What do computers and appliances have in common? They are Core Durable Goods that have a life expectancy of three or more years. The report, including US Durable Goods news, which includes transportation items like airplanes and automobiles, will be released Thursday, May 26, at 8:30 AM ET. A leading indicator for production, this news tends to get the market moving and can be traded with the right strategy and instruments.

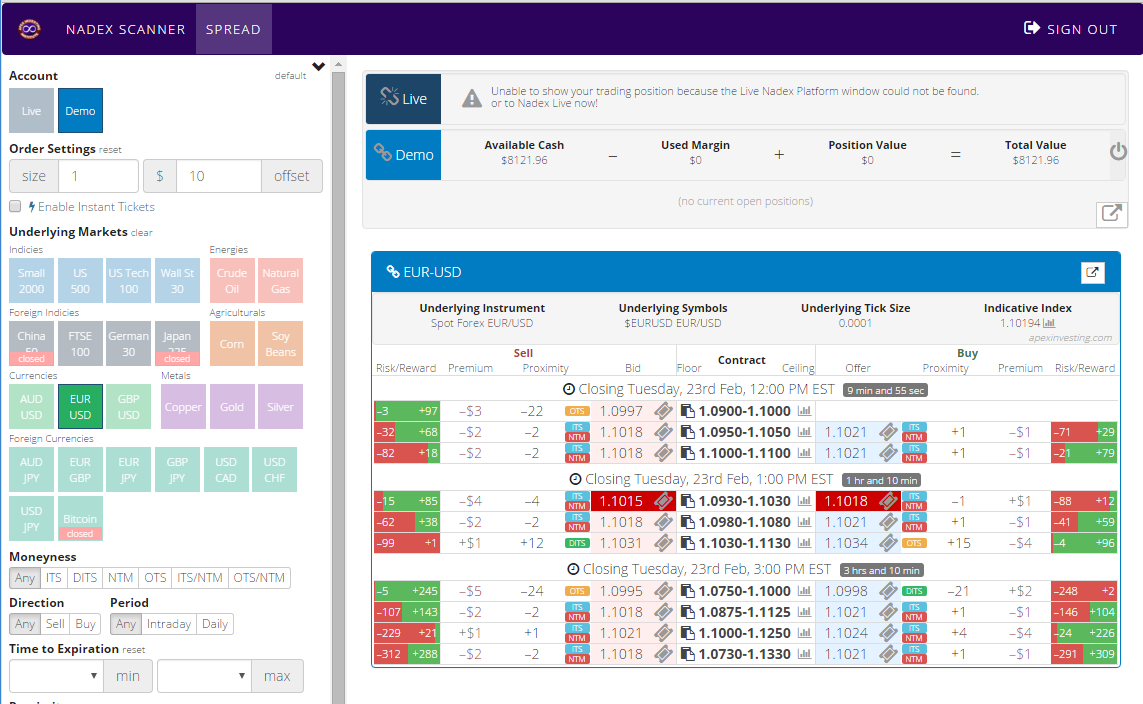

Using Nadex EUR/USD spreads for day trading as the instrument, will provide defined capped risk. Spreads can be traded either direction, long and short, and won’t profit or lose past the floor or ceiling, even if the market moves beyond those points. In addition, stops can be used to manage risk even further. The market tends to make a move and then pulls back in reaction to this news.

The trade can be entered at 8:00 AM ET for 10:00 AM ET expirations. An Iron Condor strategy works well for the typical reaction the market makes to this news. Buy a spread below the market with the ceiling where the market is trading at the time and sell a spread above the market with the floor where the market is trading at the time. When choosing the right spreads they need to have a profit potential of $30 or more combined between the spreads. This can be easily done using the spread scanner for trading Nadex spreads. See below for an example image.

To view a larger image click HERE.

The Iron Condor collects profit if the market expires within the breakeven zone. This trade strategy’s breakeven points are 30 pips up or 30 pips down. If the market settles right between the two spreads at expiration, then the trade makes full profit. The trade has a wide range it can settle within for profit. Stops can be placed to manage risk and keep it to a 1:1 risk/reward ratio in case the market makes a move and keeps on going and doesn’t pull back. The points where the market hits 60 pips up or down are where to place stops using stop limit orders. This allows the market to move within a range of 120 pips before hitting a stop.

The spread scanner can be accessed from www.apexinvesting.com along with free education for trading.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.