During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

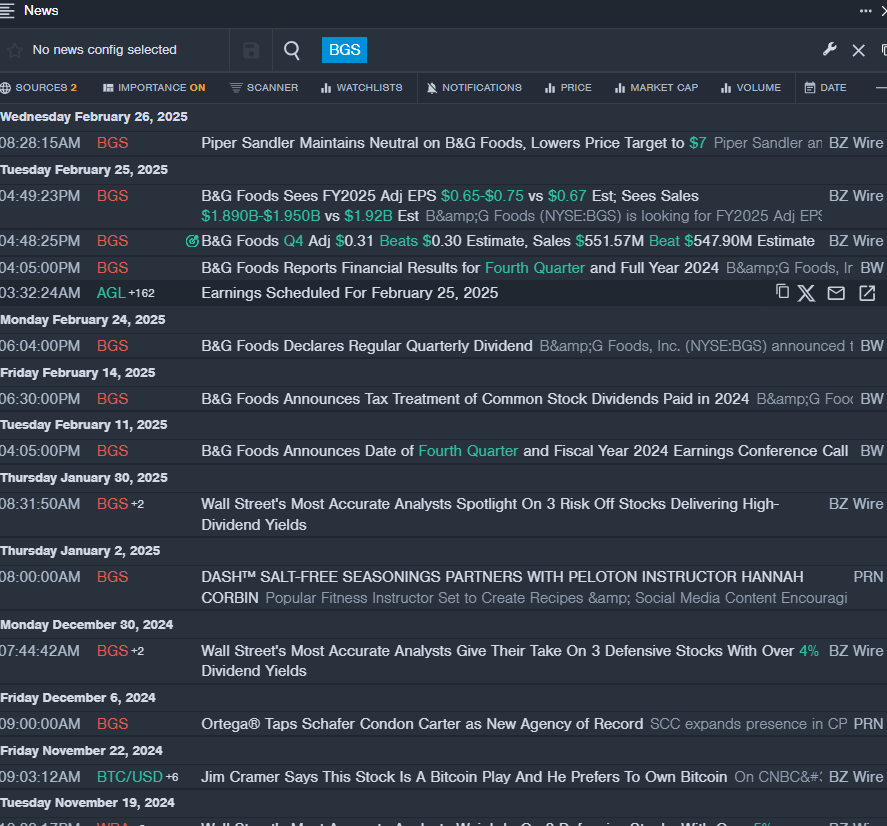

B&G Foods, Inc. BGS

- Dividend Yield: 11.38%

- Piper Sandler analyst Michael Lavery maintained a Neutral rating and slashed the price target from $8 to $7 on Feb. 26, 2025. This analyst has an accuracy rate of 66%.

- Barclays analyst Brandt Montour maintained an Equal-Weight rating and cut the price target from $8 to $7 on Nov. 7, 2024. This analyst has an accuracy rate of 69%.

- Recent News: On Feb. 25, B&G Foods posted better-than-expected quarterly earnings.

- Benzinga Pro’s real-time newsfeed alerted to latest BGS news.

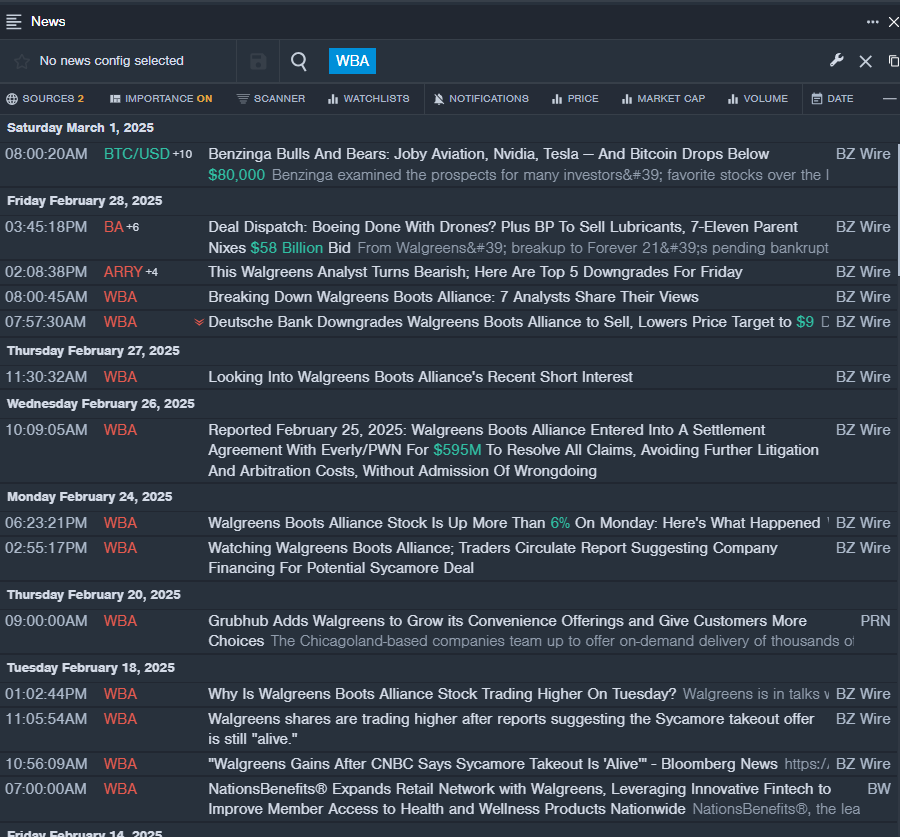

Walgreens Boots Alliance, Inc. WBA

- Dividend Yield: 9.35%

- Truist Securities analyst David Macdonald maintained a Hold rating and decreased the price target from $13 to $12 on Jan. 31, 2025. This analyst has an accuracy rate of 66%.

- B of A Securities analyst Allen Lutz maintained an Underperform rating and raised the price target from $7.5 to $8.5 on Jan. 13, 2025. This analyst has an accuracy rate of 71%.

- Recent News: Sycamore Partners is planning a buyout of Walgreens.

- Benzinga Pro's real-time newsfeed alerted to latest WBA news

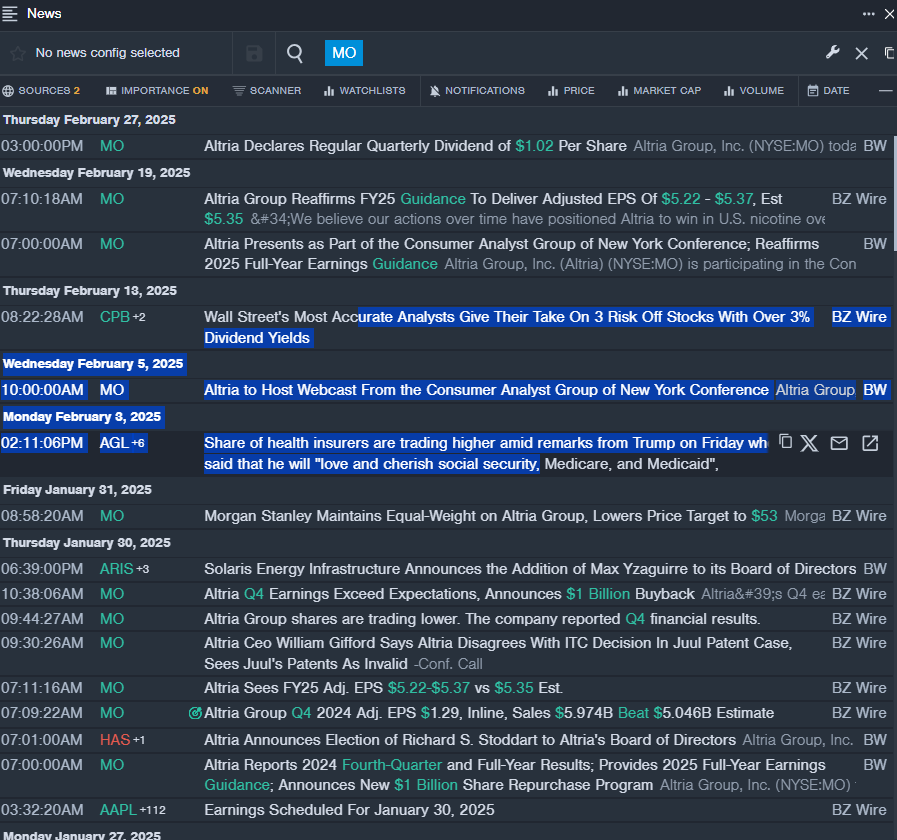

Altria Group, Inc. MO

- Dividend Yield: 7.31%

- B of A Securities analyst Lisa Lewandowskiupgraded the stock from Neutral to Buy and increased the price target from $55 to $65 on Dec. 6, 2024. This analyst has an accuracy rate of 63%.

- Barclays analyst Gaurav Jain maintained an Underweight rating and raised the price target from $45 to $46 on Nov. 6, 2024. This analyst has an accuracy rate of 65%.

- Recent News: On Jan. 30, the company posted upbeat quarterly sales.

- Benzinga Pro’s real-time newsfeed alerted to latest MO news

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.