Zinger Key Points

- $2.7 trillion in derivatives contracts are due to expire on Friday

- Bearish market sentiment has been on the rise as of late, with the CBOE Put/Call ratio hovering around 1.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

A total of $2.7 trillion in derivatives contracts are due to expire on Friday's "triple witching," an event that might result in turbulent market fluctuations after the past week's banking turmoil.

The triple witching is a quarterly event in which contracts for index futures, equity index options and stock options all expire on the same day. This may amplify fluctuations in trading volumes and prices since Wall Street traders are required to either roll over expiring contracts or open new ones.

Stock transactions often increase when the expiration of stock and index options coincides with that of index futures.

At the Triple Witching event precisely one year ago, when $3.5 trillion in derivatives expired, the volume on the S&P 500 Index in the first 15 minutes of trading was more than twice the average for that time of day over the previous 30 trading sessions, Bloomberg reported.

Since many derivative contracts now come to an end, the crucial question is whether investors would now raise their holdings of protective puts. If that happens this might exacerbate volatility in markets, leading to a surge in the VIX VIX index.

Hedging Demand On The Rise

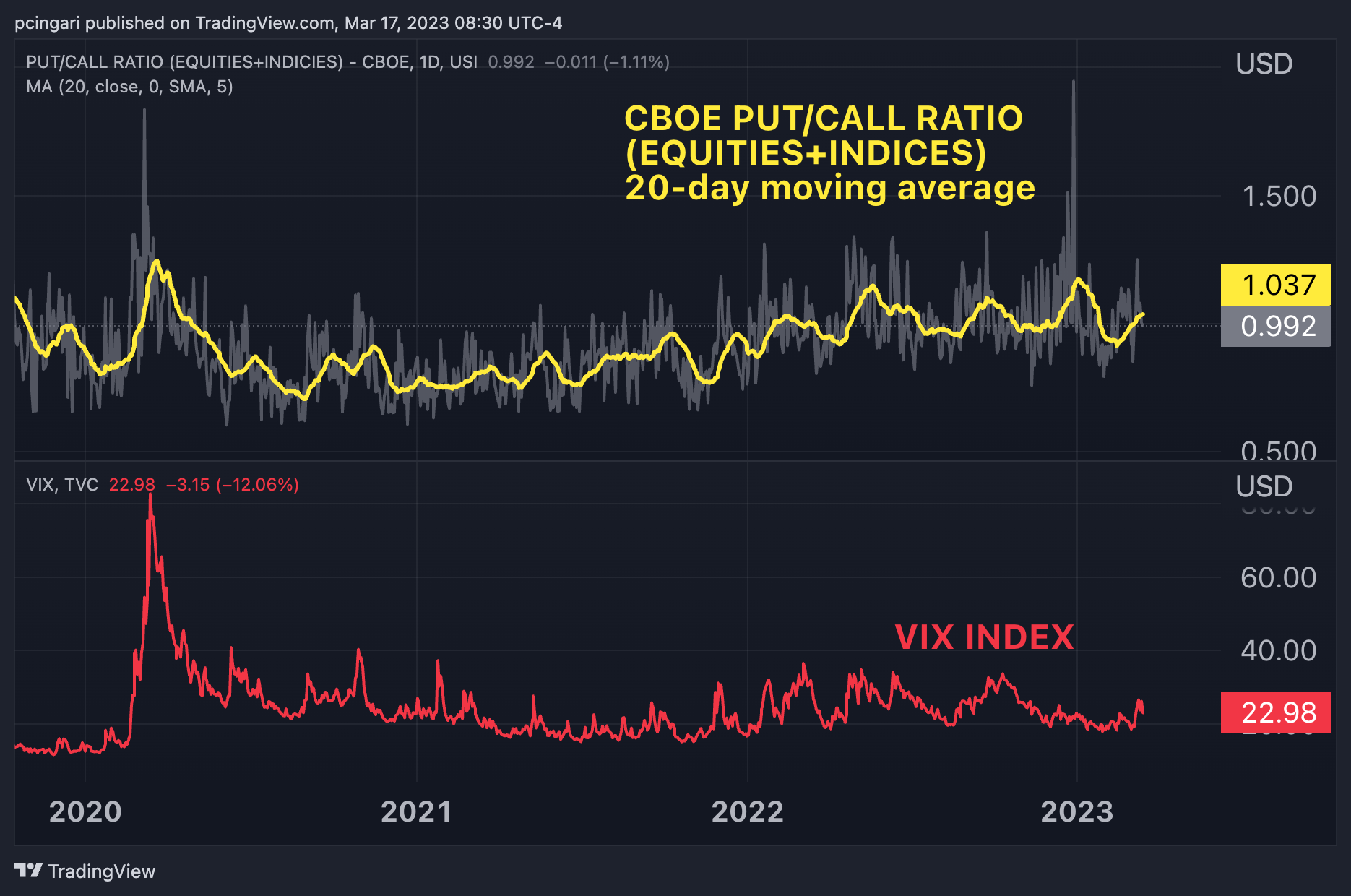

CBOE Put/Call Ratio vs VIX – Chart: TradingView

As Friday's triple witching approaches, bearish market sentiment has been on the rise as of late.

The CBOE Put/Call ratio is presently at one, and its 20-day moving average has already exceeded that threshold.

It indicates traders are buying more puts than calls, gambling on a market downturn, or hedging their portfolios. If this trajectory continues, market volatility might increase from here.

The VIX index is now trading at 22.98, up 13% in the last month.

The ICE BofA MOVE index, which is the bond market's VIX, has instead reached its highest level since December 2008, evoking flashbacks of the Great Financial Crisis.

MOVE Index – Chart: TradingView

The SPDR S&P 500 ETF TRUST SPY closed above its 200-day moving average on Thursday, March 16, and is now down roughly 1% in pre-market hours.

SPY Price Action – Chart: TradingView

SPY Price Action – Chart: TradingView

Read Next: S&P 500 Shoots Higher Into The Close: Here's Why

Photo: nyker via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.