News will be coming out this Wednesday and Friday regarding Non-Farm Employment Change. The first article will focus on the trade strategy for Wednesday, January 6, 2016, at 8:15 AM ET, when the US ADP Non-Farm Employment Change report comes out. Watch for the second article, which will focus on the Non-Farm Employment Change release from the Bureau of Labor Statistics that comes out on Friday. The trade for Wednesday is a single strategy and one trade; however, the trade recommendations for Friday are numerous trade opportunities for that release.

The report Wednesday is from Automated Data Processing, (ADP), a company that does a great deal of payroll for companies throughout the US. It tells of the change in employment excluding farm and government employed people. Based on previous market analysis from reaction to this report, an Iron Condor strategy is recommended using Nadex Spreads.

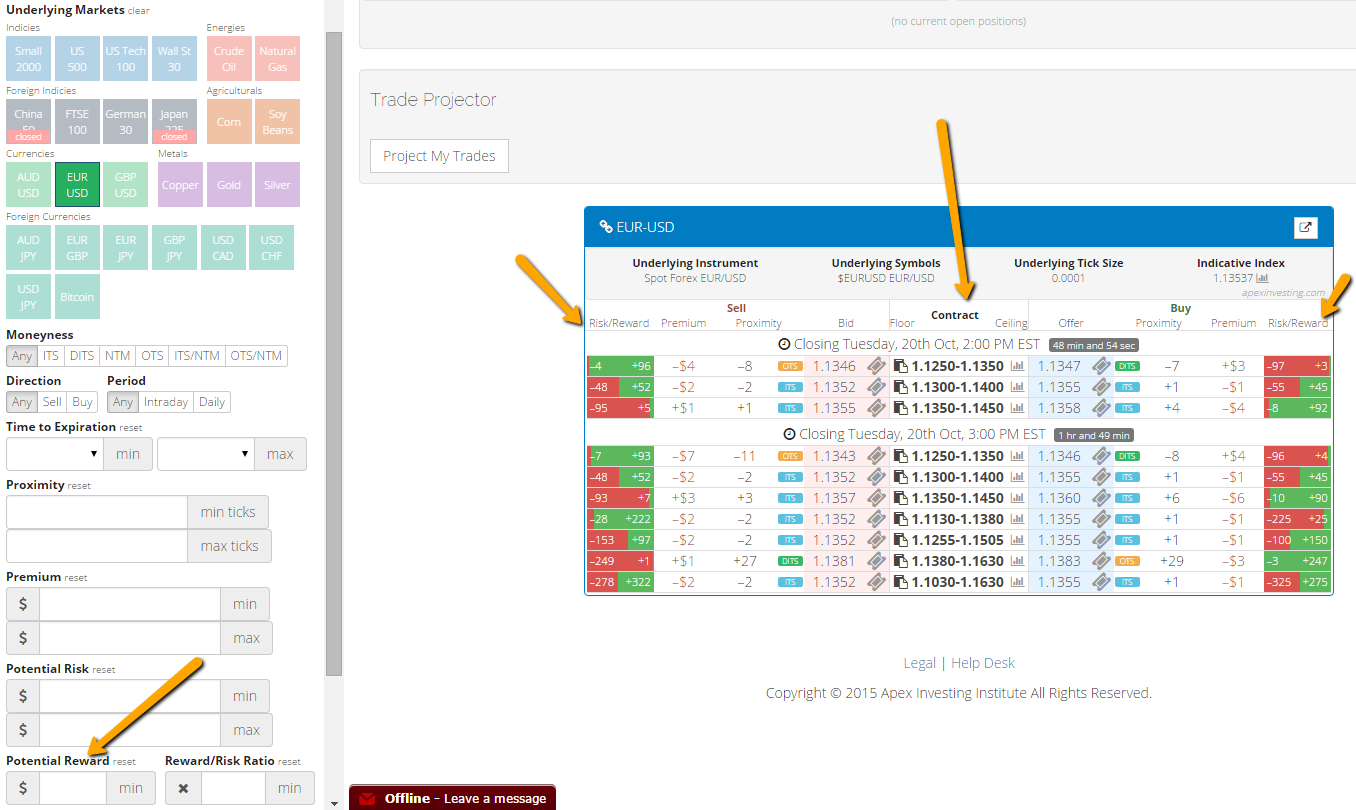

Nadex spreads enable you to trade a range of the market. They have a floor and a ceiling to the spread and you cannot lose or win past those points. This means you have capped risk. For this setup, you will buy a lower Nadex EUR/USD spread below the market with the ceiling where the market is trading at the time, and you will sell a Nadex EUR/USD upper spread with the floor where the market is trading at the time. You also want to make sure your Iron Condor has a profit potential of $30 or more combined between the spreads. To find this, just open the spread scanner available free at www.apexinvesting.com.

To view a larger image click HERE.

You can see the spreads are listed down the center of the scanner. The floor price is on the left and the ceiling price is on the right. If you look further to the side columns, you’ll see risk/reward is listed on the far left if you sell the spread and the far right if you buy the spread. For this Iron Condor setup, each spread should have a reward potential of approximately $15 or more. You can enter at 7:00 AM ET for a 9:00 AM ET expiration.

For this news event, the market tends to either range or make a move and then pullback, which is what you’re looking for on this trade. When the market is right between your spreads, in the middle of the Iron Condor at expiration, then you have max profit. You can set up stops where the market would reach 60 pips above or below from where it was when you entered. At those points, you reach a 1:1 max risk/reward ratio. This makes a range of 120 pips for the market to move within.

To find out more on how to trade Nadex binaries spreads as well as futures forex and CFDs visit www.apexinvesting.com. Nadex is a US based exchange and can be traded from 48 different states.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.