Have a day job? Don’t have the free time during the day to day trade? Then, evening trade. That’s right, trade at night. There are markets out there and strategies for trading at night. A perfect example is a news trade based on a scheduled news event. Eurostat, the statistical office of the European Union, will be releasing three reports on Friday, October 16, 2015, at 5:00 AM ET. The recommended trade for this event is to use Nadex EUR/USD spreads and place the trade the night before on Thursday, at 11:00 PM ET with 7:00 AM ET expirations.

The strategy for this event is the Iron Condor using two spreads. This is a great strategy for when you don’t know which way the market will go, and when the market is going to react but not necessarily by much or it may pull back. If the market ends up just ranging, chances are this strategy can still capture some profit.

The three reports to be released are the Final CPI, Final Core CPI and Trade Balance. Final CPI is the Consumer Price Index and the final reporting of it. There are other flash or prelim estimated numbers in earlier reports so the Final CPI isn’t necessarily so impactful. It reports change in the price of goods and services consumers purchased and is reported monthly. The Final Core CPI reports on the same statistics only this report excludes food, energy, alcohol and tobacco. Finally the Trade Balance reports on the difference in value between imported and exported goods during the reported month. If the Trade Balance is a positive number then exports were higher.

Capturing Profit Is All About The Strategy

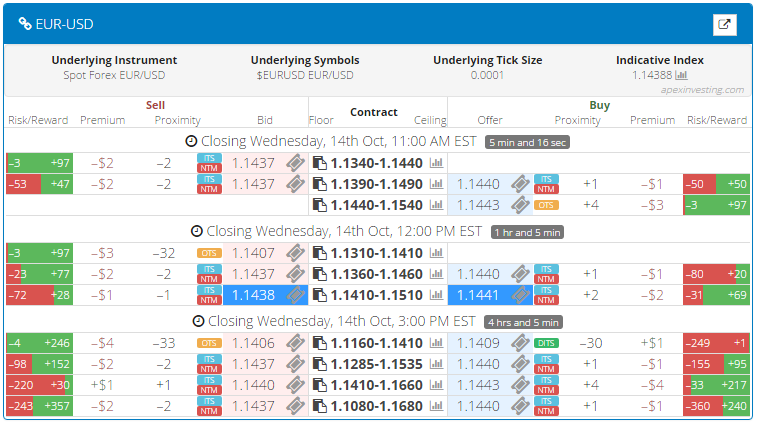

The strategy for trading this event is at entry time 11:00 PM ET Thursday, you want to buy a lower spread below the market with the ceiling of the spread where the market is trading at the time. Also, sell an upper spread above the market with the floor of the spread where the market is trading at the time. Go for a $35 or more profit potential. To find your two spreads easily, just use the spread scanner. Below is an example of the spread scanner with the EUR/USD spreads showing.

To view a larger image click HERE.

You can see in the image that the spread contracts are listed down the center. The floor is the number on the left and the ceiling is the number on the right. The Bid price to sell the spread contract is directly to the left and the Offer price to buy the spread is directly to the right. To find the two spreads with the combined profit potential of $35, look all the way to the left at the Risk/Reward for selling and then to the right at the Risk/Reward for buying. Find the spreads with the correct ceiling and floor requirements listed above and combined green bar Reward of $35 split as evenly as possible between the spreads. If you want to have more profit potential, you can trade more contracts of the same spreads. Be sure to have the same number of contracts on each side of your Iron Condor setup.

Once you’ve bought your lower spread and sold your upper spread, be sure to enter your take profits and stop triggers. For this Iron Condor, the market can move up or down 70 pips. Depending on your entries, the trade will be at a 1:1 risk reward ratio. There is a large range, a total of 140 pips, the market can move before you take on losses greater than the potential profit of the trade. If the market moves 35 pips up or down, that is your breakeven point, again depending on your entries.

To access the spread scanner for Nadex spreads, go to www.apexinvesting.com. There you can find free education and information on how to trade Nadex, news trades and a complete calendar of news events and strategies to trade them. Nadex can be traded from 49 countries and is a regulated, US based exchange.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.