During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

CVS Health Corporation CVS

- Dividend Yield: 4.01%

- Truist Securities analyst David Macdonald maintained a Buy rating and raised the price target from $60 to $76 on Feb. 13, 2025. This analyst has an accuracy rate of 65%.

- Leerink Partners analyst Michael Cherny upgraded the stock from Market Perform to Outperform and boosted the price target from $55 to $75 on Feb. 13, 2025. This analyst has an accuracy rate of 61%.

- Recent News: On March 4, Wellvana and CVS Health disclosed that Wellvana has acquired the Medicare Shared Savings Program business of CVS Accountable Care™, part of CVS Health, in an all-stock transaction.

- Benzinga Pro’s real-time newsfeed alerted to latest CVS news.

Bristol-Myers Squibb Company BMY

- Dividend Yield: 4.06%

- Wells Fargo analyst Mohit Bansal maintained an Equal-Weight rating and raised the price target from $60 to $62 on Feb. 7, 2025. This analyst has an accuracy rate of 74%.

- Citigroup analyst Andrew Baum maintained a Neutral rating and boosted the price target from $60 to $65 on Jan. 28, 2025. This analyst has an accuracy rate of 72%.

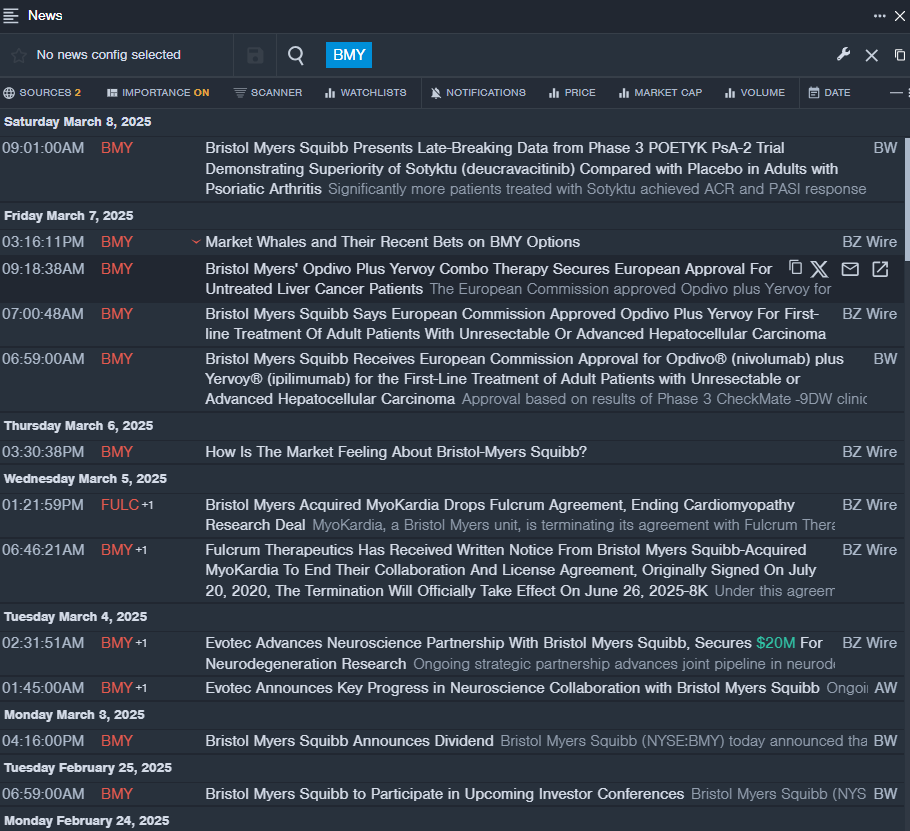

- Recent News: On March 7, the European Commission (EC) approved Bristol Myers Squibb's Opdivo (nivolumab) plus Yervoy (ipilimumab) for the first-line treatment of adult patients with unresectable or advanced hepatocellular carcinoma (HCC), a type of liver cancer.

- Benzinga Pro's real-time newsfeed alerted to latest BMY news

Johnson & Johnson JNJ

- Dividend Yield: 2.98%

- Guggenheim analyst Vamil Divan maintained a Neutral rating and raised the price target from $162 to $166 on Feb. 3, 2025. This analyst has an accuracy rate of 76%.

- Barclays analyst Matt Miksic maintained an Equal-Weight rating and increased the price target from $159 to $166 on Jan. 28, 2025. This analyst has an accuracy rate of 69%.

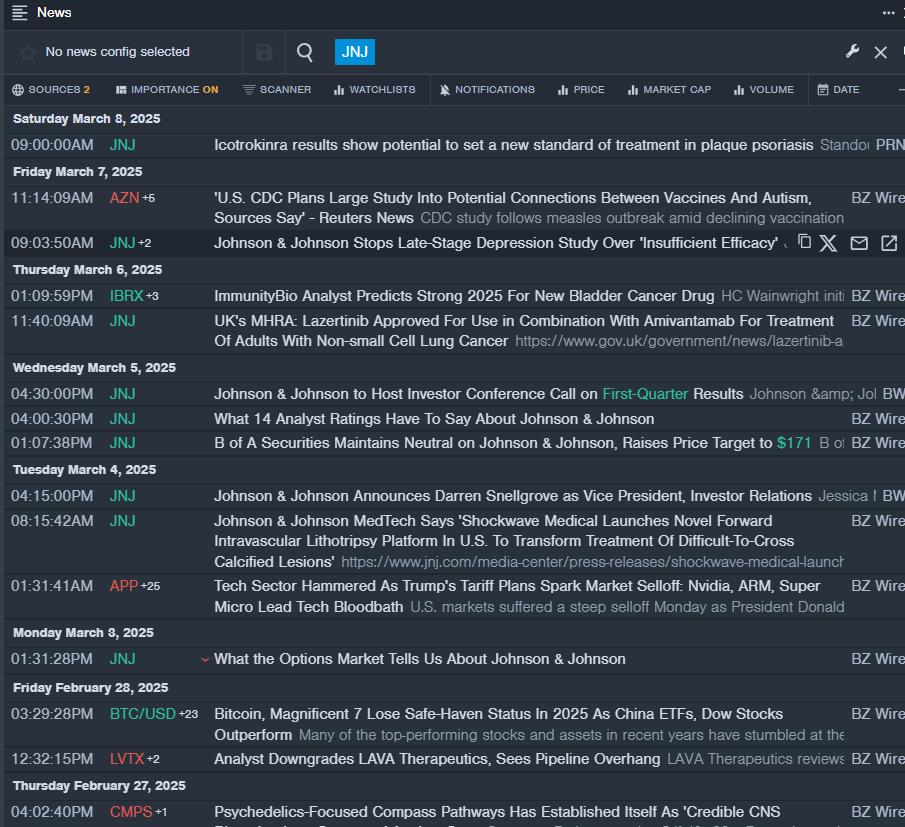

- Recent News: On March 7, Johnson & Johnson decided to discontinue the Phase 3 VENTURA development program evaluating aticaprant, a kappa opioid receptor (KOR) antagonist, as an adjunctive treatment for major depressive disorder (aMDD).

- Benzinga Pro’s real-time newsfeed alerted to latest JNJ news

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.