Union Pacific Corporation UNP reported mixed fourth-quarter results on Thursday.

Union Pacific reported operating revenue decline of 1% year-over-year to $6.121 billion, missing the consensus of $6.143 billion. Earnings per share were $2.91 (+7% year-over-year), above the consensus of $2.78.

Union Pacific anticipates that volume will be impacted by mixed economic conditions, fluctuating coal demand, and challenging year-over-year comparisons in international intermodal.

Pricing is expected to drive improvements in the operating ratio, with earnings per share growth projected to reach high-single to low-double digits over the next three years.

“Our strong fourth quarter results represent a great capstone to a very successful year for Union Pacific,” said Jim Vena, Union Pacific Chief Executive Officer. “The team has fully embraced our strategy to lead the industry in safety, service, and operational excellence. That commitment has produced industry leading financial results in 2024, punctuated by our strong finish to the year. We will carry this momentum into 2025 as we seek to unlock the full potential of the UP franchise.”

Union Pacific shares fell 0.3% to close at $608.66 on Thursday.

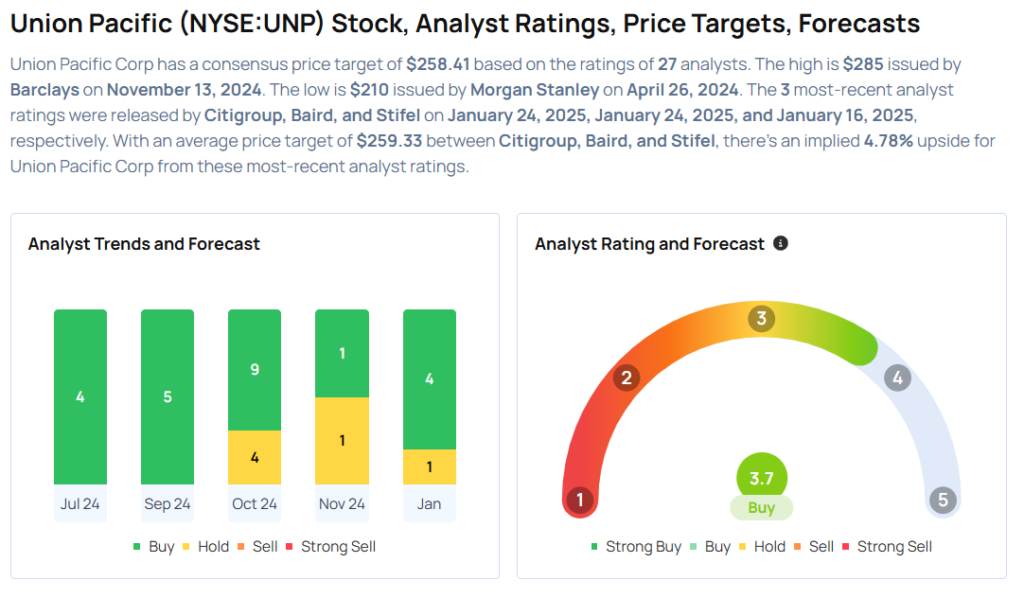

These analysts made changes to their price targets on Union Pacific following earnings announcement.

- Baird analyst Benjamin Hartford maintained Union Pacific with an Outperform and raised the price target from $260 to $265.

- Citigroup analyst Ariel Rosa maintained Union Pacific with a Neutral and raised the price target from $254 to $260.

Considering buying UNP stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.