The Census Bureau and Bureau of Labor Statistics on Wednesday will be releasing a total of four reports. The reports are relating to retail sales and the price of production. Whether the numbers go higher or lower, there is a trade opportunity for setup at 7:00 a.m. ET trading Nadex EUR/USD spreads with 9:00 a.m. ET expirations.

The Retail Sales and Core Retail Sales reports give a total value of retail sales with and without automobiles respectively. The Producer Price Index (PPI) and Core PPI give the change in price of finished goods and services sold by producers including and then excluding the numbers for food, energy and trade respectively. These numbers are an important influence on the economy as retail sales make up the majority of spending and producer costs are often passed on to the consumer.

With An Iron Condor Strategy, You Can Profit When Market Moves and Then Pulls Back or Ranges

Using Nadex spreads for this strategy called an Iron Condor. You want to sell an upper spread above the market with its floor being where the market is trading at the time. Also, buy a lower spread below the market with its ceiling being where the market is trading at the time. Your profit potential should be $35 or more. An Iron Condor strategy is great for when you don’t know which way the market will go, and you think the market may pull back and or just stay in a range.

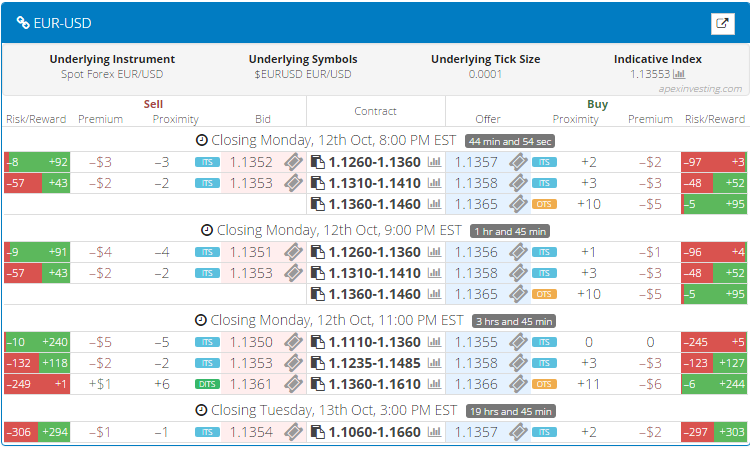

To easily find the spreads you’re looking for, you can consult the Apex Investing new and improved spread scanner. This scanner makes it possible for Nadex traders to choose their optimum spreads at a glance and with a few clicks. Below is an example of the EUR/USD Nadex spread market on the spread scanner. Down the middle, you can see the spreads are listed with the floor price on the left and the ceiling price on the right. To the far left, you will see the Risk/Reward for the sell side and the far right you will see the Risk/Reward for the buy side. Find two spreads matching the above listed floor ceiling parameters and then look at the reward bars to see together if the two spreads have a $35 or more profit potential.

To view larger image click HERE.

With the spread scanner, you can also enter take profits and stop triggers. The reports are released at 8:30 a.m. ET and the market will make its move and then tends to pull back. With the Iron Condor strategy, the market need not move at all for you to profit. The market can remain where it was when you entered, and as time goes by and expires, you will profit. If the market makes a move in one direction, one side of your Iron Condor can profit, and then, if the market pulls back and moves the other direction, the other side can profit as well.

For more information on how to trade Iron Condors or learn more on how to trade news events along with a complete calendar and strategies to trade them, go to www.apexinvesting.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.