Knowing which direction the market is going to go can often, if not always, be a challenge, if not impossible to know. This creates the need for a strategy that can profit either way the market goes. Enter the Iron Condor. An Iron Condor strategy buys a lower spread and sells an upper spread. The ceiling of the lower bought spread meets the floor of the upper sold spread and is at or very near where market is trading. With this kind of setup, the Iron Condor strategy can profit three ways.

- If the market doesn’t move at all

- If the market moves and then pulls back to where it started when you entered

- If the market moves in one direction but not significantly relative to your entries

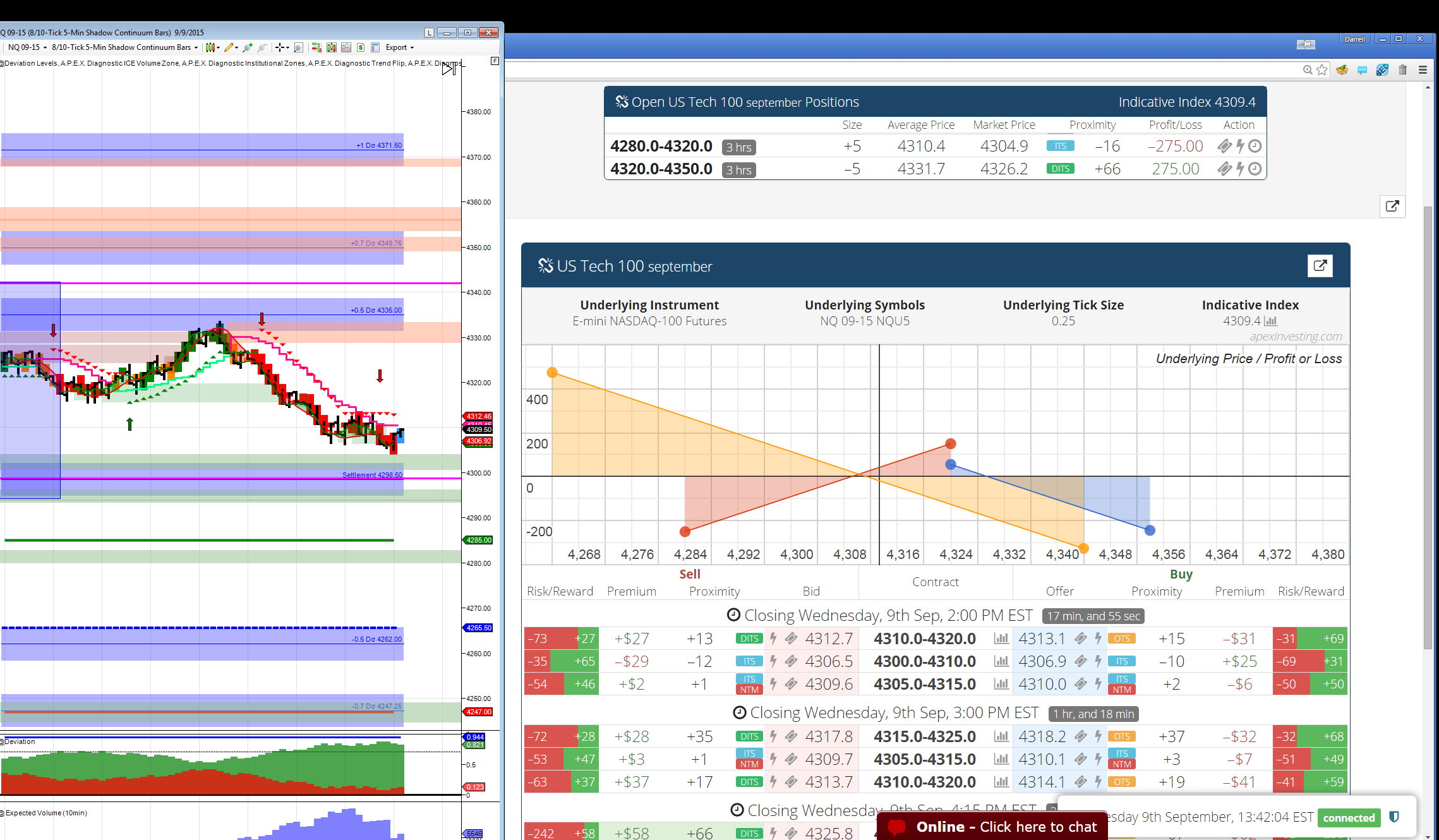

Consider how the following Iron Condor trade played out using Nadex spreads trading the US Tech 100, a spread derivative of the E-mini NASDAQ.

To start all of the Nadex US Tech 100 spreads were brought up on the spread scanner for viewing. For this trade you wanted to look at spreads with positive green numbers in the Premium column, denoting those spreads had positive premium.

The How’s And Why’s To Trade With Positive Premium

What does it mean to have positive premium? If you are selling a spread and it has positive premium, that means you are selling and entering the spread above the market. Wouldn’t it be nice to sell above where the market is? The market would have the distance between where the market is and your entry price, to move without your trade losing. The market would have to go all the way up, past your entry price, before your trade would start to lose.

The same would hold true for buying below the market, only just the reverse. If you are buying a spread, and it has positive premium, that means the offer price to enter is below the market. With positive premium the market can stay where it is until expiration and your trade will make money. It will make whatever the premium was at the time of entry.

Going back to the example trade, two spreads were chosen that had positive premium. At the time of entry, the premium on the sold spreads was about $73 and the premium on the bought spreads was about $96. Had the market remained in that same place, the trade would have collected that premium as time expired, and at expiration would have profited $73 x 5 sold spreads = $365 and $96 x 5 bought spreads = $480.

To view larger image click HERE.

You can see from the image that on the five spreads bought, the average price was 4310.4, and on the five spreads sold, the average price was 4331.7. With this setup if the market goes up, you can make money on your bought spread. If the market goes down, you can make money on your sold spread. If the market stays flat, you can make money by collecting the premium from both.

As the market moved up after entry, the profit from the bought spreads hedged the sold spreads losses.

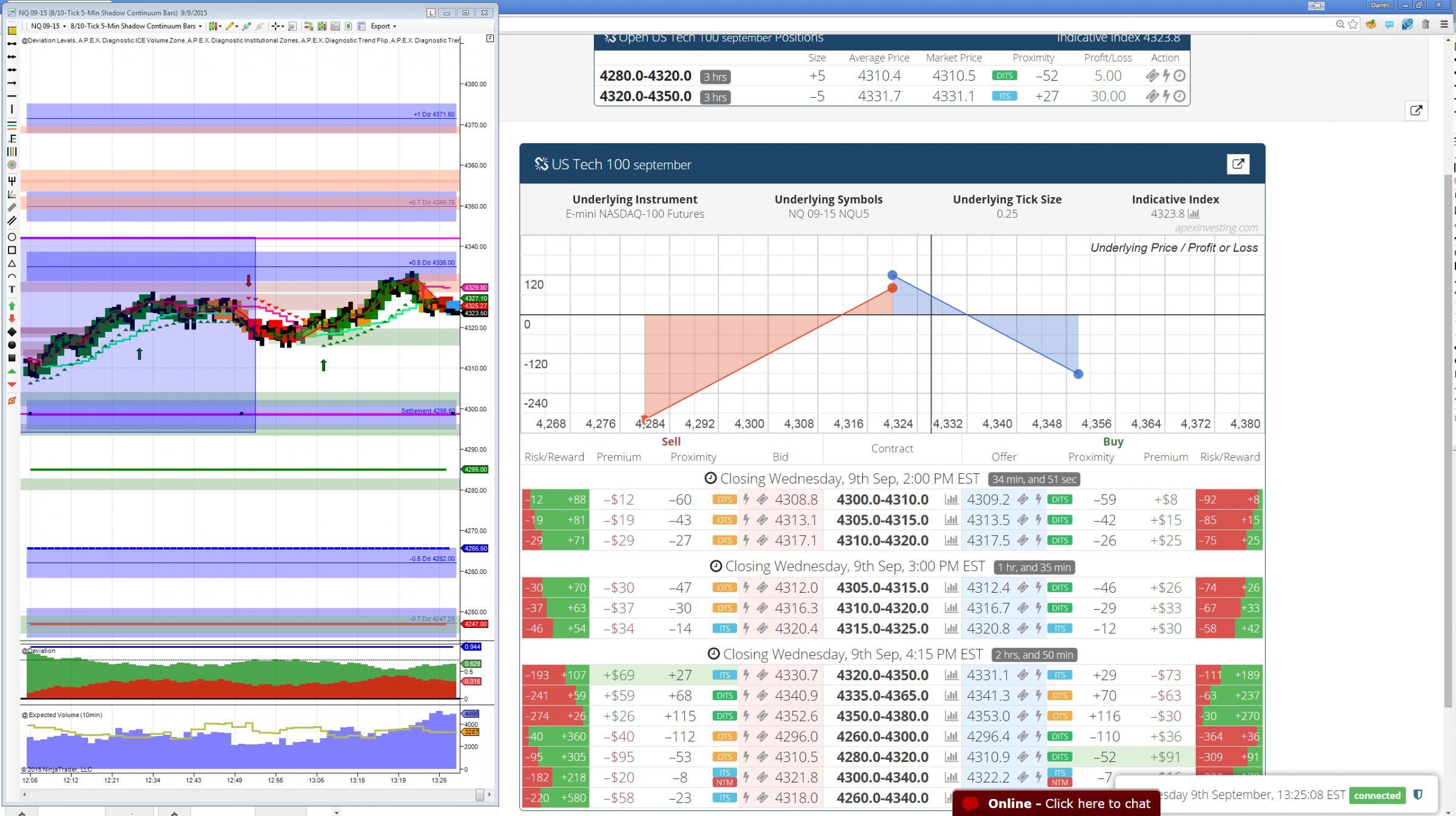

To view larger image click HERE.

When do you get nervous? You may get nervous when the market moves past your maximum profit on the other side. For example, on the bought side the maximum profit on one spread would be 9.6 or $96. On the other side, the sold spreads were sold at 4331.7, the market could move up in price by 9.6, to 4341.3. That is where you should call the trade. At that point, the bought spreads have profited, but the market has gone past the point of break-even being the entry price of the sold spreads, and is now losing. Below you can see how the bought side hedged the other as the market neared the breakeven line.

To view larger image click HERE.

As Time Passed Both Spreads Became Profitable

To view larger image click HERE.

If the market landed right in the middle at 4320, then profit on the sold spread would be 4331.7 - 4320 = 11.7 x 5 spreads = 58.5. Profit on the bought spread would be 4320 - 4310.4 = 9.6 x 5 spreads = 48.0. With each tick being worth $1 on Nadex, that would be a combined profit potential of $1065, and yet it was never known which direction the market was going to move.

You can watch the video of this Iron Condor as shown on The Diagnostics Trading Hour in its entirety. Duration: 54 minutes.

For more information on how to trade Nadex, futures, forex or CFDs visit www.apexinvesting.com, a service by Darrell Martin. Nadex can be traded from 49 different countries.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.