Two US reports will be released Friday, April 7, at 8:30 AM ET, Nonfarm Payrolls and Average Hourly Earnings. As the names imply, Nonfarm Payrolls — also called Nonfarm Employment Change — accounts for the change in the number of people employed excluding the farming industry, while the earnings report tells of the change in the price of labor that businesses pay, also excluding the farming industry.

Markets can react strongly to these reports and as a result, implied volatility present can make for nice trade opportunities trading Nadex spreads.

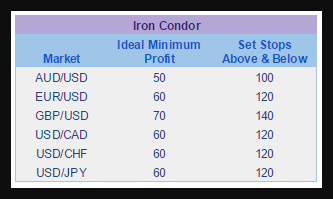

The Iron Condor strategy can be set up for several markets in this type of release. For example, in the chart below AUD/USD has a combined minimum profit potential of $50. Therefore, one spread is bought below the market for a minimum profit potential of around $25 and one spread is sold above the market for a similar minimum profit potential. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time.

The Iron Condor profits when the market makes a pull back after its reactionary move to the news. Max profit is made when the market pulls back to center between the two spreads. For every pip away from the center is $1 less in profit. See the chart below for combined ideal minimum profit amounts. In addition, stops can be set above and below from where the market was at entry. These stops reflect the profit potentials listed.

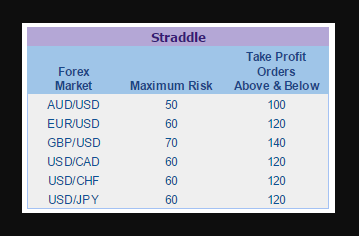

Straddles, if they can be pulled off for a 1:1 risk reward ratio, are another option. They are the opposite setup of an Iron Condor. Again, using AUD/USD as an example, one spread is bought with the floor where the market is trading with a maximum risk of $25. Another spread is sold with its ceiling where the market is trading with a maximum risk of $25. The ceiling of the sold spread meets the floor of the bought spread. The risk is lower and doesn’t necessarily require stops. This trade does require take profit orders to be placed just after entry, both above and below from where the market was at entry. The table below will give the maximum risk and where to place the take profit orders above and below based on that specific risk.

The biggest move tends to happens within the first fifteen minutes 90% of the time, so go for as much time as is possible. Entry can be any time between 7AM ET and 8:15 AM ET, for Nadex spreads 9AM, 10AM, and 3PM ET expiration times.

Again, Stop orders are advisable for Iron Condors and take profit orders are best placed immediately after entering Straddles .

No need to be overwhelmed by news trades. Most often price leads news. Just be sure to enter with the minimum profit potential for the Iron Condor and stay at or under the maximum risk for the Straddle. This will give you a high probability setup for each strategy.

For free access to the spread scanner, day trading education and news calendar with trade setups, go to www.apexinvesting.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.