The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

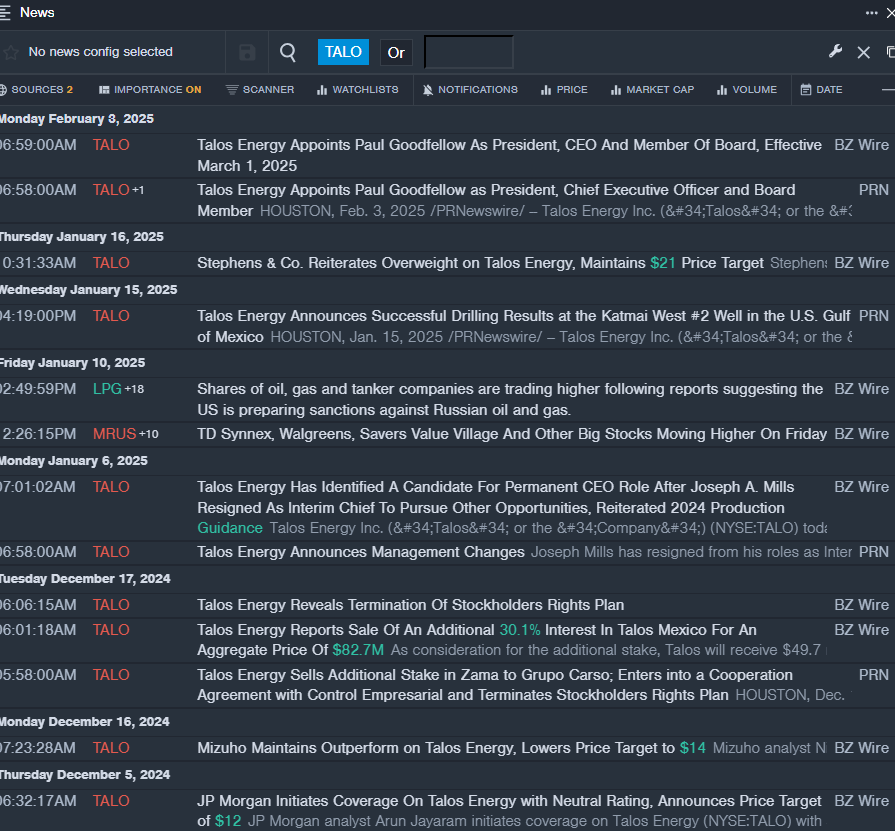

Talos Energy Inc TALO

- On Feb. 3, Talos Energy named Paul Goodfellow as President, CEO and Member of Board, effective March 1, 2025. The company' stock fell around 8% over the past five days and has a 52-week low of $8.88.

- RSI Value: 27.8

- TALO Price Action: Shares of Talos Energy fell 5.9% to close at $9.34 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest TALO news.

Dorchester Minerals LP DMLP

- On Jan. 23, Dorchester Minerals announced the Partnership’s fourth quarter 2024 cash distribution. The distribution of $0.739412 per common unit represents activity for the three-month period ended Dec. 31, 2024. The company's stock fell around 9% over the past month and has a 52-week low of $28.41.

- RSI Value: 28.8

- DMLP Price Action: Shares of Dorchester Minerals gained 1.5% to close at $31.14 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in DMLP stock.

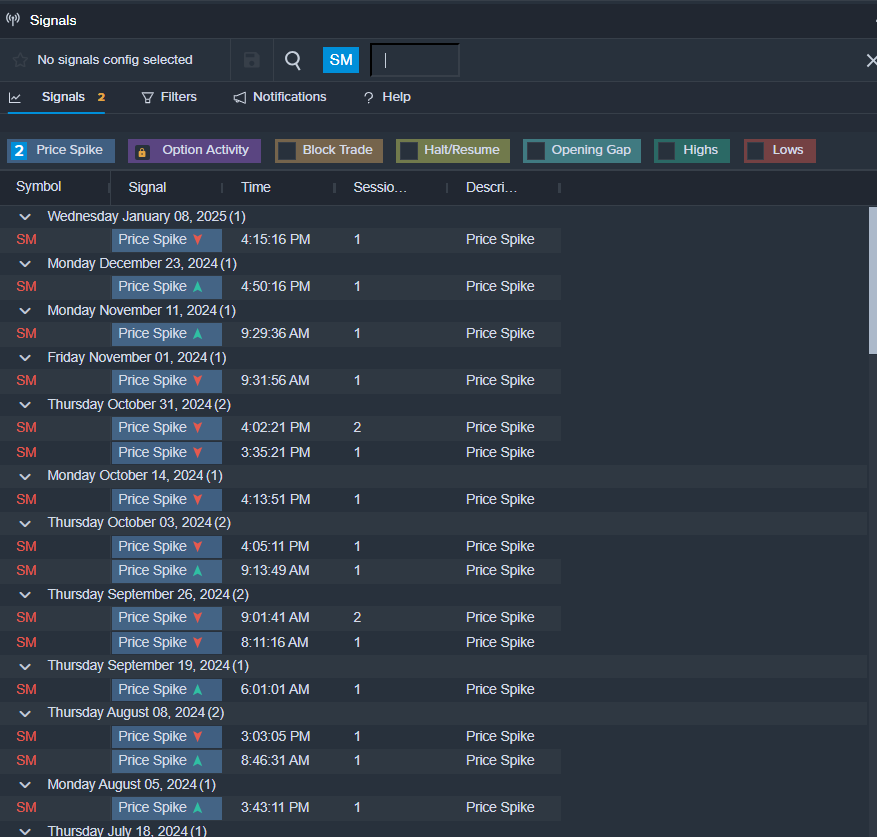

SM Energy Co SM

- On Jan. 13, Truist Securities analyst Neal Dingmann maintained SM Energy with a Hold and raised the price target from $42 to $45.. The company's stock fell around 9% over the past month and has a 52-week low of $34.90.

- RSI Value: 29

- SM Price Action: Shares of SM Energy fell 1.5% to close at $37.38 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in SM shares.

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.