Image provided by CME Group

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

AT-A-GLANCE

- In a year of unknowns around COVID-19, growing conditions and exports, producers found an increased need for precise risk management tools

- Some brokers and producers looked to short-dated options on futures as a way to plan for any sudden price swings

Farmers are accustomed to volatility, but 2021 offered more than one whipsaw event for producers to navigate.

The year started with significant unknowns about demand as the COVID-19 pandemic continued to touch all aspects of farm life, adverse growing conditions in the U.S. and Brazil impacted harvests and a strong U.S. dollar affected exports. Inflation reared its ugly head by mid-year, causing input prices to scale up dramatically.

But it wasn’t all negative news. Demand was surprisingly strong, and farmers enjoyed a record year of grain exports, which helped to alleviate two years of declining shipments. The U.S. Grain Council said U.S. exports of grains in all forms for the 2020/2021 marketing year was a record 129.5 million metric tons, with exports rising 28.3%.

Strong demand spurred a rally, with corn, wheat and soybean prices hitting their highest prices since 2012. Corn and soybean prices reached their highs in the late spring, while wheat prices were hovering just off their highs in late December.

John Georgy, chief financial officer at Allendale, says prices rose higher than most producers expected they would due to fear and panic around strong demand and poor crop conditions seen earlier in the year. Once demand started to return after COVID lockdowns, it came back sharply, eating through stockpiles that had built up in previous years.

“When demand made a strong return, the trade watched grain and livestock supplies dwindle quickly. This created fear of the unknown as to how much supply, domestically and worldwide, would be left, catching a lot of traders and producers off guard,” he says. Volatility brings risks and opportunities, and farmers are continuing to grapple with some of the challenges seen in 2021 as they prepare for 2022.

Managing Risks

Georgy says the financial situation for farmers changed significantly in 2021. After about five years of suffering through low grain prices, crop values rebounded to near 10-year highs.

“You’re at these price levels where most producers have been pretty profitable. And the question being asked is, how long will this last? Will crop production overtake demand or not,” he says.

There’s a temptation from producers to think prices will continue to rise and make their crops worth more later. The question, Georgy says, is how do producers protect themselves if prices don’t stay strong?

“You’re already long out in the field, so how do you protect yourself, even if it’s just a short-term swing,” he says.

Georgy says when he talks to clients about protecting positions, it’s usually at a certain price, buying puts or selling futures contracts. He also uses short-term options to protect positions around days when the U.S. Department of Agriculture releases reports since those sessions are likely to be more volatile than other days. In those cases, it’s about managing the customer’s margin risk.

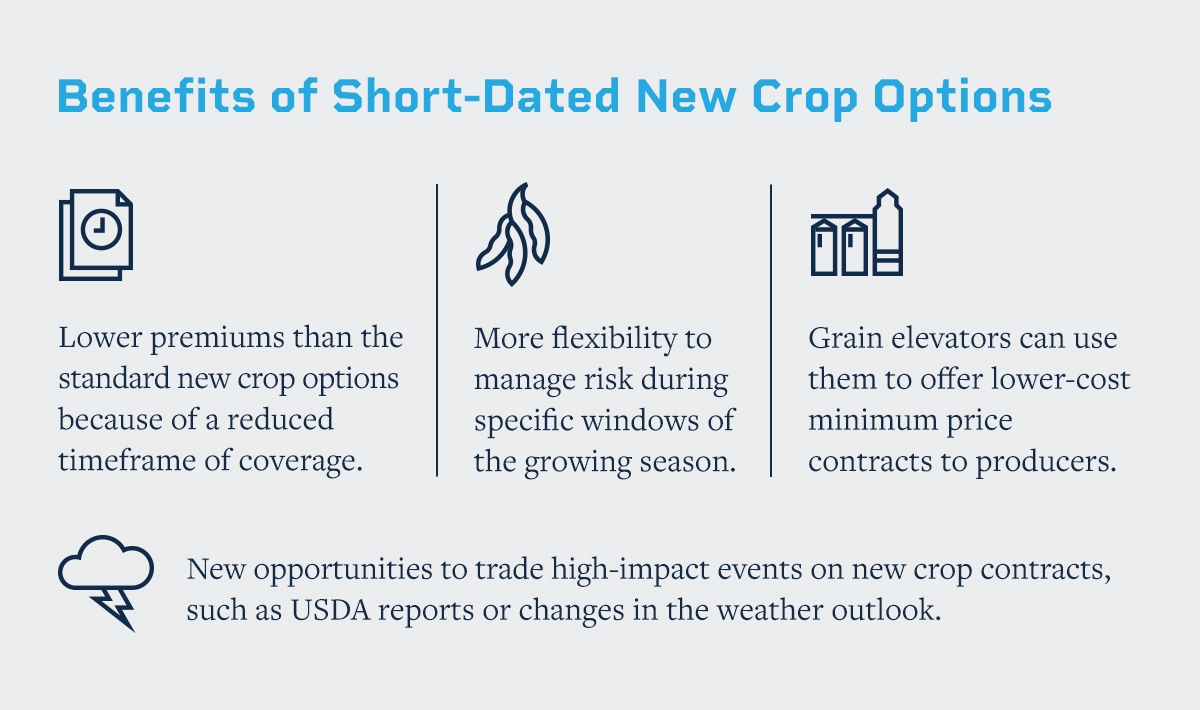

Short-term options have several benefits for producers and end users. They allow users to manage risk during a specific window, such as crop reports, as Georgy points out. Other users, such as grain elevators, can incorporate these options to offer lower-cost minimum price contracts to producers.

Doug Kirk of Terra Plana Family Farms in central Illinois says in early 2021 his biggest concern was to “protect ourselves from our own worst behaviors,” especially with all the uncertainty around.

Some of those past behaviors were not paying attention to their risk-management strategy.

For example, he used to buy harvest month options to protect risk around a USDA report, especially reports known to be volatile, such as the final report released in January or around the USDA March Prospective Planting report.

Read more about short-dated new crop options

He says when buying those options, he would “pay for months of time value just to absorb a potential temporary change in prices. Then, we’d fail to manage the value of those options simply holding them into expiration. Hey, we’re busy. Our day job is in the fields.”

This year he delayed pricing the 2021 crop later than normal to benefit from higher prices. To hedge, Terra Plana Family Farms used short-term options around several key USDA reports.

Since these options have a shorter time value and the premiums are lower than standard crop options, that also offers users the flexibility to manage risk more precisely and cost-effectively throughout the growing season at a reduced cost.

“I like the short-dated options because I can buy or sell them as part of a plan but also forget about them if the risk episode they were intended for passes without coming to fruition, as it most often and most preferably does. Still, there’s plenty of liquidity to trade in and out of them as desired,” he says.

Kirk’s represents a growing understanding of the value of short-dated options. Overall, average daily trading volume in these options was up 170% year-over-year through late December. More than 12,000 unique participants traded short-dated options in 2021, up 39% year over year.

The biggest trading surge came in June, ahead of the June 30 USDA Planted Acreage report. With volatility increasing leading into the report, average daily volume peaked that month at nearly 30,000.

Getting Stability

Betsy Leager, of Leager Farms in the Delmarva area of eastern Maryland, says they started to add short-dated options as a way to bring some certainty to their operations. In the past they leveraged forward contracting or locking in basis levels, but risk management could be more precise since it’s hard to predict harvest size months ahead of time.

“My husband's greatest quote is, ‘you have to have the bushels before you have the price.’ A lot depends on the weather. We can have a bad drought year and we're only getting 100 bushels to the acre versus 250. You have to have the bushels first before you get the price,” she says.

Leager, who manages the books for the farm, says with input costs rising she was looking for ways to protect the profits they saw this year when grain prices rallied. Compared to forward contracting, short-dated options allow more participation in higher prices while protecting against downside risk during the growing season.

“It gives us a sense of where our profit margin will be before the crops are in the ground,” she says.

Looking Ahead

With a new year starting, short-term options can offer users fresh opportunities to trade high-impact events on new-crop contracts, such as key USDA reports and weather outlooks.

Uncertainties are always part of the grain business, Georgy says, but the added uncertainties seen this year has some producers wondering if this will be a longer-term risk.

“With the flow of money that’s come into the system, you have that inflation fear. Producers are seeing inflation first-hand with a lot of their input costs rising,” he said.

Leager says higher input costs are definitely on her mind for 2022 and may determine what her ultimate crop mix will be once planting time occurs. “Everything is going up, but so far our grain prices are not reflecting what input costs are going to be,” she says.

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.