In this third part of a four part series, we will compare the high leverage you get with Nadex spreads to the leverage you get with stocks and ETF’s. Most people know what stocks are but what is an ETF? ETF stands for Exchange Traded Fund, and is just that, an investment fund traded on stock exchanges. It trades like a stock, in that you can own a share that can increase or decrease in value, and trade it throughout the trading day, yet it’s like a mutual fund, in that it holds assets like stocks, commodities or bonds. To trade ETF’s you have similar account requirements as you have trading stocks. Now what is a Nadex Spread? A Nadex spread is a short term position, with high leverage, and defined risk, that doesn’t get stopped out by a temporary unfavorable move. Unlike using margin for leverage to trade stocks and ETF’s, when you use leverage trading Nadex spreads, no matter what happens you can’t lose any more than what you put into the trade. It also doesn’t take much to open an account. You only need $100 to fund an account, and only $100 to start and place a trade.

Typically people trading stocks and ETF’s have either a cash account or what is called a Reg-T account. A cash account has no leverage, and risk is equal to what you put up for the stock or ETF trade. If the stock/ETF cost you $100 then that is your risk, $100 bucks. This also limits your ability to make profits to only making profits on the $100 invested. Frequently people will have what’s called a Reg-T account and not even realize it. This is short for the Federal Reserve Board Regulation that governs customer cash accounts and margin accounts. What exactly is margin? Margin is the minimum amount of cash necessary to trade using borrowed money from the broker. The Reg-T account allows for you to get 2x the leverage. If you want a $100 stock, you only have to put up $50 and you borrow the other $50 from the broker. Of course the broker will charge interest on that borrowed amount.

Leverage is the use of margin to increase the potential of return. Therefore increasing leverage is a good thing right? It can be certainly, but leverage using margin can be a double edged sword. You can have potential for an increase in profits using leverage, but it can also work the other way and be potential for an increase in loss. With margin accounts you can also have margin calls. This is when the broker increases the margin requirements for the account, and the money must be deposited into the account by a certain time. If the money is not deposited, your positions can be sold to cover the margin call. Brokers can increase the minimum margin amounts or make a margin call at any time as well. Nadex has none of that.

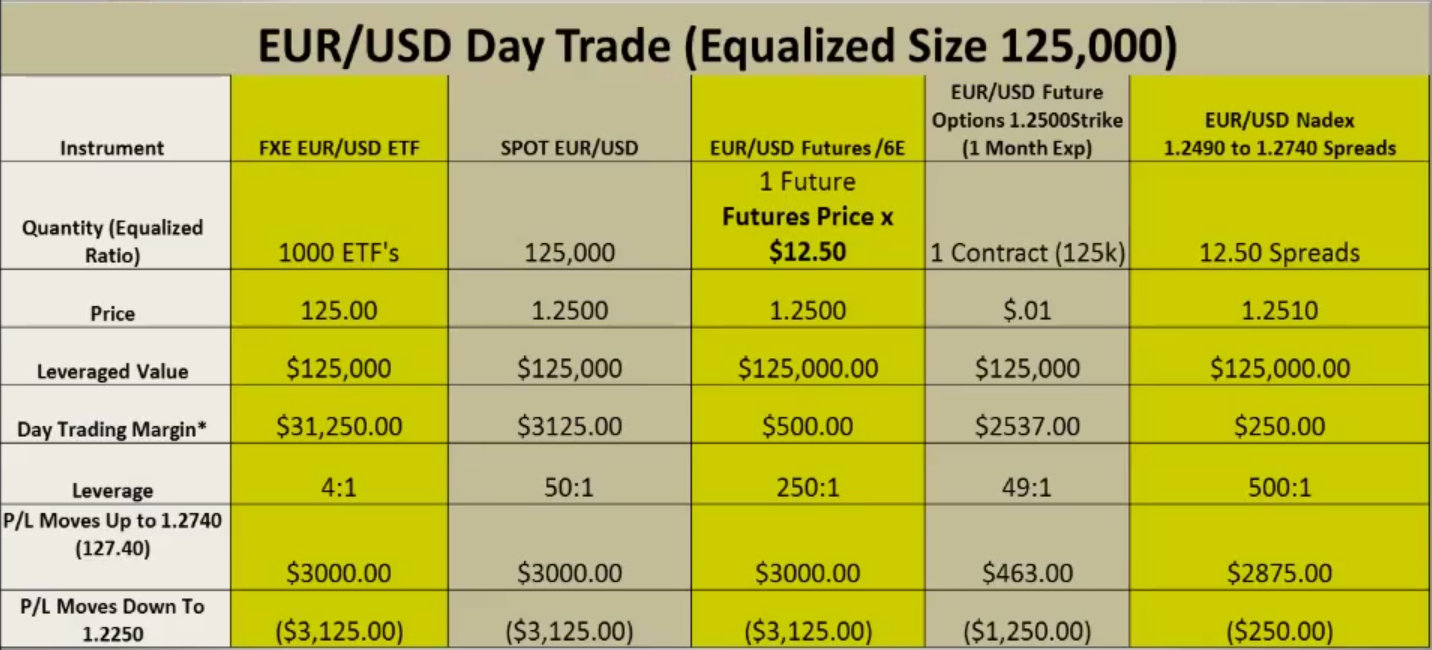

If you want to day trade stocks you need a $25,000 account size to trade. To open a Nadex account and begin to trade spreads, you only need $100 to open the account. There are also no account minimums and no margin calls. A Nadex spread has a defined floor and ceiling for the trade. There is no additional max profit/max loss past the floor and ceiling levels. Therefore, the max risk on a long trade is the distance between the entry price and the floor, and the max risk on a short trade is the distance between the entry price and the ceiling. That max possible risk is the cost of the trade. When you enter a Nadex spread you put up an amount equal to the max possible loss on the spread you traded. You don’t have to worry about a call that your account is negative and you owe money now. To better understand the max possible risk in relation to leverage with Nadex spreads, take a look at the example of the equalized day trade going long on the EUR/USD below. While the instruments are not specific stocks the example using ETF’s EUR/USD, can still show the excellent leverage ratio with Nadex Spreads and compare max risk. Leverage is an efficient use of capital, you can see when day trading ETF’s or stocks how your money is not being used effectively at all.

To view image click HERE

Comparing the instruments FXE EUR/USD ETF and the EUR/USD Nadex Spread you can see 1000 ETFs is equal to 12.5 Spreads. To trade those 12.5 spreads the day trading margin and cost is only $250, while to trade the ETF it cost $31,250. Now look at the risk, say the price went down to 1.2250, the max loss for the Nadex spreads is only -$250 while the loss on the ETF’s is -$3125.00. Now look at the leverage. With the Nadex spreads you had a leveraged value of $125,000, putting up only $250 that’s a leverage of 500:1, and the risk and cost……still only -$250. The ETF’s leverage didn’t come close at 4:1 and still had a loss of -$3125.00. Now look at the possible max profit if the price moved favorably in your direction. The Nadex spreads profited $2875 and the ETF’s profited $3000, almost the same amount. There are many more examples like this with Nadex spreads as well.

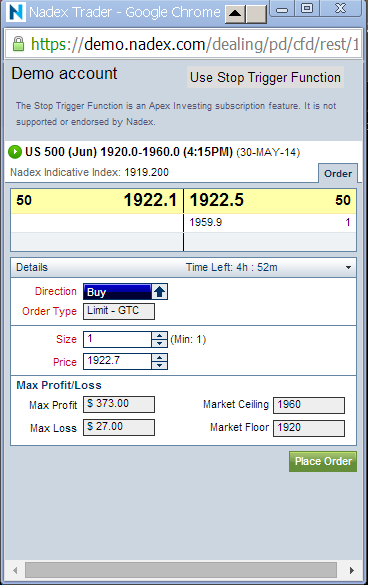

While with Nadex spreads you can’t trade any particular stock, you can trade US and foreign Indices, commodities, and currencies. They offer spreads of various distances or widths, with different time frames and you can trade them around the clock. The trade ticket below shows an example of a Nadex Spread for the US 500, which is a derivative of the E-mini Future S&P 500. You can see on the ticket the market ceiling and market floor of the spread, both at the top and the bottom, along with the max profit and max loss of the trade. The max loss is also the cost of the spread. In this example, if you thought the market was going to go up, you could buy this spread for $27 which would also be your max loss on the trade. Your max profit potential however is $373, assuming you traded simply one contract.

To view image click HERE

For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go to www.apexinvesting.com. To practice trading spreads on a free demo account go to www.nadex.com and click on trading demo, trading account.

Apex Investing Institute offers free education, effective tools and a room community of seasoned as well as up and coming traders. Together in a supportive environment, along with tools to trade with ease and convenience, traders of all levels can learn how to trade Nadex binaries and spreads as well as futures, forex, stock and options, and gain an edge for successful trading overall. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.