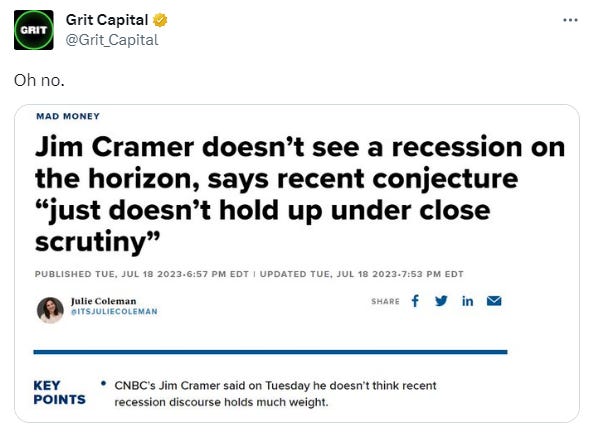

Do with this information as you see fit: Jim Cramer said this week he doesn’t see a recession in the cards for the US…

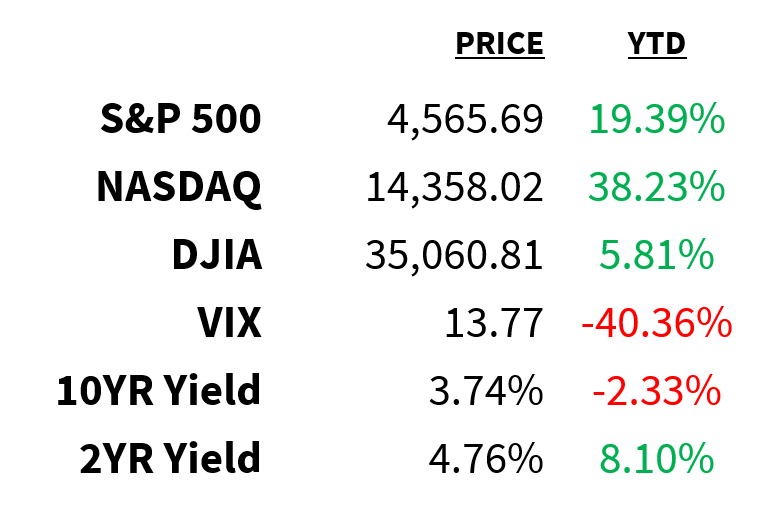

Market

Prices as of 4 pm EST, 7/19/23

Macro

The end of Fed hikes may be on the horizon but what about their effects on the economy?

-

According to TD, the peak impact from a rate hike occurs ~4 quarters later for GDP and ~6 quarters later for inflation.

-

In other words, what we see now is the effect of policy rates from mid-2022.

-

That means the peak impact of rate hikes on the economy has yet to be felt.

-

As Apollo’s Torsen Sløk notes, this will likely lead to further deterioration in credit conditions and lending growth.

Corporate bond spreads act as a proxy for overall macro concern among bond investors.

-

What are they saying?

-

Excluding a spike in March following the banking crisis, spreads have declined since October.

-

In fact, spreads are just as low now as they were before the banking failures.

-

This suggests investors believe the impact of macro headwinds on future earnings will be minimal.

Housing starts in the US fell by more than expected in June.

-

Building permits also declined against estimates for a modest gain.

-

Permits for single-family homes (SFH), however, increased by 2.2% and have been steadily rising which points to a rebound in SFH starts ahead (chart).

-

On the other hand, permits for multi-family units fell to the lowest since October 2020.

@RenMacLLC

Stocks

Apple has hopped on the AI bandwagon, sort of.

-

Noticeably absent from the recent AI buzz, the company is now developing AI tools to compete with Microsoft and Google.

-

It has created a framework called “Ajax” to build large language models (LLMs).

-

It’s also created an internal AI chatbot referred to as “Apple GPT”.

-

Though it has no clear plans for releasing any new tech to the public currently, it’s aiming for a major AI announcement by next year.

If you invested in Carvana on January 1, you’d have a ten-bagger on your hands today.

-

Shares jumped 40% yesterday after it announced a deal that would reduce outstanding debt by +$1.2 billion.

-

The stock has climbed over 1,000% YTD.

-

At ~$56 a share, however, it still has a long way to go in reclaiming its 2021 high of $376.

Yesterday we noted the divergence in sentiment between institutional and retail investors – here are some points on the latter:

-

Retail investors have never been so aggressively positioned ahead of an earnings season (chart).

-

The AAII Bull/Bear Ratio just flipped above 50% this morning for the first time in more than 2 years.

-

Consumer sentiment is at its highest since September 2021.

-

The put/call ratio is at its lowest since late 2021.

Vanda Research

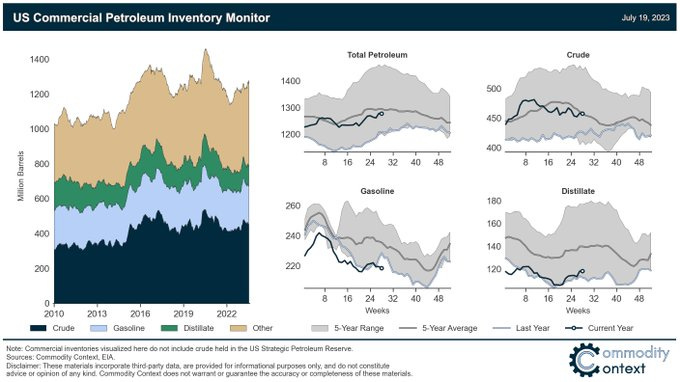

Energy

Total US petroleum inventories fell by 1.1 million barrels last week, according to the EIA.

-

This follows a massive 17 million barrel build in the previous week.

-

At Cushing, meanwhile, crude stockpiles fell by the most in almost 2 years to the lowest in May.

-

Separately, last week marked the first time since March that the Strategic Petroleum Reserves were left untouched.

Commodity Context, @rory_johnston

Earnings

Yesterday’s highlights:

Tesla TSLA: $0.91 EPS (vs. $0.82 expected), $24.93 billion in sales (vs. $24.47B expected).

-

Price cuts and incentives led to lower profit margins despite record revenue.

-

Specifics and dates for Cybertrucks and robotaxi-ready vehicles were not provided.

-

Musk warned production would slow in Q3 because of factory shutdowns and upgrades.

Netflix NFLX: $3.29 EPS (vs. $2.86 expected), $8.19 billion in sales (vs. $8.3B expected).

-

Subscriptions and revenue rose 8% and 4% YoY, respectively.

-

The company expects higher sales in H2 and is forecasting a 7% YoY rise in revenue for Q3.

What we’re watching today:

-

Taiwan Semiconductor Manufacturing TSM

-

Johnson & Johnson JNJ

-

Abott Laboratories ABT

-

SAP SE SAP

-

Philip Morris PM

-

Intuitive Surgical ISRG

-

Marsh & McLennan MMC

-

Blackstone BX

-

Infosys INFY

-

CSX CSX

-

Freeport-McMoRAn FCX

-

Kenvue KVUE

-

Truist TFC

-

Capital One COF

-

DR Horton DHI

-

The Travelers Companies TRV

-

Newmont NEM

-

PPG Industries PPG

-

Genuine Parts GPC

-

Nokia NOK

-

Fifth Third Bank FITB

Top Headlines

-

Financial plumbing: Today the Fed launches FedNow, a real-time payment system.

-

USD ban: The US has banned 14 Iraqi banks from conducting dollar transactions.

-

Fed fine: Deutsche Bank will pay a $186 million fine for inadequate measures against money laundering.

-

CRE SOS: Distressed office buildings in the US have reached $24.8 billion.

-

Activist stake: Activist investor Elliott has taken a significant stake in drug manufacturer Catalent.

-

CEO banks: Microsoft’s payouts to CEO Satya Nadella have surpassed $1 billion.

-

Box office: “Barbie” and “Oppenheimer” are expected to bring in a combined $200 million over the weekend.

-

Powerball: A Californian was the sole winner of the $1.08 billion Powerball, the 7th largest lottery price ever.

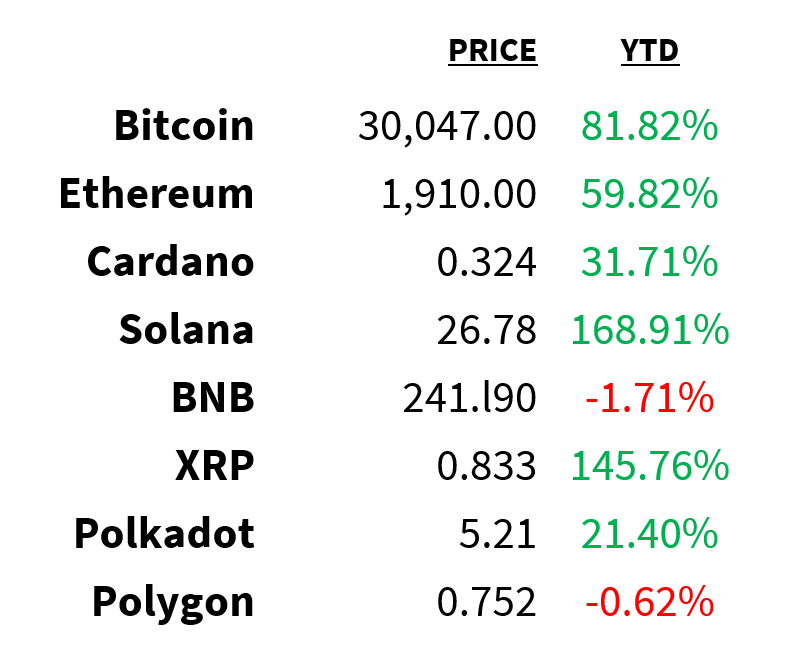

Crypto

Prices as of 4 pm EST, 7/19/23

-

Compiler unveiled: Solana Labs has rolled out Solang, a new compiler aimed at enhancing Ethereum compatibility.

-

Wild West: The SEC’s Gary Gensler has requested increased funding from lawmakers to police the “Wild West” of crypto markets.

-

Custody pause: Nasdaq will pause plans to launch a crypto custody business due to regulatory concerns.

-

BTC vs. bonds: Fueled by the Bitcoin BTC/USD rally, bonds in El Salvador have surged by 62%.

-

Luxury NFTs: A Ferrari F40 sold for $2.5 million on luxury NFT marketplace Altr.

Deals

-

AUM leader: Blackstone is inching its way to becoming the first private equity firm to reach $1 trillion in assets.

-

Deadline: Microsoft and Activision have agreed to extend their deal deadline to October 18.

-

Healthcare IT: Private equity firm TPG will buy Nextech for $1.4 billion.

-

IAC + AI: Media and Internet holding company IAC is implementing AI tools in its M&A prospecting.

-

Shapewear unicorn: Kim Kardashian raised $270 million for her Skims apparel brand at a $4 billion valuation.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.