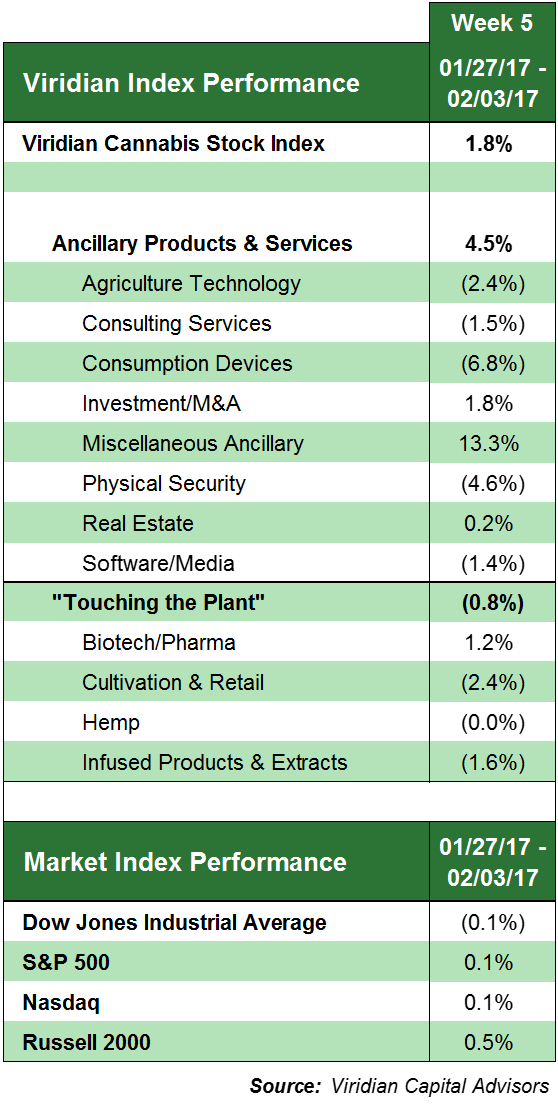

Cannabis stocks had another great week, with the Viridian Cannabis Stock Index up for the eighth consecutive week. For the seven days ended February 3, the index gained 1.8 percent.

While this surge represented a slowdown in relation to previous weeks, it still implied a marked outperformance in relation to major market indexes and ETFs like the S&P 500, the Dow Jones Industrial Average, the PowerShares QQQ Trust, Series 1 (ETF) QQQ and the iShares Russell 2000 Index (ETF) IWM.

Benzinga reached out to Viridian Capital Advisors analyst Harrison Phillips, who walked us through some of the most recent M&A activity, deals and capital raises in the marijuana industry, as well as the most notable figures in the Index report.

Volatility Between Sectors

“A couple of weeks ago we spoke about how the returns between the various sectors [in the index] were quite varied,” Phillips said. “We saw a continuation of that last week, but we only saw four of the twelve index sectors with positive gains, which is fewer than we've seen year-to-date. The volatility in between these sector returns is increasing, so we may be experiencing a slight turnaround. We'll have to wait and see for how it performs this week.”

“The Ancillary Products & Services sector outperformed the Touching the Plant sector again,” the analyst continued. “We saw cultivation/retail and infused products decline a little bit. I believe this is due to the run-up that we had at the end of last year, where the touching the plant segment really took off, especially the cultivation/retail side.”

Cultivation & Retail

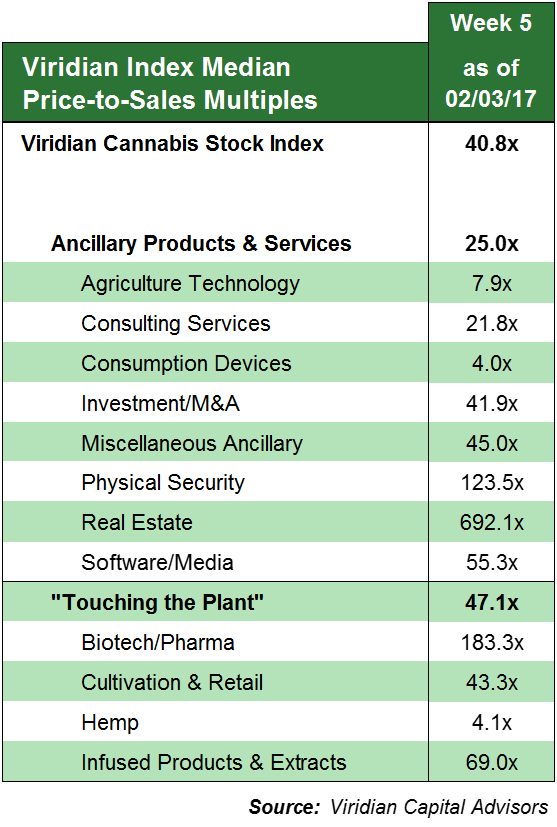

Why were cultivation and retail stocks so popular, even in spite of the high valuations?

“When people think of the cannabis industry and investing in the cannabis industry, not only are the Canadian LPs some of the largest publicly traded companies and the ones that are more financially developed, let's say…. When people think of cannabis, they think of growing and selling the plant,” Phillips explained. “So, I believe people kind of naturally gravitate towards those companies, and that led to quite a bit of price appreciation. So, as prices go up and investor demand tends to decrease a little bit... we may be seeing a little bit of hesitation to invest at this higher valuation.”

A Look Into Valuations

Going into sector valuations, the expert noted last week witnessed a decrease in the median price-to-sales multiple in the index to 40.8x, down from 42.3x in the previous week.

“It's still quite high, but seeing that decrease points to potentially (...) a turnaround,” he commented.

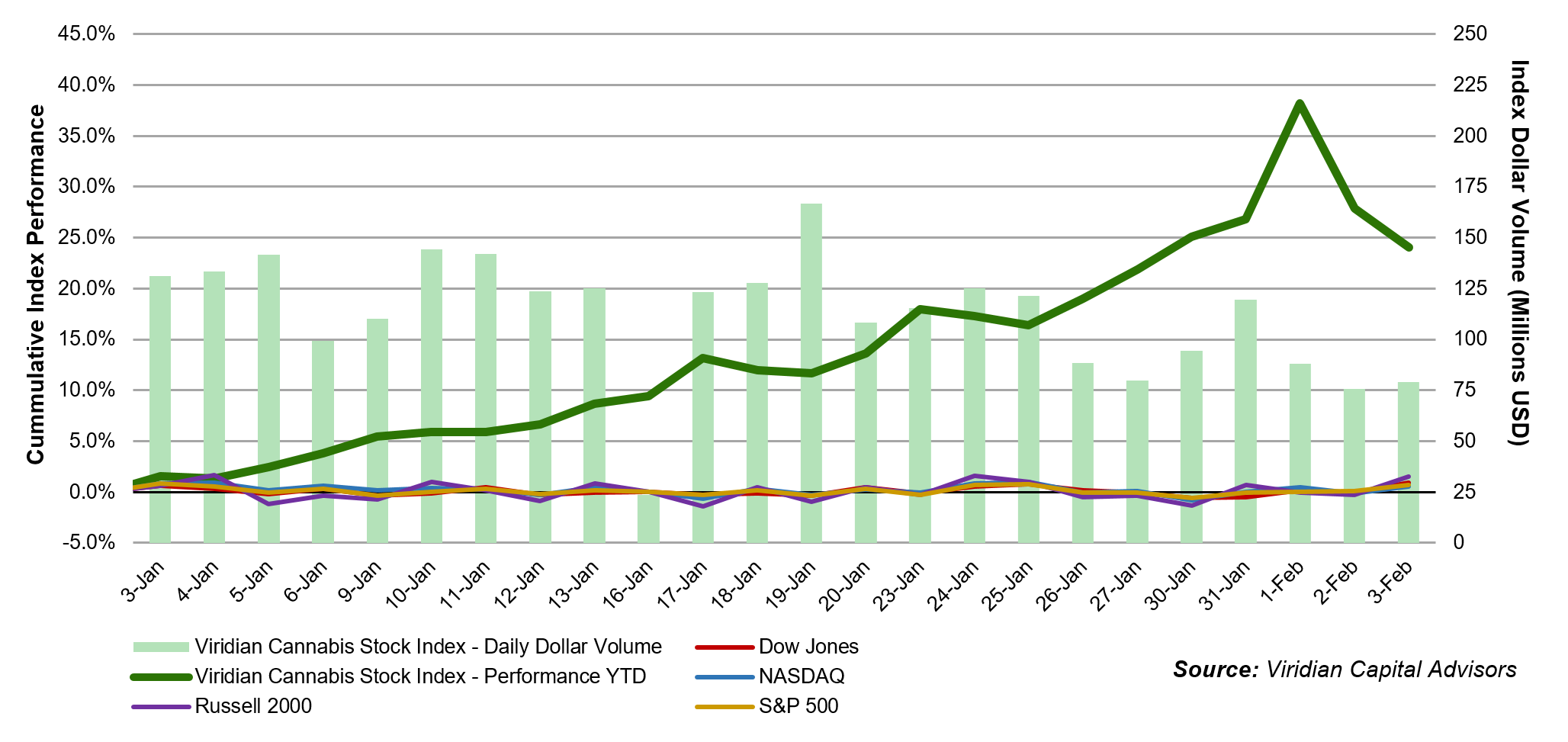

Year-To-Date Performance

Phillips shared a look at year-to-date data. As of the market close on February 3, the Index was up 24 percent.

“If you look at the first three days of the year, you see that there was increased trading activity; then, going into the next week, there's a little bit of a low. This still points to the January effect [we discussed previously],” Phillips said.

“The index's dollar volume is bouncing between $75 million and $125 million a day (...) However, trading is pretty concentrated in some companies in the index, like GW Pharmaceuticals PLC- ADR GWPH.

“The index's dollar volume is definitely stronger now than it was last year. So, we expect continued interest and liquidity development in the space,” Phillips concluded.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.