Before delving into the current expansion cycle, which has completed its eighth year, it is imperative that one gets a hang of the different phases of an economic cycle, why it is important that a trader keeps himself abreast of which phase of economic cycle we are currently in and the current expansion cycle versus the previous ones.

Economic cycles, according to Investopedia, are natural fluctuations of economy between expansion and contraction.

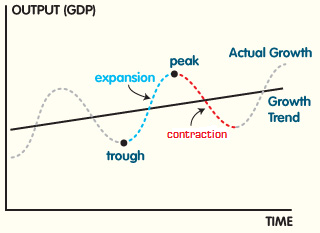

An economic cycle is said to have four distinct stages, namely:

- Expansion: Increasing GDP and industrial production, employment growth, growth in credit, corporate profit growth and rising prices.

- Peak: The economy is performing up to its full potential, employment level is full and inflationary pressure is evident.

- Contraction: GDP declines, employment falls and pricing pressure subsidies.

- Trough: The economy hits the bottom, characterized by falling activity levels, drying up of credit and declining corporate, sales, profits and inventories.

Source: Lumen Learning

Source: Lumen Learning

Who Declares Peaks And Troughs Of Economic Cycles?

In the U.S., the National Bureau of Economic Research is vested with the power to declare the dates of peaks and troughs.

Why Knowing Phases of Economic Cycle Matters

Historically, stocks perform better than other investment avenues such as cash and bonds in the expansion phase: As monetary policy remains accommodative, the economy puts forth green shoots of revival; and with employment picking up, corporate profit growth rebounding and pricing pressure remaining relatively inane.

Though stocks continue to perform well during the peak of the economic cycle, overbought levels of the markets lead to correction, tempering performance.

When the economy moves into contraction territory, stocks sensitive to economic growth begins to take a beating and defensive stocks and asset classes take over as the better performers.

The Current Economic Cycle

The economy emerged out the Great Recession of 2007–2008 in June 2009. This was announced by the NBER in September 2010. Therefore, the current expansion cycle that followed the Great Recession has just completed its eighth year.

The current expansion cycle may go on to become the longest, according to CNBC quoting Goldman Sachs. The firm sees a 31 percent chance for a U.S. recession in the next nine quarters, which it interpreted that there is a two-thirds possibility of the recovery going onto become a record.

The current expansion that began in June 2009 is now 96 months old.

In 2016, the U.S. economy has expanded 2 percent year over year.

How The Current Cycle Stacks Up Against The Previous Ones

From 1854 to today, there have been 33 economic cycles. Here is the list of the economic expansions (the top five) ordered in terms of the length:

- March 1991–March 2001: 120 months.

- February 1961–December 1969: 106 months.

- June 2009–now: 96 months.

- December 1982–July 1990: 92 months.

- December 2007–June 2009: 73 months.

However, the race to record may not spell good news for the stock markets. Even as the expansion ages, the market performance begins to wane. The 3- and 5-year price returns of the S&P 500 Index were a negative 1.7 percent and a negative 6.1 percent, respectively, during the expansion that began in 1961, according to CNBC. For the expansion that began in 1991, the 3-year and 5-year returns were worse at -10.8 percent and -12.45 percent.

Therefore, investors may have to tread with cautions, as the current expansion has left its youth way behind and is currently going through maturity phase.

Related News: If The Economy Is Improving, Why Are Dollar Stores The Only Retailers With Positive Trends?

Strategist: FANG Stocks Can Still Grow In A Sluggish Economy

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.