Zinger Key Points

- ADP data reported U.S. private companies added 140,000 jobs in March, well below 200,000 expected.

- Investors believe that a cooling labour market will lead the Fed to pause in May.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The market got another hint of labor market weakness in the United States on Wednesday, as Automatic Data Processing, Inc. (ADP) reported 145,000 jobs added by private companies in March 2023, down from 261,000 in February and significantly below forecasts of 200,000.

According to ADP Chief Economist Nela Richardson, "March payroll data is one of several signals that the economy is slowing. Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down."

Financial, Business Services And Manufacturing Industries Cut Jobs In March

Mid-sized businesses with 250 to 499 employees slashed 42,000 jobs in March, while large businesses with more than 500 people added just 10,000 employees.

Among different industries, financial activities had the greatest decline, with 51,000 layoffs, followed by professional and business services, with 46,000 layoffs, and manufacturing firms shed 30,000 employees in February. Meanwhile, the leisure and hospitality sectors added roughly 100,000 jobs.

Market Reactions: A Fed On Hold In May Is Now More Likely Than Not

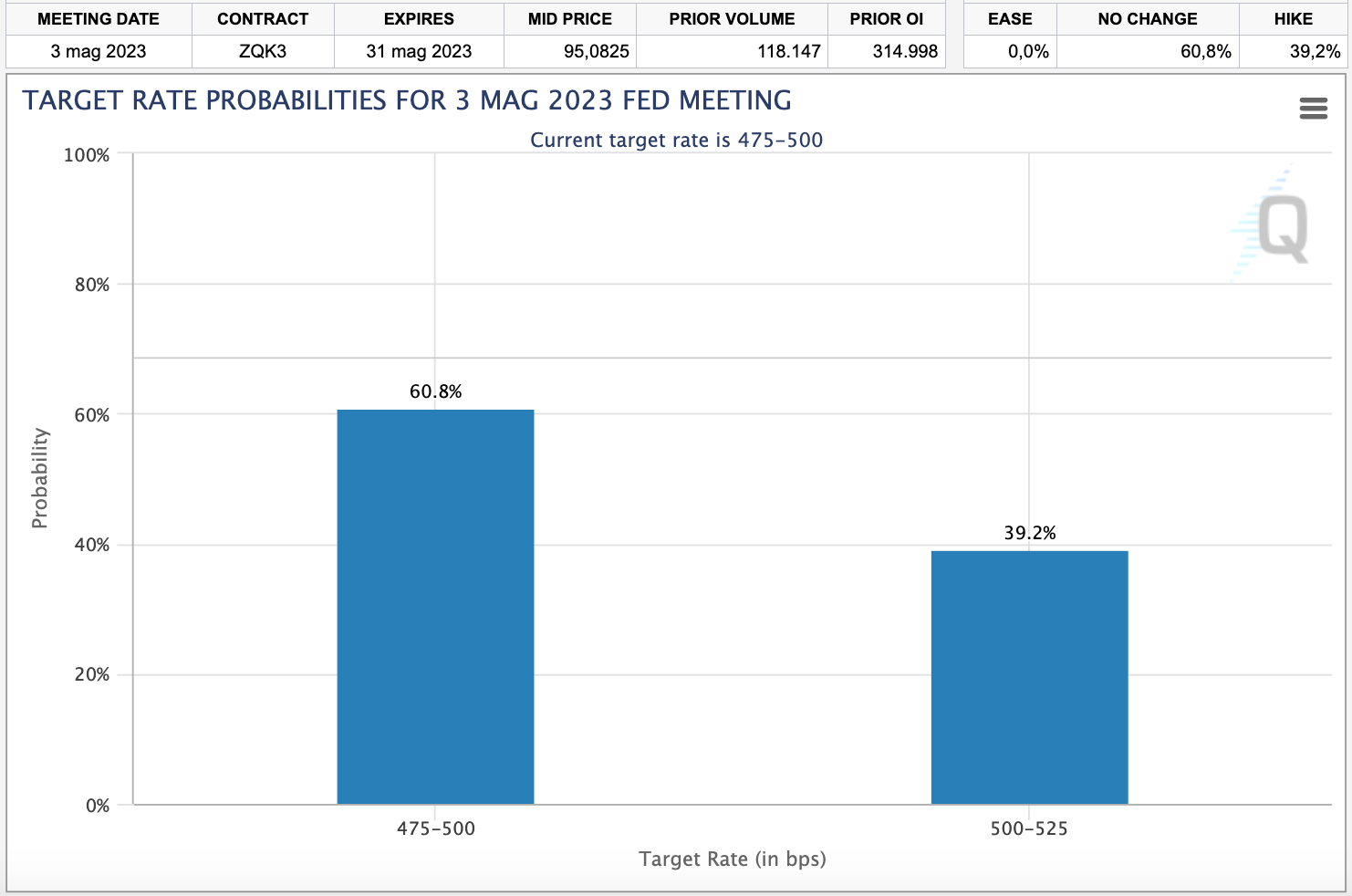

Investors have reduced their expectations for a Fed rate hike next month and now give a 60% probability to a rate hold, according to the latest CME Group FedWatch.

Source: CME Group

U.S. Treasury yields further dropped, with the yield on the 10-year benchmark falling to 3.32%, only a few basis points higher than its 6-month lows.

Gold continued to kick higher to $2,030/oz, eyeing its all-time highs.

U.S. equity futures inched lower, with the S&P 500 index down 0.3% to 4,100 points in the pre-market. The SPDR S&P 500 ETF Trust SPY closed at $408.7 in the previous session, down 0.6%.

WTI crude marginally eased 0.7% on the day, but held above the $80 a barrel mark, indicating that OPEC+ supply cuts continue to have a stronger impact than early signals of a possible demand slowdown.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.