset, MicroStrategy, highlighting potential risks for investors.

- MSTU: On No. 21, MSTU declined 25.3%, 7% less than expected given MicroStrategy’s 16% drop. However, on Nov. 25, MSTU fell 11.3%, exceeding the expected 8.7% decline based on MicroStrategy’s 4.4% fall.

- MSTX: This fund also displayed tracking error, most notably on Nov. 25, when it plummeted 13.4%, 4.7% more than anticipated.

This underscores a potential for significant deviations in leveraged ETFs like MSTU and MSTX from their intended two times daily performance, presenting heightened risks for investors.

Why It Matters: MicroStrategy is the only publicly listed company holding the highest Bitcoin BTC/USD reserves, representing 2.1% of the total 21 million supply, at a cost of $27.1 billion. The company has also raised $20 billion of debt in 2024 to buy more.

According to a report by Financial Times, Dave Mazza, the chief executive of Roundhill Investments says that the ETF tracking error is not an ETF or leveraged ETF problem, it is a MicroStrategy ETF problem. He said that these ETFs indirectly own (through saps and options) over 10% of MicroStrategy’s market cap, an unprecedented level for leveraged ETFs and a significant holding even among traditional ETFs.

"Simply put, MicroStrategy is too small a company to accommodate the AUM and trading volume in these products. At this point, these ETFs have already reached the breaking point,” Mazza told FT.

According to Elisabeth Kashner, director of global fund analytics at FactSet, one solution to the tracking error is that these ETFs can stop the new unit creation and behave like a closed-end fund when swap lines are exhausted, however, this is discouraged by the Securities and Exchange Commission (SEC.)

Kashner told FT that T-Rex and Defiance, the firms that operate these ETFs face a suboptimal choice. “They can limit their growth or they can live with the limited accuracy and so far they have chosen to prioritise growth over accuracy," Kashner added.

Price Action: Shares of MicroStrategy were down over 1% in premarket trading on Tuesday. The stock has returned 385% on a year-to-date basis, compared to the Nasdaq Composite’s return of 33.85% in the same period, according to Benzinga Pro data.

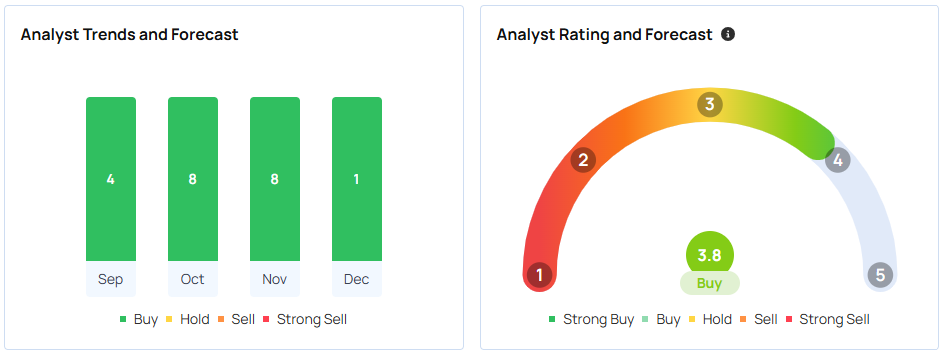

About 12 analysts tracked by Benzinga have a consensus ‘buy’ rating on the stock with a price target of $449.5 per share.

The three most recent analyst ratings between Bernstein, TD Cowen, and Barclays imply a 62% upside for MSTR.

Read Next:

Photo courtesy: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.