Export demand impacts currency because in order for foreigners to purchase exports from a country, the foreigner must first buy the currency to pay for the goods. This is true in Switzerland and true for the Swiss Franc. The Federal Statistical Office of Switzerland will release the Trade Balance report at 2:00 AM ET, Tuesday, October 20, 2015, making for a great trade opportunity the night before at 11:00 PM ET Monday evening.

To trade this scheduled news event, it is recommended to trade two Nadex USD/CHF spreads and set up an Iron Condor. In the past 12 - 24 reports, it was found the market reaction was to react and then pull back. To set up this strategy you want to buy a lower spread below market with the ceiling being where the market price is trading at the time, and to sell an upper spread with the floor being where the market price is trading at the time. Your profit potential for this trade is $35 or more. You can go for more with more spreads but be sure you have the same number of spreads on each side of the Iron Condor.

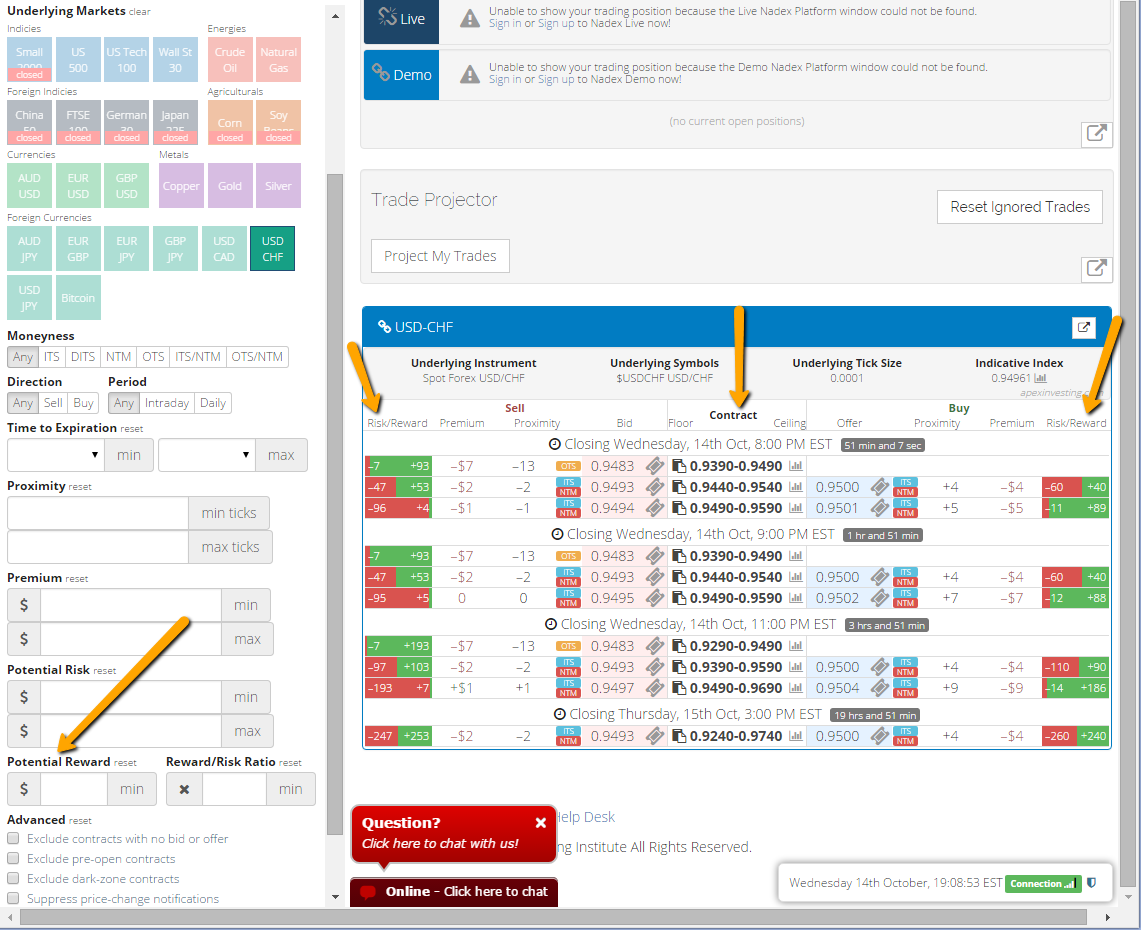

Use A Spread Scanner To Easily Find The Spreads You Need At A Glance

If you use the spread scanner, you can easily see which spreads to choose that meet your parameters. You can enter as early as 11:00 PM ET on Monday for 7:00 AM ET expirations. Using the filters on the side of the spread scanner, choose your market USD/CHF for this trade. Then, in the Potential Reward area, enter $17. This is the minimum Potential Reward amount per spread needed to make a combined amount of approximately $35. Once you have found your two spreads meeting the above criteria, enter your trade. If there are no spreads with all the parameters then wait this news trade out and try the next one. Below you can see an example of the spread scanner showing the USD/CHF spreads available at that time along with the filters on the side.

To view a larger image click HERE.

From the example, you can see the spread contracts are listed down the middle and the floor number is on the left with the ceiling number on the right. The Bid for selling a spread is on the left along with a visual of the Risk/Reward amount. The same is true for the Offer for buying a spread. It’s on the right with its Risk/Reward visual being to the far right. The scanner makes setting up an Iron Condor trading Nadex spreads extremely easy and convenient.

Once you’ve placed your trade you can set up your take profits and stops. For this trade with a profit potential of $35, depending on your exact entries, the market can move 70 pips up or down and the trade will still have a 1:1 risk reward ratio. Your breakeven point is when the market moves 35 pips up or down. After the news is announced and the market reacts, one side may profit before the other side.

Nadex is a US based, regulated by the CFTC, exchange listing binaries and spreads, which can be traded from 49 different countries. Markets available to trade include currencies, various indices and various commodities. To access the spread scanner available to use for free, visit www.apexinvesting.com, a source for free daytrader education as well.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.