During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

The Kraft Heinz Company KHC

- Dividend Yield: 5.57%

- TD Cowen analyst Robert Moskow maintained a Hold rating and cut the price target from $34 to $32 on Jan. 8, 2025. This analyst has an accuracy rate of 67%.

- Evercore ISI Group analyst David Palmer downgraded the stock from Outperform to In-Line and lowered the price target from $38 to $35 on Jan. 7, 2025. This analyst has an accuracy rate of 62%.

- Recent News: On Oct. 30, Kraft Heinz posted third-quarter earnings of 75 cents per share, beating estimates, but reported a revenue decline and anticipates a prolonged recovery in U.S. retail.

- Benzinga Pro's real-time newsfeed alerted to latest KHC news.

Conagra Brands, Inc. CAG

- Dividend Yield: 5.37%

- JP Morgan analyst Ken Goldman maintained a Neutral rating and cut the price target from $30 to $29 on Jan. 3, 2025. This analyst has an accuracy rate of 77%.

- B of A Securities analyst Bryan Spillane maintained a Neutral rating and cut the price target from $31 to $29 on Dec. 20, 2024. This analyst has an accuracy rate of 62%.

- Recent News: On Dec. 19, the company reported second-quarter adjusted earnings per share of 70 cents, beating the analyst consensus estimate of 67 cents.

- Benzinga Pro's real-time newsfeed alerted to latest CAG news

Cal-Maine Foods, Inc. CALM

- Dividend Yield: 3.89%

- Goldman Sachs analyst Adam Samuelson maintained a Sell rating and raised the price target from $47 to $52 on July 17, 2024. This analyst has an accuracy rate of 60%.

- Stephens & Co. analyst Ben Bienvenu reiterated an Equal-Weight rating with a price target of $65 on April 3, 2024. This analyst has an accuracy rate of 75%.

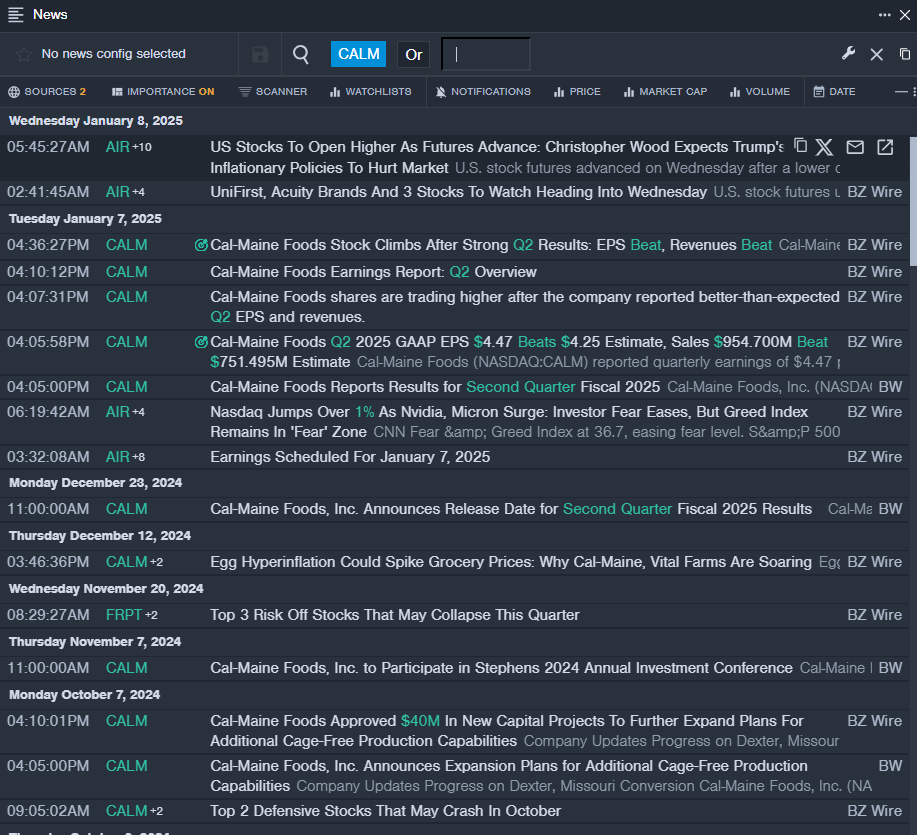

- Recent News: On Jan. 7, Cal-Maine Foods reported better-than-expected quarterly EPS and revenues.

- Benzinga Pro’s real-time newsfeed alerted to latest CALM news

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.