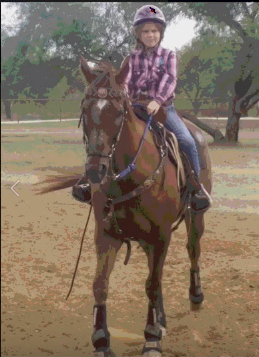

What do trading and helmets have in common? The weekend of October 24, Darrell Martin was spending time with his nine-year-old daughter, Felicity, when she fell during her training for barrel racing in rodeos. She has been training with Charmayne James, an amazing woman who holds more world titles than anybody in any single sport, along with Sammie Sellers and Kendra Dickson.

A helmet made by Cosmic Cowboy Hats, a company that makes designer safety helmets for use by those involved in rodeo, was sent the week before to Felicity by Jackie Jatzlau, a top NFR (National Finals Rodeo) trainer. As Felicity was riding Comet, her horse, the arena was slick and they fell. If Felicity had not been wearing the helmet, she would have been seriously injured. The well-trained horse did not step on her. Even with the best gear, the best horse, the best tack and the best trainers, you still have to have safety in mind. It was the helmet that saved Felicity’s life.

A CT scan at the hospital let Felicity and her family know there were no issues. All Felicity wanted to know was how soon she could ride again! Doctors stressed the importance of wearing a helmet, but told Felicity she could return to riding as soon as she wished.

Cosmic Cowboy Hats is now sponsoring Felicity because they feel that other kids are watching her. They see the success she is having in barrel racing and if other kids see her wearing a helmet, they will want to wear one, too.

Just as Felicity has goals and sets limits like running her horse at only 70 percent while getting used to his power, as a trader you have goals and limits too. You don’t want to risk 100 percent of your account as you realize how powerful the market moves can be.

When trading, you don’t wear helmets, but there are days where it feels like your trades fall. It’s about getting back up, getting back on and being safe. You cannot let your losses get you down. You keep going. There will be those accidents or wrecks that can pretty much mess you up for a while. This can happen when you don’t use proper risk management. You can’t take stupid risks. You have to protect yourself by using stop losses or defined risk products.

When you trade Nadex binary options and spreads, your risk is defined before you ever enter the trade. You know the amount you can win or lose and you are able to exit before expiration in order to cut your losses or protect your profits. Nadex spreads and binaries, with their defined risk, provide you a sort of helmet for risk management.

When trading, you also set your own limits of risk, thus further defining your risk. Before entering a trade, you already know at what place you will set your stop and exit the trade. By doing this, you are accepting up front, the amount of risk and loss on the trade. You can now manage the trade without sweating it. You set your limit of risk capital. Your decision was already made while you were calm, your head was clear and you were not in the middle of a trade.

Setting advanced take profits are important to use to ensure your orders are filled and profits are locked in. For example, you can pull up an order ticket and set it to get you out of the trade if the price hits a certain amount, such as $80. At that point, you would take the profit and be out of the trade.

There are other strategies and indicators available to help you define your risk and use proper risk management. You can hedge your trades by using lower cost binaries or spreads to offset other instruments you may be trading. Being aware of the expected range and the expected volume can help you in planning your trade and defining your risk. Both of these are available as indicators at Apex Investing. Expected Range shows you when the market has made its expected move. Expected volume can indicate continued movement in the direction of your trade with confirmation to stay in a trade. Conversely, if volume is declining, it can be an indication to tighten your stop, the direction of the move could be coming to a stop or turning around. This can help you limit your losses or protect your profits simply by knowing how expected range and expected volume can influence your trades.

Proper risk management is like putting your helmet on when you trade. You are protecting yourself from a potential fall. You can learn more about the strategies and indicators to help you define your risk at www.apexinvesting.com. In addition, you can find free education to help you learn more about proper risk management.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.