Last week's Commitment of Traders (COT) Report revealed that producers increased their short positions for the first time in five weeks, which may indicate the first sign of a temporary floor around these price levels. There was also an abnormal spike in long positioning for producers, an unusual move that traditionally signals delivery concerns. However, I would not place too much emphasis on the long positioning adjustments at this point, as they are most likely residual adjustments to refineries coming back online after the blend changing season.

Another key focus of the COT report is the washout we have seen from Managed Money. Managed Money includes CTAs, ETFs, among other classifications. This group, typically positioned for speculation, can cause fund flows in and out of a commodity to be very fluid. This is exactly what we witnessed during the oil price run-up from mid-September until after the peak in November. In fact, Managed Money has the largest short position since June 27th of this year, coinciding with the final test of the $67.20 level before it surged to $95.

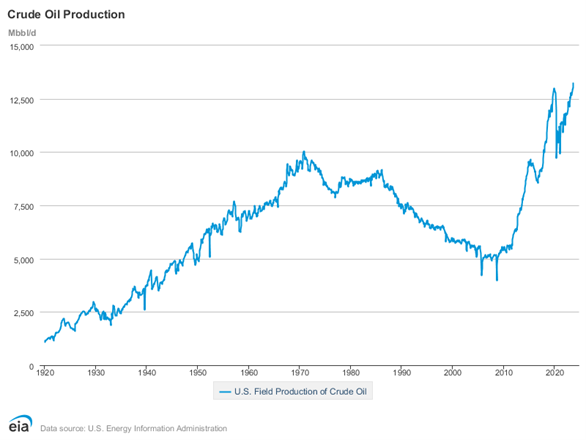

Both of these key factors indicate that the current price level is the "foundational" bottom in the near term. THIS DOES NOT MEAN THAT PRICE HAS BOTTOMED. The "foundational bottom" refers to environmental factors that have now been fully priced into the market. U.S. crude production is sustaining at over 13 million barrels per day (bpd), OPEC+ has pledged to cut production by 5.86 million bpd, including the recently announced voluntary cuts at the beginning of the month, and there are geopolitical tensions in the Middle East and now in South America with the dispute between Venezuela and Guyana, which could threaten operations of ExxonMobil XOM and Chevron CVX.

Any further deterioration from here will be purely demand-driven, as the supply side has provided ample opportunity for downside price action. Further downside pressure will result from demand, deflationary for now, but potentially unsustainable for the second half boom described in the "soft-landing" narrative. Bringing supply back online from OPEC+ will take some time.

This article is from an external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.