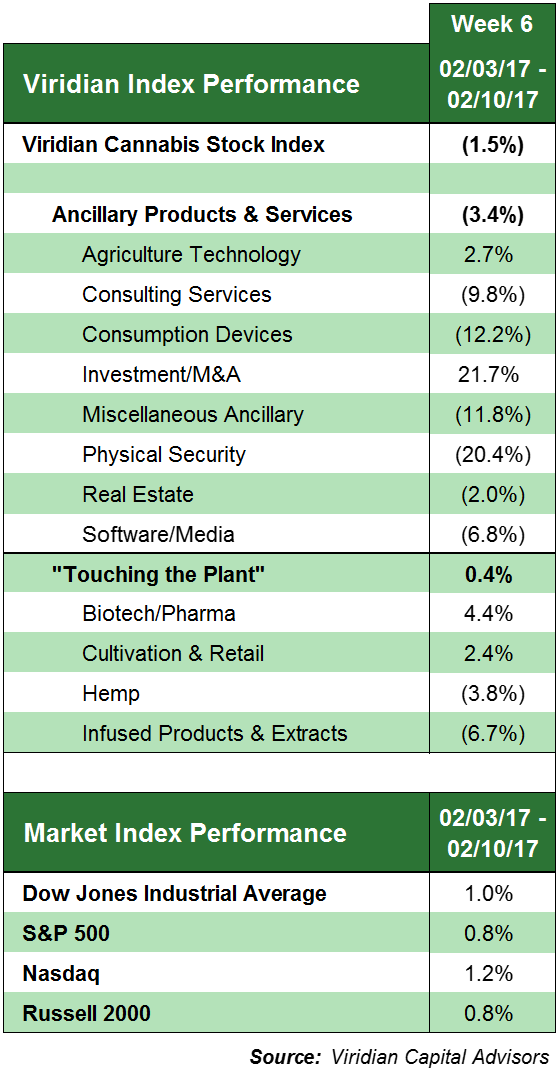

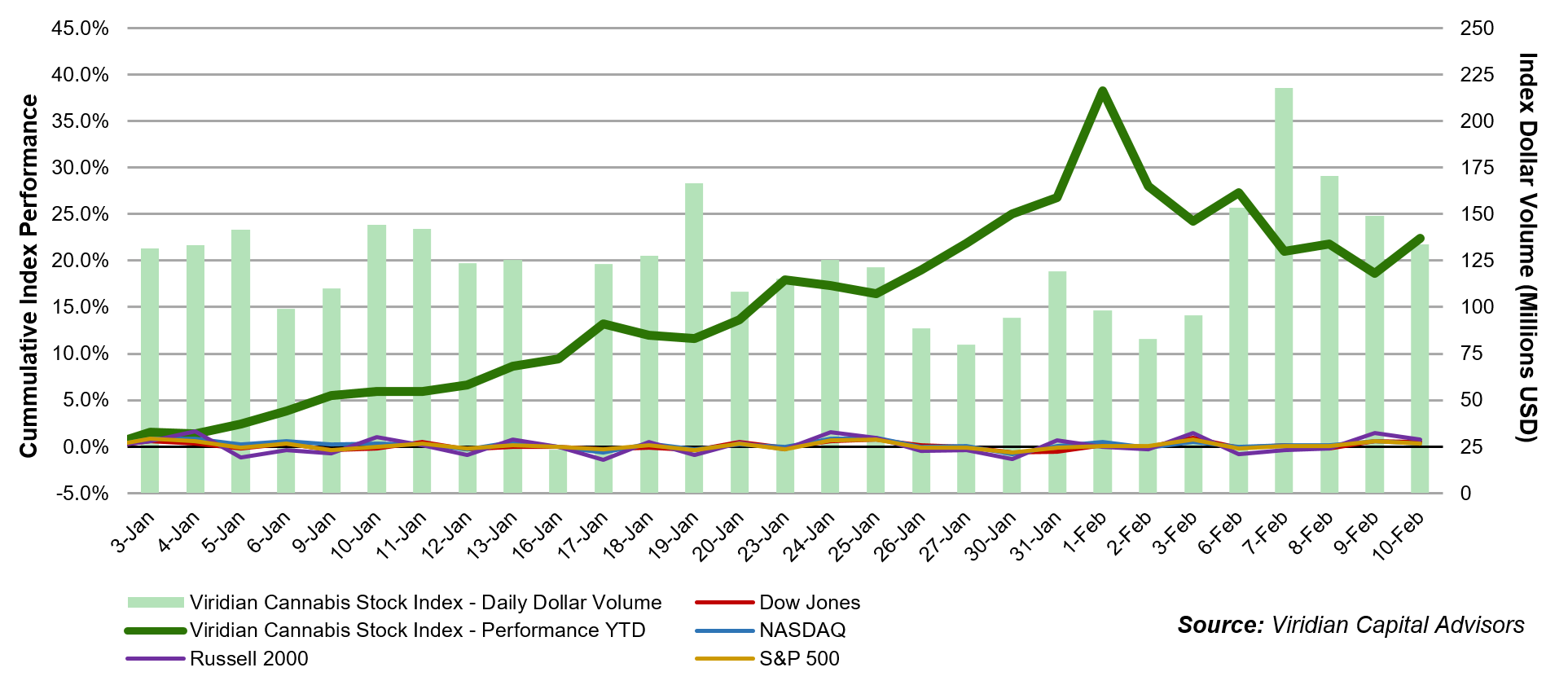

After posting eight consecutive weeks of gains, the Viridian Cannabis Stock Index, which groups a majority of the most relevant securities in the marijuana space, experienced a reversal last week.

For the five days comprised between February 6 and February 10, inclusive, the Cannabis Stock Index lost 1.5 percent, marking the first weekly decline since the beginning of the year. In contrast, the four major market index ETFs, the SPDR Dow Jones Industrial Average ETF DIA, the PowerShares QQQ Trust, Series 1 (ETF) QQQ, the SPDR S&P 500 ETF Trust SPY, and the iShares Russell 2000 Index (ETF) IWM, all surged over the week.

In order to get a better picture of what happened, Benzinga reached out to Viridian Capital Advisors analyst Harrison Phillips, who is in charge of the Cannabis Stock Index weekly report.

Correction Ahead?

“We didn’t see a dramatic correction this week,” Phillips noted. However, he added, when one looks at the year to date performance, one notices that it did mark an important change in relation to the almost uninterrupted upward trend seen over January.

Going into the second month of the year, the Cannabis Stock Index appreciated quite significantly on Feb. 1, before declining the next day. “It actually reached a high point on the mid-day of February 1st, being up 38.2 percent year-to-date, but split going through the month of February thus far, and finished up 22.4 percent year-to-date – as of last Friday. So, it has come down from its 52-week high,” the analyst added.

Related Link: Earth Science Tech: Another Marijuana Stock That Looks 'Insanely Overvalued'

“So, it will be interesting to see how this week plays out, because that could have been a slight correction from that high, or we could continue to see a slight decline going into the end of February,” he concluded.

High Volume

Next up, Phillips went into weekly volumes, pointing out that last week saw the highest volume so far this year, with nearly $825 million traded. “This is also the first week of the year where every day’s dollar volume was above $125 million.”

“We also saw the highest daily dollar volume year-to-date on Feb. 7 — $218 million,” the expert supplemented. “That was due to the fact that two of the most highly traded and most highly valued (in terms of market cap) companies in the Index traded much more significantly than their average.”

While Viridian cannot reveal which companies are included in the Index, the evidence suggests that one of the companies responsible for the spike in volume witnessed on Feb. 7 was GW Pharmaceuticals PLC- ADR GWPH.

In line with what we’ve discussed in the past, “while the Index volume overall is pretty strong, it is concentrated in only a few of the more highly traded securities,” Phillips continued.

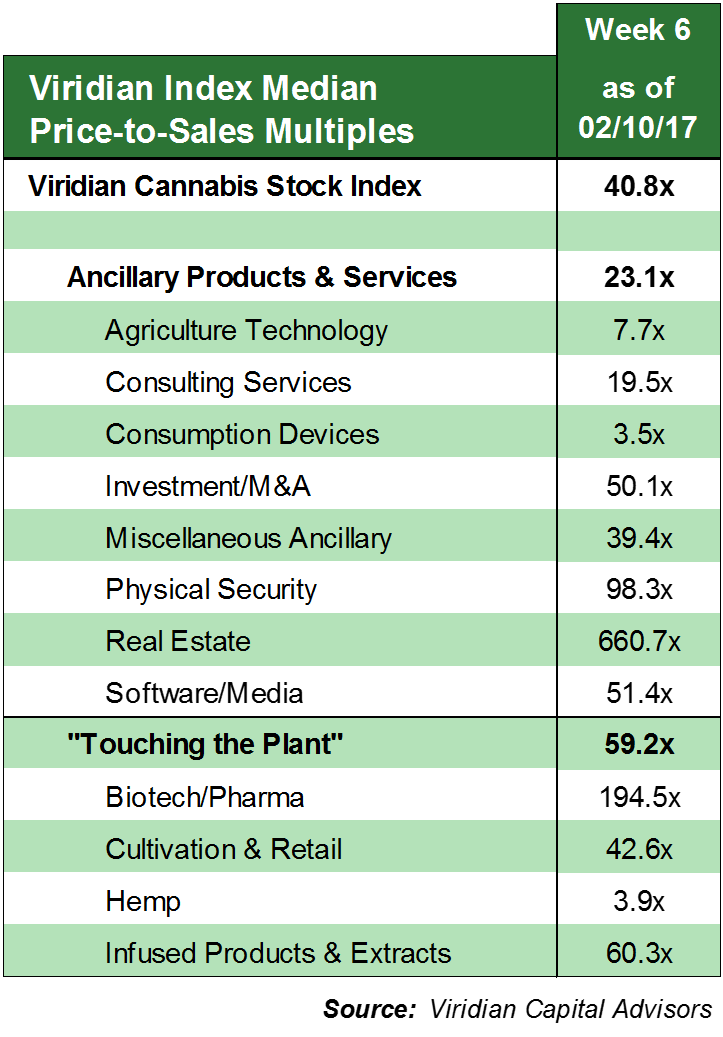

Valuations

Finally, the analyst shared a look at the trading multiples for each of the Index sectors.

"We expect there to be continued volatility in these multiples and cannabis stocks in the short-to-medium-term [...] But, in the long-term, we do expect these multiples to decrease towards values seen in more mature industries,” he ended, citing the examples of the hemp and consumption devices sectors, which have been around for a while, and thus boast lower valuation multiples.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.