A binary option contract is simply a true/false or yes/no statement. The main consideration options traders need to make is whether they believe the statement will be true at settlement, in which case they should buy the contract, or if it will be false, in which case they should sell.

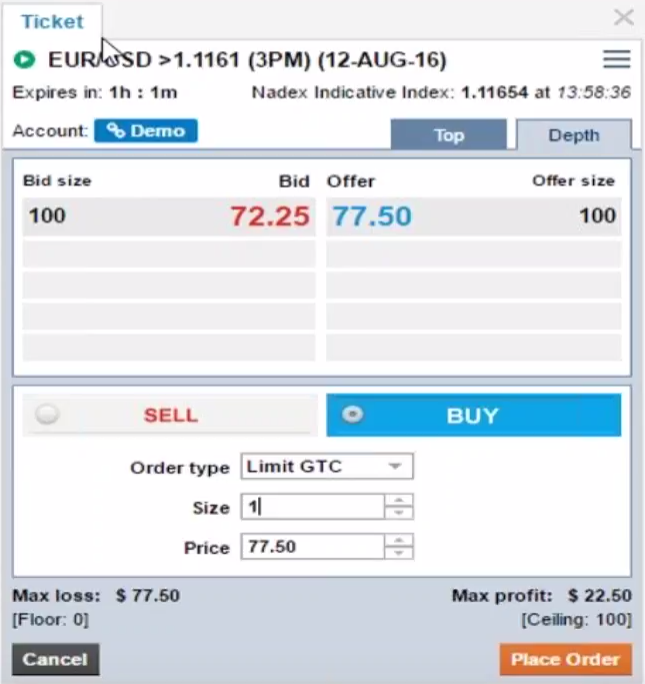

After consulting charts to determine a position, whether buying or selling, the Nadex demo and live platform can provide numerous contracts to fit the chosen trading position. Click on a listed contract and a ticket will open. The following image illustrates this example.

The statement is EUR/USD >1.1161 (3PM): The EUR/USD will be greater than 1.1161 at 3 PM ET. Since the indicative is 1.11654, the statement is already true. Notice the max loss (risk) and max profit (reward). If the contract was bought and the market didn’t go up anymore, simply staying where it is, this trade would be profitable.

As long as the statement is true at settlement, the market can stay where it is or move slightly up or down and the bought contract will remain profitable.

Why are some contracts priced around 70 while others are priced about 20? On the ticket above, notice its offer price of 77.50 is closer to 100 because the statement is already true. This is an in-the-money (ITM) binary because the market is already above the statement or contract price.

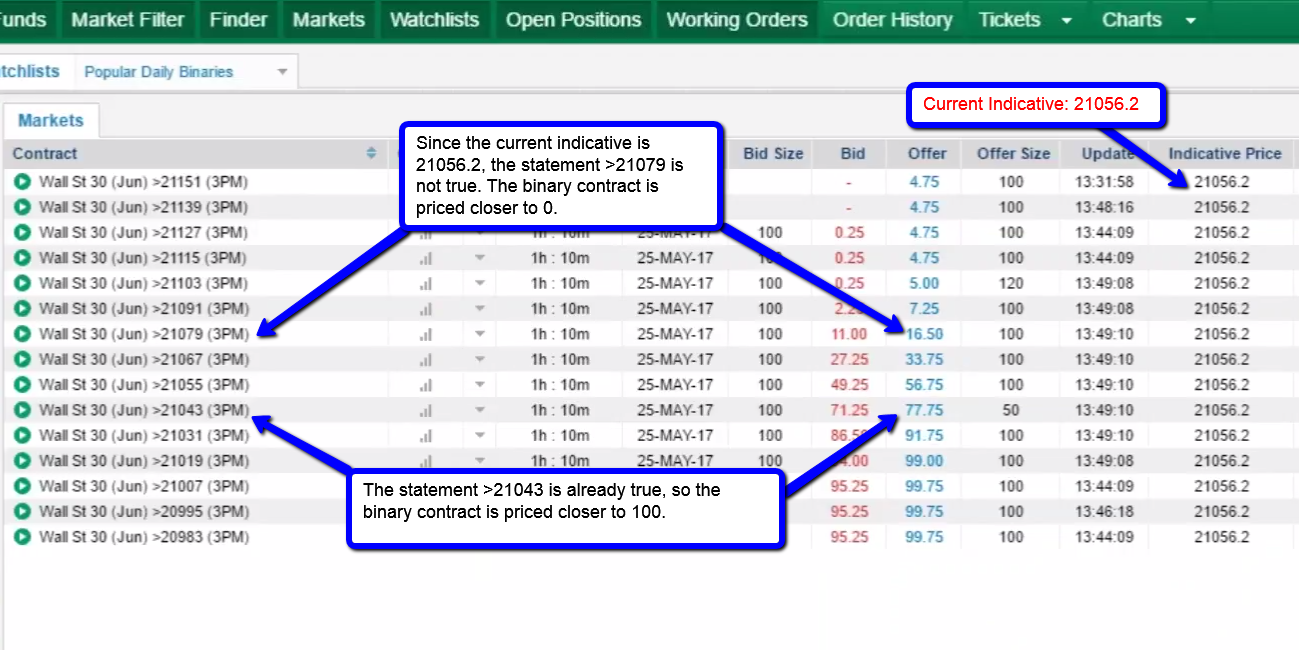

Looking at the image above, notice that the current market (indicative) is 21056.2. The >21043 contract is already true since the market is above that number. In order for the >21079 contract to be true, the market needs to move more than 20 points in the next 70 minutes. For the >21043 contract, there is a much higher probability that the statement will expire true because it is already true. The >21079 contract has a much lower probability of expiring true because it requires the market to move.

Binaries pricing does not take into account the direction of the market, where the market is going, what strategies are being used or what charts and indicators may show. It is merely from a pricing and probability standpoint. It compares the current market (indicative) to the strike price and then comes up with a pricing model. The pricing model can serve as a probability or a percentage.

The average of the bid and offer prices gives a percentage or probability of the binary expiring above the strike. When selling a contract, it is good to use that average in reverse to say that the binary has that much of a percentage or probability of being false. To clarify, suppose a binary is sold for $20. It has a 20 percent chance that the statement will be true and an 80 percent chance that the statement will be false. In this example, there is a higher percent chance of being right if the binary contract is sold.

Free trading education is available at www.apexinvesting.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.