In a recent development, 13 institutional investors have unanimously predicted that Microsoft Corp. MSFT will outpace Apple Inc. AAPL in terms of stock market value over the next five years.

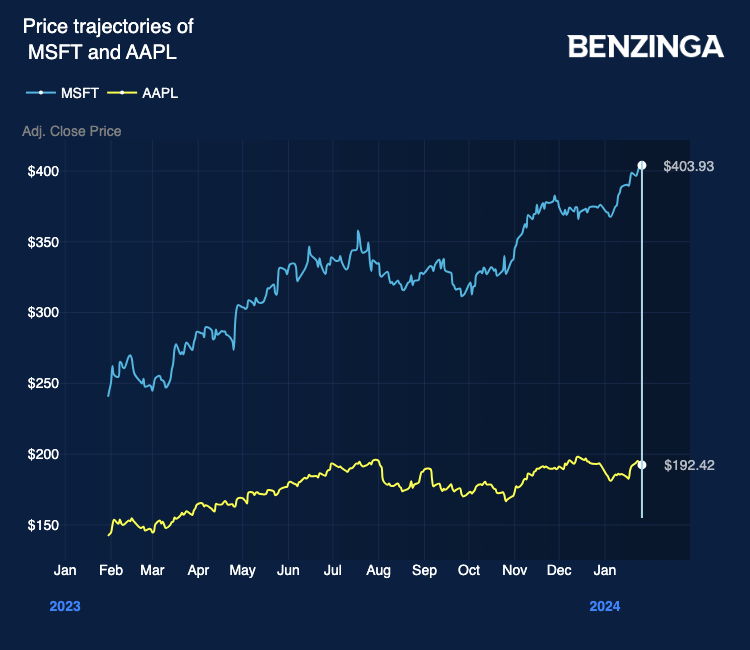

What Happened: Microsoft’s shares have surged by 7% in 2024, propelling its market value above $3 trillion and surpassing Apple as the world’s most valuable company, reported Reuters on Monday. As of Friday, Microsoft’s market capitalization was slightly higher than Apple’s.

All 13 investment strategists and portfolio managers consulted by Reuters last week believe that Microsoft will outperform Apple in the next five years, despite potential share price and valuation fluctuations following the quarterly results of both companies.

Microsoft’s recent strides in generative AI are seen as a significant advantage over Apple in the long term. However, some investors suggest that the race between the two tech giants could turn into a second-place race, with Nvidia Corp. NVDA emerging as a strong contender.

Why It Matters: Microsoft’s rise in AI has been a focal point in recent discussions. The company’s AI advancements have been viewed as a key factor in its $3 trillion market valuation in January 2024. Microsoft’s shares surged by 57% in 2023 due to its AI leadership.

On the other hand, Apple has been incorporating AI into its product features, such as improving iPhone photography. However, the company’s reliance on the iPhone, a mature market, and its unclear strategy in the AI race have raised concerns among investors.

Image by FellowNeko via Shutterstock

Engineered by Benzinga Neuro, Edited by Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.