Tesla Inc. TSLA short interest has increased by over 21% during its current reporting period, making it the fourth most shorted stock in the U.S. market currently.

What Happened: The short interest on the company led by Elon Musk has increased from 67.126 million to 81.331 million shares. About 2.9% of the company's publicly available shares were shorted as of the settlement date on March 14, having an effective date of March 25.

According to Nasdaq data, the short interest soared by 21.16% from the previous settlement date of Feb. 28.

The average daily trading volume during the latest period increased from 84.714 million to 125.16 million shares. The volume indicated that it would require approximately one day for the short sellers to cover their positions without significantly impacting the stock price.

While high short interest signals bearishness, an increase during the current report period indicates lower confidence. According to Beth Kindig, a tech analyst at I/O Fund, this increase makes its notional short interest of 81.331 million shares, the fourth-most currently after Nvidia Corp. NVDA, Microsoft Corp. MSFT, and Apple Inc. AAPL.

Technical Analysis

The technical indicators painted a grim picture for the stock, according to Benzinga Pro. As the stock closed at $268.46 apiece on Tuesday, its price trend remained weak. While it was above its 20-day simple moving average of $254.19, it trailed the eight, 50, and 200-day moving averages.

The relative strength index of 47.30 was in the neutral zone. The momentum indicator MACD indicated that the stock is in a bearish trend as the score of its MACD line was -11.6, showing that its 12-period exponential moving average is below the 26-period EMA.

However, the histogram has a positive number of 6.65, meaning that the MACD line is rising and getting closer to the signal line. This signaled a bullish sign within a bearish trend, depicting that the bearish momentum is decreasing.

Price Action: Shares of Tesla were trading 1.37% lower in premarket on Wednesday, while the Invesco QQQ Trust ETF QQQ, tracking the Nasdaq 100 index, was down by 0.46%.

The stock has fallen by 29.22% on a year-to-date basis, whereas it was up 61.11% over the last year.

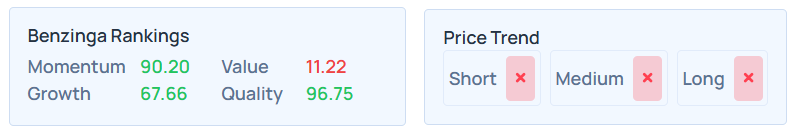

Benzinga Edge Stock Rankings indicate Tesla has negative price trends over the short, long, and medium term. Its momentum ranking was solid at the 90.20th percentile, but its value ranking was weaker. Further fundamental details and the quality and growth rankings are available here.

Benzinga’s analysis of 29 analysts shows a consensus “hold” rating for the stock, with an average price target of $309.55, ranging from $24.86 to $550. Recent ratings from Stifel, Deutsche Bank, and Wedbush average $450, suggesting a 67.86% potential upside.

Read Next:

Photo courtesy: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.