The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

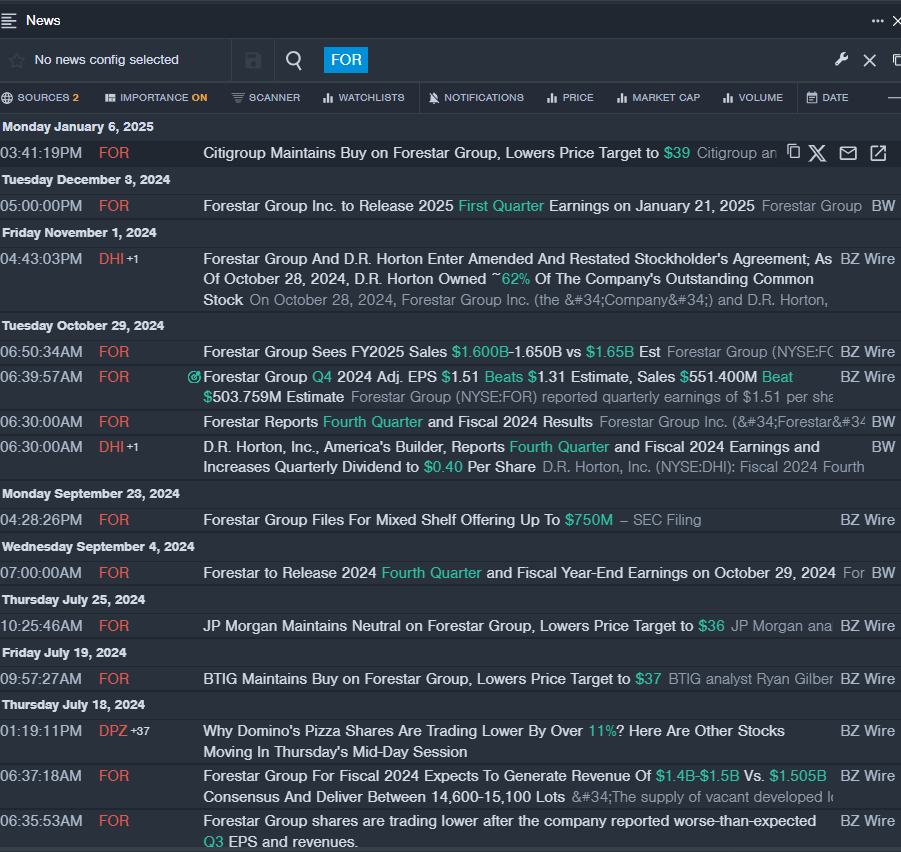

Forestar Group Inc FOR

- On Jan. 6, Citigroup analyst Anthony Pettinari maintained Forestar Group with a Buy and lowered the price target from $43 to $39. The company' stock fell around 10% over the past month and has a 52-week low of $24.81.

- RSI Value: 20.5

- FOR Price Action: Shares of Forestar Group fell 2.5% to close at $25.10 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest FOR news.

American Assets Trust, Inc AAT

- American Assets Trust will announce its fourth quarter and year-end 2024 earnings after the market closes on Tuesday, Feb. 4. The company's stock fell around 10% over the past five days and has a 52-week low of $20.03.

- RSI Value: 22.7

- AAT Price Action: Shares of American Assets Trust fell 3.2% to close at $23.56 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in AAT stock.

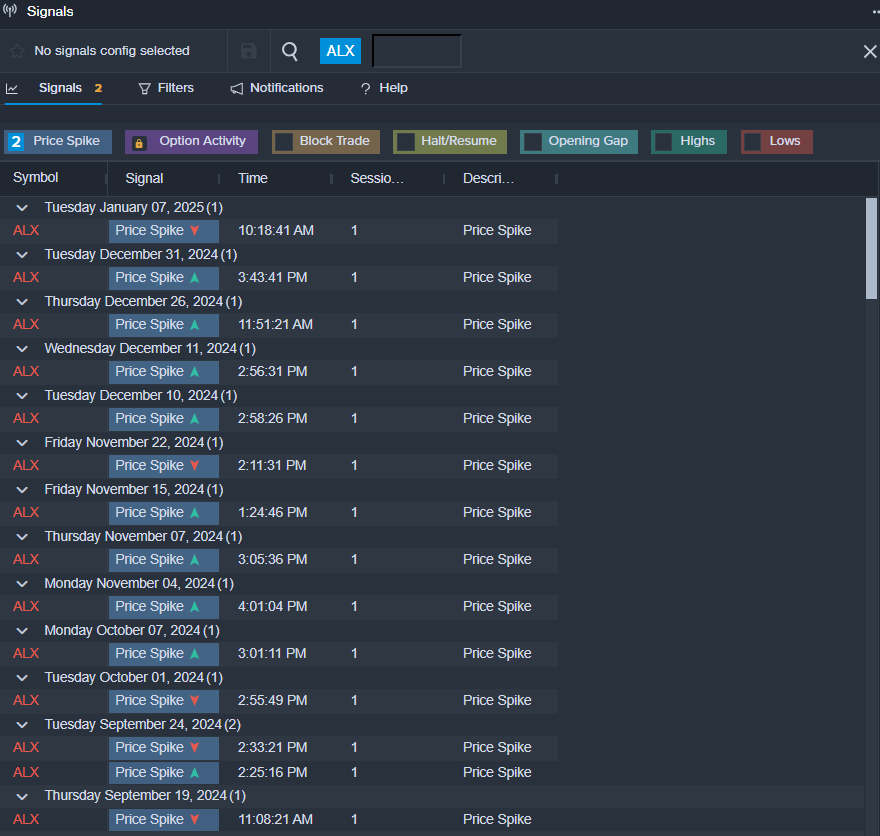

Alexander’s Inc ALX

- On Nov. 4, Alexander’s posted better-than-expected quarterly results. The company's stock fell around 12% over the past month and has a 52-week low of $185.00.

- RSI Value: 25.9

- ALX Price Action: Shares of Alexander’s fell 6.6% to close at $186.88 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in ALX shares.

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.