Markit, a leading global provider of financial information services, will be releasing Great Britain’s Purchasing Manager’s Index, Services PMI for short, on Wednesday. This is a news event that can be traded using Nadex GBP/USD spreads and fortunately, this trade strategy can be placed the night before.

Services PMI is based on purchasing managers having been surveyed in the services industry. Purchasing managers can have the most current and relevant insight into their company’s idea on the economy. They have to react quickly to market conditions. Therefore, this report is a leading indicator for the state of the economy.

The report comes out at 4:30 a.m. ET and as stated, this strategy allows you to enter the night before, put on your trade and then go to bed. The strategy called the Iron Condor was chosen based on analysis of the market’s reaction after 12-24 reports.

Using Nadex GBP/USD spreads, you are able to trade a range of the market and have capped risk, unlike trading spot forex with unlimited risk. For this Iron Condor strategy, you will trade two spreads, one ranging below the market and one ranging above the market. Entering the night before at 11:00 p.m. ET for 7:00 a.m. ET expirations, buy a Nadex GBP/USD spread with the ceiling or top of the spread range where the market is trading at the time. Also, sell a Nadex GBP/USD spread with the floor or bottom of the spread range where the market is trading at the time. Ideally, the ceiling of your bought spread will meet with the floor of your sold spread where the market is trading at that time, if not exactly at market, then very close to it.

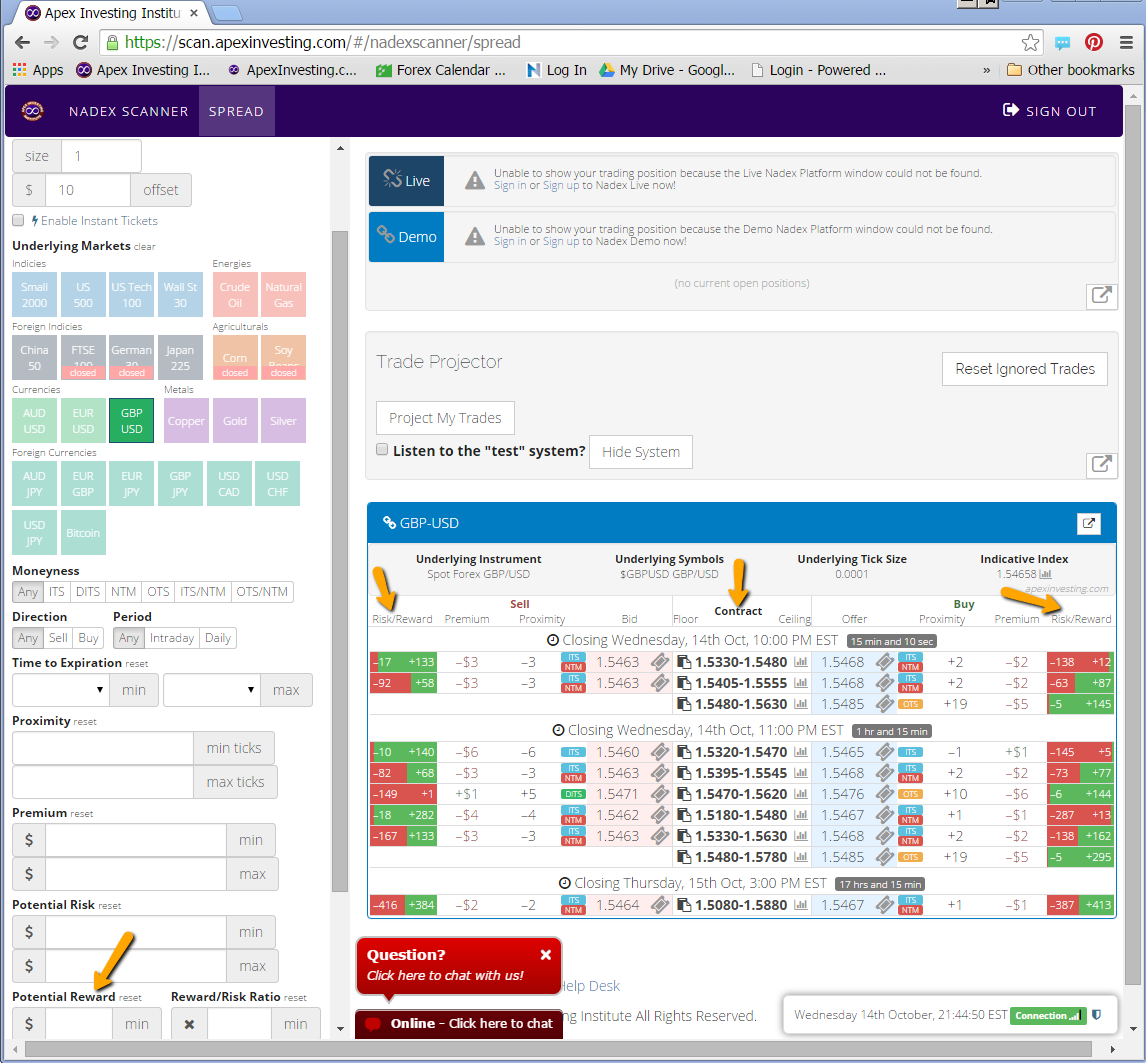

Before entering though, you need to be sure these spreads have a profit or reward potential of $35 or more. To find spreads that meet all the requirements above and to see that they have a $35 or more combined profit/reward potential, use the spread scanner available for free at www.apexinvesting.com. You will also need a demo or live account at Nadex and be logged into your account. Both take just a few minutes and are easy to open. For an example of what the spread scanner looks like, see below for a view of the scanner showing Nadex GBP/USD spreads.

To view larger image click HERE.

With this strategy, you are buying below the market and selling above the market, this is an ideal situation. Therefore, to make profit, all you need is for the market to stay where it is, move slightly, or move and then pull back, but basically stay or return between those prices. Based on the previous market analysis that kind of movement is typically what the market does after this report. Going back to the spread scanner, you can see to the far left the reward potential is listed for the spreads if you are selling them and then on the far right the reward potential is listed for buying them. For this trade you want the reward potential for each spread to be around $17 or more for a combined potential of $35. Depending on where your exact entry is, this will mean your break even points will be where the market moves up or down 35 pips. The place to call the trade and place your stops is where the market hits 70 pips up or down. This allows the market a 140-pip span to move and your trade is still within a 1:1 risk reward ratio. Max profit is when the market remains where it is or moves and returns to between your two spreads.

To learn more about Nadex and how to trade binaries and spreads as well as futures, forex and CFDs go to www.apexinvesting.com. Nadex is a US based CFTC exchange and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.