MIRA Pharmaceuticals, Inc. (NASDAQ:MIRA) on Monday revealed new animal study results from SKNY-1, a next-generation oral therapeutic.

The company says the findings further support the advancement of SKNY-1 toward Investigational New Drug (IND) enabling studies.

With obesity and smoking representing two of the leading causes of preventable death and a combined global market opportunity exceeding $200 billion, MIRA intends to prioritize SKNY-1 as a potential cornerstone asset pending the completion of the acquisition of SKNY Pharmaceuticals, Inc.

In a zebrafish model that mimics human obesity and craving behaviors, SKNY-1 demonstrated weight loss, suppression of appetite and craving for high-calorie diets, and reversal of nicotine-seeking behavior—all achieved within six days of oral treatment.

Also Read: EXCLUSIVE: MIRA Pharmaceuticals Lead Program Ketamir-2 Shows No Brain Toxicity In FDA-Mandated Study

SKNY-1 is being developed as an oral alternative to GLP-1 injectables, which are often limited by nausea, GI discomfort, injection reaction, and growing concerns around muscle loss.

Key Results

SKNY-1 reduced body weight by approximately 30% after six days of oral treatment. Treated animals weighed about 10% less than healthy controls. The company said the weight loss was not accompanied by muscle density changes.

Treated animals showed an increase in breathing rate, which is a reliable signal that their metabolism was speeding up.

In untreated obese animals, fat buildup in the liver was about 50% higher than normal. SKNY-1 reversed this buildup, bringing liver fat back to healthy levels. At the same time, cholesterol levels—including LDL (‘bad’ cholesterol) and HDL (‘good’ cholesterol)—also returned to normal without affecting fat levels in the blood.

Obese animals were eating 2–3 times more high-calorie food than normal. SKNY-1 dose-dependently reduced the behavior—high-dose animals ate less than healthy controls. The drug also made the animals less likely to pursue food in stressful environments and reduced obsessive food-seeking in tests designed to measure craving.

SKNY-1 significantly reduced the desire to seek out and consume nicotine. At the high dose, their behavior matched that of healthy animals with no nicotine craving.

Obese animals had extremely high levels of leptin (a hunger-regulating hormone) and unusually low levels of ghrelin (the ‘hunger signal’). SKNY-1 normalized both hormones, improving the body’s ability to regulate hunger and energy use.

Obese animals had too much dopamine in their brains, likely tied to increased reward and cravings. SKNY-1 reduced these dopamine levels—but only at the lower dose. The high dose did not affect dopamine, suggesting the drug can reduce cravings without overstimulating the brain.

Price Action: MIRA stock is down 1.20% to $1.23 during the premarket session at the last check on Monday.

Read Next:

Photo by shisu_ka via Shutterstock

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending June 27:

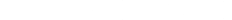

Prologis (NYSE:PLD): The logistics real estate company saw increased interest from readers during the week. The company was recently named to the TIME 100 Most Influential Companies list in the “Leaders” category. Investors may be gearing up for second quarter financial results, which are set for July 16. The company has beaten funds from operation estimates from analysts in four straight quarters, while revenue has missed analyst estimates in six straight quarters. Prologis could be fitting several themes for investors with a dividend payment and operating in the growing logistics REIT market. The stock was nearly flat on the week, as seen on the Benzinga Pro chart below and shares are up only 1.3% year-to-date in 2025.

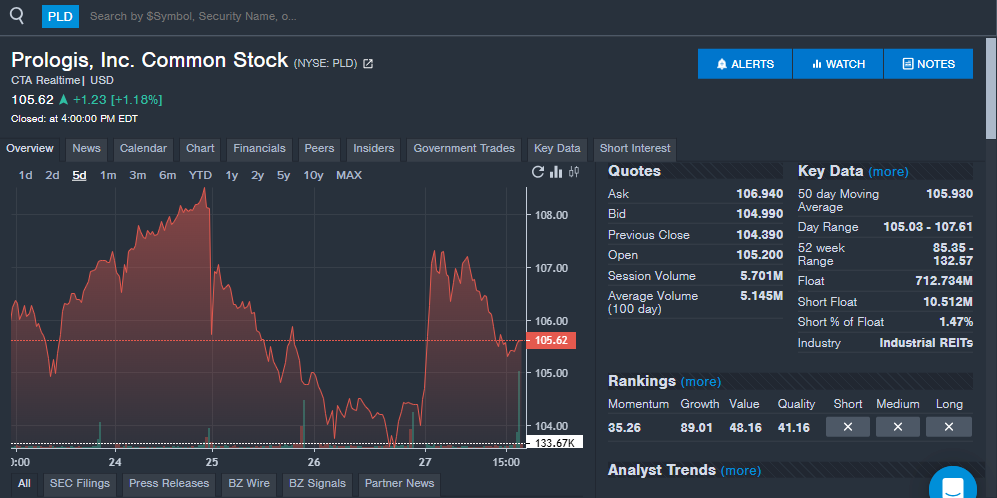

Global-E Online (NASDAQ:GLBE): The ecommerce solutions company saw strong interest from readers during the week with the stock price up 6%. The company reported first-quarter financial results in May with sales beating analyst estimates. The company saw 30% year-over-year sales growth and gross merchandise value also rose 34% year-over-year in the quarter. Global-E Online also reported growth in its Adjusted EBITDA with the operating loss narrowing. The company reiterated its full year guidance after the quarter. Along with financial results, Global-E Online also announced a new three-year strategic partnership with Shopify, extending an existing long-term partnership for first-party and third-party solutions.

“We had another quarter of strong results, demonstrating our ability to grow fast even within macroeconomic turbulent times with Q1 results coming in at or above the midpoints across our guidance,” founder and CEO Amir Schlachet said.

Schlachet said the company’s pipeline is very active and the company is seeing increased interest in its services.

Agilent Technologies (NYSE:A): The life sciences and diagnostics company saw increased interest from investors during the week, which comes after the company reported quarterly financial results last month. Agilent reported 6% year-over-year sales growth, which beat analyst estimates. The company beat revenue estimates from analysts for a fourth straight quarter and ninth time out of the last 10 quarters. The company’s earnings per share also beat analyst estimates, which kept a streak of more than 10 straight quarters beating estimates in place. Agilent reaffirmed earnings per share guidance for the full year and raised its full-year sales guidance, saying that it will be able to mitigate most of the impacts of tariffs.

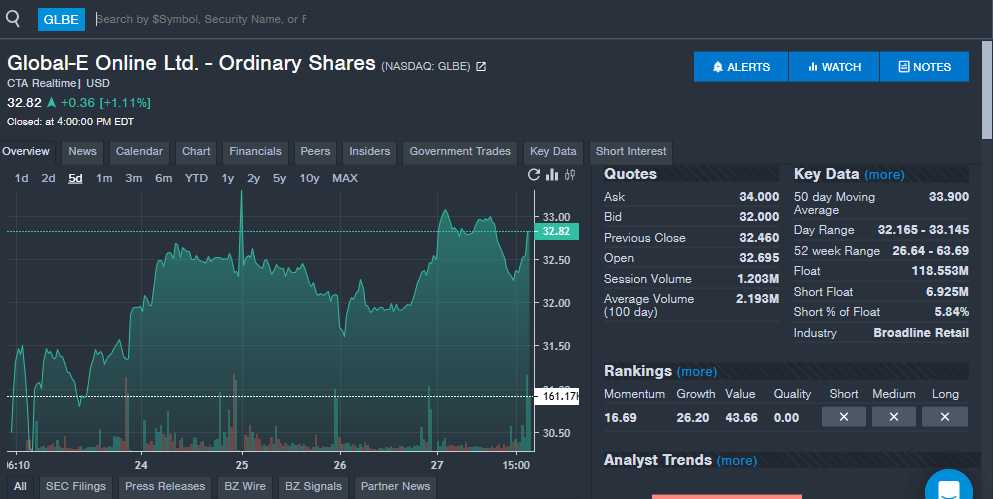

Alcoa Corporation (NYSE:AA): Investors showed increased interest in the metals company ahead of its July 16 second-quarter financial results. Analyss expect the company to report earnings per share of 57 cents and revenue of $2.96 billion. The company has beaten analyst estimates for earnings per share in four straight quarters and seven of the last 10 quarters overall. Revenue has been more mixed with a miss in the last quarter and five beats and five misses over the last 10 quarters. Investors are likely looking to hear more on the impact of tariffs for the company. Alcoa reported $20 million in additional costs in the first quarter due to the impact of tariffs on Canadian aluminum imports. The forecast for the second quarter impact from tariffs was $90 million.

“This is the most material impact to Alcoa, as approximately 70% of our aluminum produced in Canada is destined for U.S. customers,” Alcoa CEO William Oplinger said.

He estimated the annual cost of the 25% tariff could reach as high as $425 million.

Investors will likely want to hear that these numbers have not gone up and that higher metals prices and demand could help offset some of the increased costs.

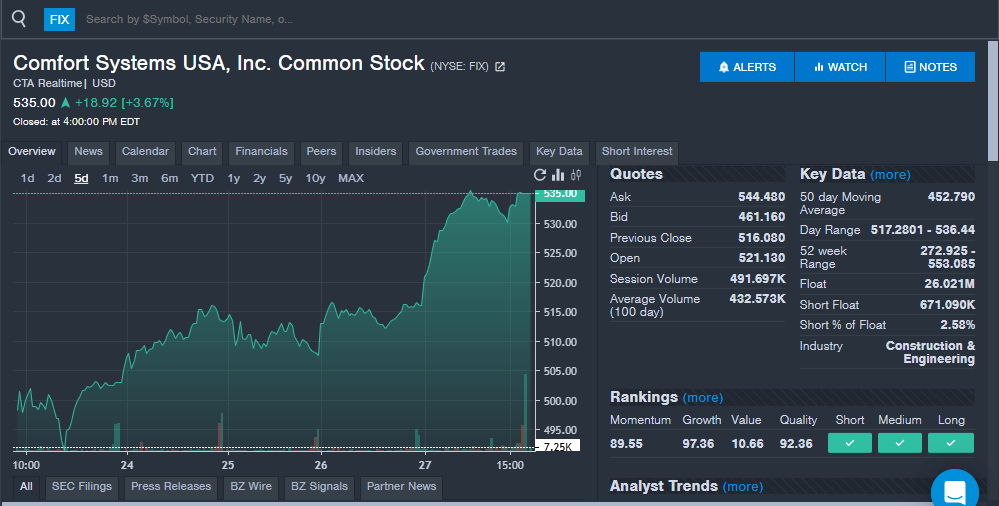

Comfort Systems USA (NYSE:FIX): The HVAC and electrical company saw increased interest from investors with shares at all-time highs. While most investors may not be familiar with the company, Comfort Systems has shown consistent growth and has a history of beating analyst estimates. Second quarter financial results are expected in June. Analysts expect the company to report earnings per share of $4.78, up from $3.74 in last year’s second quarter. The company has beaten analyst estimates for earnings per share in more than 10 straight quarters. Analysts expect the company to report quarterly revenue of $1.97 billion, up from $1.54 billion in last year’s second quarter. The company has beaten analyst estimates in two straight quarters and nine of the last 10 quarters overall. Analysts have raised price targets on the stock in recent months and the new quarterly results could see more analyst action.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

HIVE Digital Technologies Ltd (NASDAQ:HIVE) is charging ahead with plans to nearly triple its hashrate to 25 EH/s by the fourth quarter of 2025. But while the ambition is clear, the execution risks are anything but negligible — especially in Paraguay, where much of this growth is concentrated.

Read Also: HIVE Digital Energizes Paraguay Site With Major Bitcoin Mining Expansion

Big Ambitions, Bigger Bottlenecks?

“Scaling to 25 EH/s is an ambitious goal. While we’re on track, there are always execution risks,” says CFO Darcy Daubaras in an exclusive email interview with Benzinga. Among them: hardware shipping delays, global supply chain snags and construction setbacks.

HIVE is betting on Paraguay’s abundant hydropower and favorable climate to drive efficient mining. But can the country’s infrastructure keep up with HIVE’s scale-up?

Daubaras acknowledges the challenges. “Risks do exist. These include regulatory changes, limitations in grid infrastructure, and dynamics of regional trade.”

In other words, even the most miner-friendly environment can pose headaches when you’re building out industrial-scale data centers.

A Local Edge – But Is It Enough?

To mitigate the risk of the ramp-up, HIVE has boots on the ground. Its president in Paraguay, Gabriel Lamas, is a veteran electrical engineer who previously held key roles at Bitfarms and Paraguay’s national utility, ANDE. Under his leadership, HIVE is focusing on grid integration, reliability, and energy optimization.

“His deep technical knowledge and proven track record in energy optimization ensure we maintain HIVE’s high standards as we scale in South America,” says Daubaras.

Still, the question lingers: Can Paraguay deliver the power, political stability and grid reliability needed to keep the lights on at 25 EH/s?

If the answer is yes, HIVE may emerge as one of the most efficient and greenest miners on the planet. If not, the hashrate dream could hit an electric wall.

Read Next:

Photo: Shutterstock

HIVE Digital Technologies Ltd (NASDAQ:HIVE) is putting its money, or rather, its Bitcoin (CRYPTO: BTC), where its mouth is.

While most Bitcoin miners scramble for capital or take on high-interest debt, HIVE is doing something different: using the BTC on its balance sheet to fund growth. But as CFO Darcy Daubaras admits in an exclusive email interview with Benzinga, this strategy is a double-edged sword.

Bitcoin As Balance Sheet Fuel — With Volatility Risk Baked In

“Utilizing Bitcoin from our treasury to fund growth provides us with flexibility without incurring debt,” Daubaras says. “However, it demands disciplined timing and robust treasury management.”

Translation? It’s bold, but not without danger. Bitcoin’s notorious price swings could wreak havoc on HIVE’s liquidity and net asset position. In plain terms: when BTC dips, so might HIVE’s wiggle room.

This isn’t just a paper risk either. Daubaras warns that volatility can “affect borrowing capacity, financial covenants, and risk tolerance among lenders or investors.” In a downturn, just when capital is most needed, HIVE could find itself handcuffed.

Read Also: HIVE Digital Energizes Paraguay Site With Major Bitcoin Mining Expansion

No Collateral, No Cushion: HIVE’s High-Stakes Strategy Explained

And the regulatory fog doesn’t help. Shifting accounting standards for crypto assets could complicate how this balance sheet strategy plays out. Yet, despite these risks, Daubaras is clear on one thing: “HIVE does not use our BTC as a pledge or as collateral against debt or other obligations.”

In other words, they’re not gambling the house. Still, they’re definitely playing high-stakes poker.

It’s a sharp contrast to competitors who are piling on debt or diluting shareholders. HIVE’s play is leaner, greener (they use hydro power), and highly leveraged—but only in terms of Bitcoin conviction.

Investors watching this bet unfold should ask: can HIVE time the market well enough to turn Bitcoin into a sustainable growth engine?

Or will the very asset that makes HIVE unique become its biggest constraint?

It’s a bold bet—and a reminder that crypto remains a double-edged tool in capital strategy.

Read Next:

Image created using artificial intelligence via Midjourney.

Beeline Holdings (NASDAQ:BLNE) announced Wednesday that its subsidiary, Beeline Title Holdings (“Beeline Title”), has closed one of the first-ever residential real estate transactions funded through the sale of a cryptocurrency token backed by real property.

Nick Liuzza, CEO of Beeline Holdings, said several mortgage lenders are already developing funding models that involve converting cryptocurrencies to U.S. dollars at closing.

But for these models to function at scale, they need a title company that not only understands blockchain transactions but also has the infrastructure to disburse and reconcile them in compliance with federal and state regulations, Liuzza added.

Also Read: Beeline Breaks $1 Billion Barrier, Bets Big On AI And Short-Term Rental Surge

Beeline’s first cryptocurrency-enabled transaction is the beginning of a broader rollout. Beeline Loans, another subsidiary, is set to launch its full cryptocurrency token funding platform nationally in early August 2025. Beeline Title will provide the title and closing services for each transaction unless borrowers elect to use an outside title company.

Importantly, Beeline Title will open this platform to all mortgage lenders, giving them access to a cryptocurrency token transaction reconciliation, compliance, and disbursement solution.

Liuzza said its team built Linear Title, a privately held title agency in the U.S., before merging with Real Matters and going public on the Toronto Stock Exchange (TSX).

Through 2019, they closed over one million title transactions across all 50 states, and this new platform is an extension of that expertise tailored to the next generation of mortgage transactions.

In the first week of June, Beeline announced it was launching a debt-free home equity access product using stablecoins. This product offers cash without monthly payments or interest.

The product, set for full launch in July, aims to boost Beeline’s revenue growth and profitability starting in the fourth quarter of 2025.

Price Action: BLNE stock closed higher by 29.1% at $1.42 on Tuesday.

Read Next:

Photo by SWK Stock via Shutterstock

In September 2024, Aurora Cannabis Inc (NASDAQ:ACB) launched a CBD lozenge in collaboration with Vectura Fertin Pharma (now Aspeya, Inc.), a pharmaceutical firm owned by Philip Morris International (NYSE:PM). The dissolvable product, branded Luo, debuted on Aurora’s medical platform in Canada.

To some observers, it looked like a stealth alignment between cannabis and Big Tobacco. But according to Aurora CEO Miguel Martin, the story is more nuanced.

“Our relationship really is with Vectura Fertin,” said Martin, noting the company now goes by the name Aspeya. “It’s a broader health and wellness company, and it’s really not so much with PMI, even though they have their own connection.”

Aurora’s strategy, he says, is grounded in medical science, not brand crossovers.

“We have always had a very conservative, pharmaceutically minded approach,” Martin told Benzinga. “To be able to partner with someone with [Vectura’s] history, and particularly the technology they were bringing to ingestible cannabinoids, was exciting for us.”

The companies launched the Luo lozenge in Canada as a physician-authorized product for patients seeking controlled CBD delivery. Aurora handles distribution through its direct-to-patient ecommerce platform. Martin said the partnership has been well-received and could expand in the future.

“This is really about learning and understanding… how that kind of science-based, medical approach is received. And it’s been very well received,” he said. “Our patients have enjoyed them. Hopefully, there’s opportunity for other brand extensions.”

Also read: World’s Largest Tobacco Company Is Investing In Medical Cannabis: Here’s What To Know

When asked whether this represented a deeper alignment with legacy industries, Martin was clear:

“Right now, it’s about partnering and working with thoughtful, science-based, medically oriented companies,” he said.

Aurora has similar relationships with prescribers, wholesalers and pharmaceutical partners across markets like Germany, Australia and the UK.

A Pharma-First Cannabis Strategy

The Luo lozenge deal, combined with Aurora’s global medical push and Canada-first manufacturing strategy, fits into a broader vision Martin has reinforced consistently: that cannabis should follow pharmaceutical norms—from delivery methods to regulatory rigor.

Also read: Zyn Changed Nicotine Forever – Are Cannabis Pouches The Next Big Thing?

“We’re experts in medical cannabis,” he said. “That’s where all of our profitability comes from. If a partnership helps us improve patient outcomes and deliver consistency, we’re open to it.”

For now, that means dissolvable CBD lozenges backed by pharma-grade R&D. Whether future deals bring Aurora closer to companies like PMI remains to be seen. But Martin insists the priority is patients, not optics.

“If it wasn’t additive or accretive to our financials, we wouldn’t do it,” he said. “We don’t chase headlines—we build around what works.”

Photo: Shutterstock

Tensions in the Middle East have caused the price of Bitcoin (CRYPTO: BTC) to go down by under $100,000 in the last several days. A Benzinga reader poll may have predicted that move and could show what happens next.

What Happened: The leading cryptocurrency, Bitcoin, continues to see increased interest and adoption from investors thanks to its maximum supply, institutional buying, and other elements.

Bitcoin hit new all-time highs in November around the 2024 presidential election and jumped to new highs several times in 2025.

A Benzinga poll recently asked if a new all-time high was likely in the short term.

“Bitcoin trades near $107,500 today. Which of the following do you think happens next?” Benzinga asked.

The results were:

- Bitcoin hits new all-time highs (over $112,000): 50%

- Bitcoin trades below $100,000: 50%

Readers were split in the poll on which level would be hit first. Since the poll was conducted, Bitcoin briefly dipped under the $100,000 level. Over the last 24 hours, it has traded between $98,286.21 and $102,136.32.

The drop under $100,000 could prove to be short-lived, and Bitcoin could hit new all-time highs, as predicted by the other 50% of readers in the poll.

Bitcoin hit a high of $111,970.17 in May 2025, which was also the last month that Bitcoin traded under $100,000.

While Bitcoin could remain volatile and stuck in the range under all-time highs, easing of Middle East tensions with no retaliations by Iran could see markets climb higher, including cryptocurrency prices.

Read Also: EXCLUSIVE: No HODLing For Congress, 48% Say Elected Members Shouldn’t Be Able To Buy Cryptocurrency

What’s Next: Bitcoin leads the cryptocurrency market by price and volume and continues to experience strong demand from both retail and institutional investors.

Another recent Benzinga poll asked readers to predict the highest price Bitcoin will hit before the end of the year.

“Bitcoin hit new all-time highs of nearly $112,000 in May 2025. Do you believe this will be the top price for BTC in 2025 or will the leading cryptocurrency hit new highs later this year?” Benzinga asked.

The results were:

- Bitcoin will hit $112K to $130K: 32%

- Bitcoin will hit $130K to $150K: 24%

- Bitcoin will hit $150K to $200K: 15%

- Bitcoin will hit $200K+: 15%

- Bitcoin has already topped at $112K: 14%

The poll found that readers are optimistic about Bitcoin’s future, with 86% predicting it will reach new all-time highs later this year.

In the poll, the most popular options were the $112,000 to $130,000 range and the $130,000 to $150,000 range at 32% and 24% respectively.

Over half of the respondents see Bitcoin reaching $112,000 to $150,000 before the end of the year.

Read Next:

- EXCLUSIVE: S&P 500 To Hit New All-Time Highs Again In 2025? Majority Say Yes, 27% Predict This Range

The study was conducted by Benzinga from June 16, 2025, through June 21, 2025. It included the responses of a diverse population of adults 18 or older. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 137 adults.

Photo: Shutterstock

Worksport (NASDAQ:WKSP) announced on Monday that its May 2025 sales reached $1.28 million, marking its second consecutive month of record-breaking revenue (non-audited).

Gross margins improved as Worksport’s Made-in-USA cover line gained significant traction, the company said.

Worksport’s April and May 2025 revenues have surpassed total first-quarter 2025 revenue, signaling strong momentum entering the year’s second half, the company said.

Also Read: Worksport’s March B2B Sales Soar Nearly 70%

May gross margins improved from the first-quarter 2025 levels to roughly 23%, driven by the company’s focus on higher-value branded products and operational efficiency at its New York manufacturing facility.

Management projects gross margins to trend toward 30% by year-end, reflecting expected scale benefits and continued cost optimizations. The company also expects to have a positive cash flow by year-end.

Worksport’s active dealer network has expanded from 94 in the fourth quarter of 2024 to over 550, including two major national distributors added this spring, the company said.

Management expects June 2025 to deliver another strong month as two recently onboarded national distributors ramp up ordering.

Steven Rossi, CEO of Worksport, said that with its SOLIS and COR clean-tech products launching this fall, Worksport is targeting the multi-billion-dollar clean energy and portable power markets.

The company said it believes these high-margin, IP-protected products will accelerate significant, consistent growth for the years ahead.

Worksport projects approximately $20 million in revenue by year-end 2025. The company noted that its current market capitalization remains below this year’s projected revenue.

Price Action: WKSP stock is up 0.10% at $2.80 premarket at last check Monday.

Read Next:

Guardforce AI Co (NASDAQ:GFAI) on Monday announced that its subsidiary, Guardforce Cash Solutions Security (Thailand) Company Limited (GFCS), has won a three-year renewal with Government Savings Bank (GSB).

GSB one of Thailand’s state-owned banks adn the renewal deal is effective from June 1, 2025, through May 31, 2028.

This fourth consecutive renewal represents a decade-long partnership between the company and GSB.

Also Read: Guardforce AI Taps Librum Technologies To Boost AI Agent Capabilities

Under the renewed agreement, GFCS will continue to provide secure and efficient cash-in-transit and maintenance services for GSB’s ATM network across Thailand’s upcountry regions, which covers most of the company’s ATM services currently handled.

With this renewal, Guardforce AI will secure stable and predictable revenue streams over the next three years, providing the company with a solid financial foundation to invest in innovation and expand its AI-driven solutions, the company said.

In January, GFCS renewed key contracts with its long-time customer GSB in Thailand. Under two three-year multi-million-dollar contracts, GFCS continued to deliver cash center operations and secure logistics services for coins.

Price Action: GFAI stock closed lower by 3.33% at $1.16 Friday.

Read Next:

Photo via Company