A jobs report that was just about as good as it gets easily overshadowed uncertainty from trade wars and geopolitics on Friday. News that President Trump will meet with the North Korea leader offered a bit of relief for the markets early Friday, but it was really the employment report that drove stocks higher washing out recent shorts ahead of the weekend.

Shorts were expecting another stronger than expected wage growth number in the employment data. But wages grew less than expected, causing short covering that lifted all sectors to end the week. This was a perfect mini-storm, as the wage numbers helped keep treasuries from sliding as well. If you remember, it was the strong wage growth that hit stocks and bonds last month.

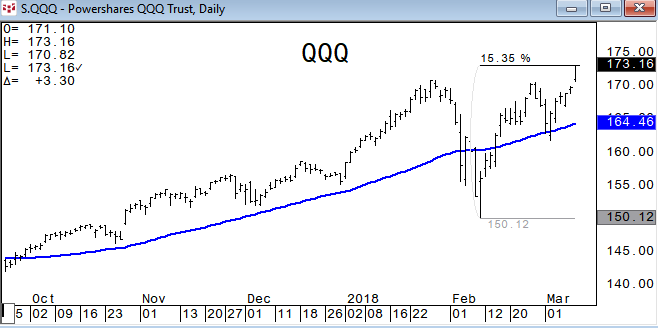

The PowerShares QQQ Trust (NYSE: QQQ) put in a new all-time high and was higher for a sixth straight day. The first six days of 2018 was the only other six-day advance this year. The Q’s have rallied 15 percent in a month.

China accused U.S. President Donald Trump on Friday of damaging the global trading system and “firmly opposes” Trump’s tariff move. Japan’s foreign minister said “These measures could make a significant impact on economic and cooperative relationship between Japan and the U.S." Later, U.S. Treasury Secretary Mnuchin mentioned some other countries could be considered for tariff exemptions over the next two weeks as the rhetoric seems to have softened a bit.

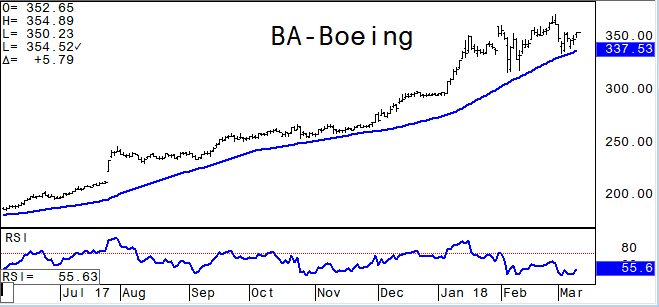

Investor concerns about a trade war have kept Boeing on the defensive, because Boeing Co BA delivers around 70 percent of its aircraft to non-US customers; China was 25 percent of their orders last year. According to Morningstar, aluminum is less than 10 percent of costs. Technically, the 50-day moving average has been a big key support in BA. Boeing had only one day in 2017 where it fell below its 50dma, and last week this level held again. Momentum was about as depressed as it gets in this stock, which should add to the possibility for upside momentum from here and new highs.

Trump will reportedly mspaneet with North Korean leader Kim Jong Un in a few weeks, which will make for great television, but could be a disaster. The President will have to appear diplomatic and leave out the condensation and name calling. Trump will want North Korea to commit to denuclearization, while North Korea wants to be treated as an equal. It's worth noting that the last two times North Korea has made commitments to de-nuke it reneged.

Emerging Markets have been a fund favorite, but you would have done better being long QQQ this year. This chart shows the iShares MSCI Emerging Markets >Index (NYSE: EEM) relative to QQQ. The 2016 lows area all-time lows in this pair.

Americans’ equity holdings climbed in Q4 2017 by the most in four years, bringing stock holdings to $17.9 trillion, or 22.2 percent of all financial assets. This is the highest share percentage since 2000 amid the technology bubble.

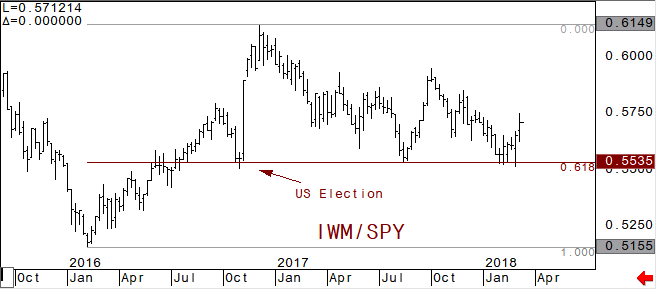

Is Rotation Back? There has been some rotation since the February lows, which is a positive for the market. Small caps have been outperforming, which has been good for the overall market tone. Flows into small caps is saying that money is not moving into safety trades. Talk of a trade war seems to be benefitting the small caps.

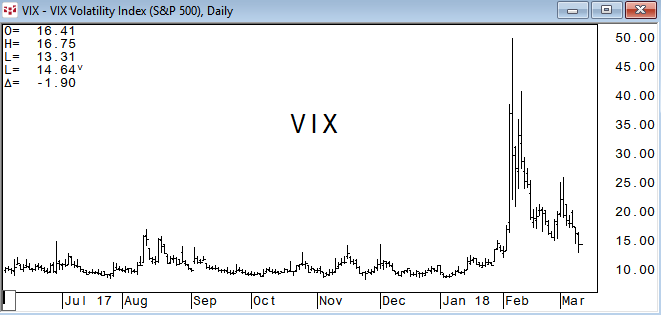

The VIX is back at levels seen just prior to the vol-crisis spike. You knew this was going to happen, but it would be hard to believe that VIX will go back to extreme lows and stay there for long after the carnage we saw just a month ago.

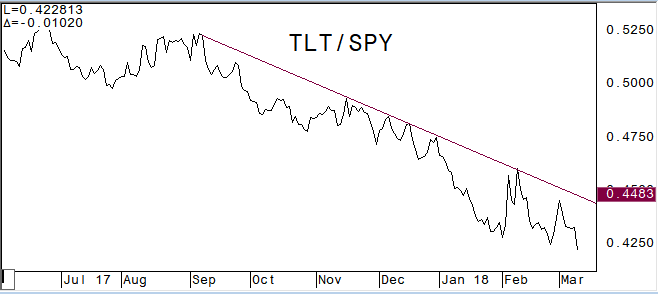

Fixed Income underperformed last week as risk on emerged. How quickly long rates rise is the key to potential reversals in equity indices. A relatively gradual trajectory in 10 and 30-year yields would likely be for stocks. The iShares Barclays 20+ Yr Treas.Bond (NASDAQ: TLT) vs SPY is back at the year lows.

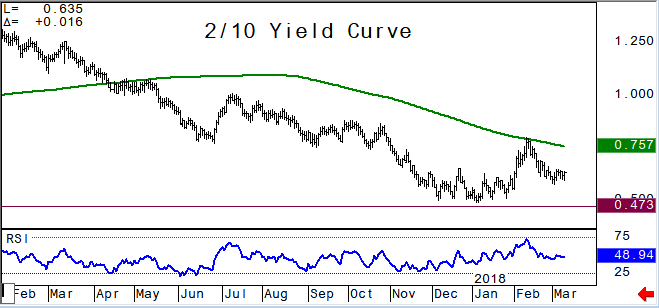

Yield curves will likely become a dominant theme going forward. The 2/10 yield curve had been steepening during the equity weakness, but after hitting the 200-day moving average the curve flattened again. Short term support in the 2/10 at .556 percent and long-term key support at .473 percent.

The Fed’s Evans said on CNBC Friday that wage growth was a little on the weak side, and he sees merit to the argument for waiting on rate hikes "just a littlebitg longer, considering low inflation." This seemed to help stem the decline in bonds as the 30-year future was nearing a short term key support. USM8 has two key short-term levels of support to be aware of; 142-21 and 142-03*. These next two charts show you just how important the 3.25 percent level in 30-year yield is from a technical standpoint. A 618 retracement is considered a pivotal level using Fibonacci analysis and the 100 month moving average has been key resistance for years.

The technology, regional banks, internet, and broker-dealer sector ETFs all put in new all-time highs last week. Most sectors within the S&P still have some work to do to get back to year highs, but some rotation into these sectors is a positive for the overall market tone. We don’t want to have high correlations across multiple sectors because when there is a pullback there is nowhere to hide. The following charts in the Technology Select Sector SPDR Fund XLK, SPDR KBW Regional Banking KRE, First Trust DJ Internet Index Fund FDN, and iShares Dow Jones US Brok-Dea. Ind. IAI illustrate this.

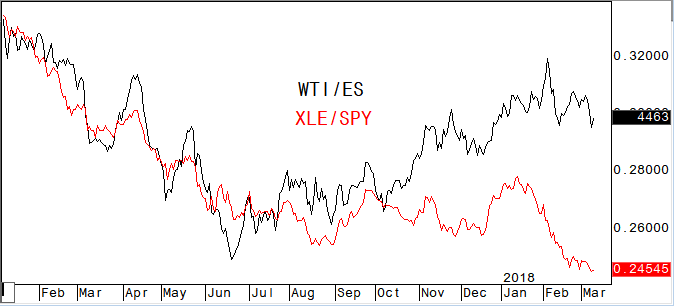

WTI had been outpacing the S&P 500 since June of last year, but has been underperforming since the vol-crisis low. The Energy Select Sector SPDR XLE relative to the SPY saw an unwind of the crowded energy sector trade starting in mid-January and the divergence with crude oil has gotten extreme. As long as crude oil futures can hold above $58 we will look for money flows into the energy sector and mean reversion in this trade.

A softening or less controversial tone geopolitically will help drive stocks higher. We will remain on guard for potential breaking points in long bonds (and pivotal resistance levels in yields). 3.25 percent is coming in 30-year yield, but the trajectory above this level will be important. Rotation between sectors has been and will remain a positive for overall market strength. Stock and sector picking is key. Multiple days where everything is up will signal danger may be coming.

David Wienke is the editor of Keystone Charts. More than 30 years of experience providing technical analysis and execution services to institutional clients is now provided in a daily newsletter, The Daily Game Plan. Coverage includes equities, rates, currencies, and commodities. Dave is also an introducing broker with Capital Trading Group, LLLP (CTG); a Chicago based investment firm specializing in execution and account management for CTAs and individual investors. Charts are created using CQG, a top of the line trading and charting service. For a free trial of the Daily Game Plan newsletter email me at dave@keystonecharts.net or go to Capital Trading Group to subscribe.

For more information go to www.keystonecharts.net

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.