Before constructing, a building a permit is needed. The number of new US Residential Building Permits for the previous month is released monthly in an annualized format. The number of new permits is an important indicator for future growth of construction and housing. For this reason, it can be expected to get the market moving and be good for a news trade. This news is released Tuesday, April 19, 2016, at 8:30 AM ET.

In the past, the market has tended to react, make a move and then pull back. This kind of movement is perfect for using an Iron Condor strategy with Nadex spreads. Nadex spreads are day trading, short-term options that expire within hours, or last as long as a day. The spread gives you the option to trade a range of the market, long or short. The floor and the ceiling specify the range. When the market moves past the floor or ceiling, your trade is still in effect; however, your profit and loss amount only counts until the floor or ceiling. The advantage is you have capped defined risk going into the trade, unlike futures and spot forex trading.

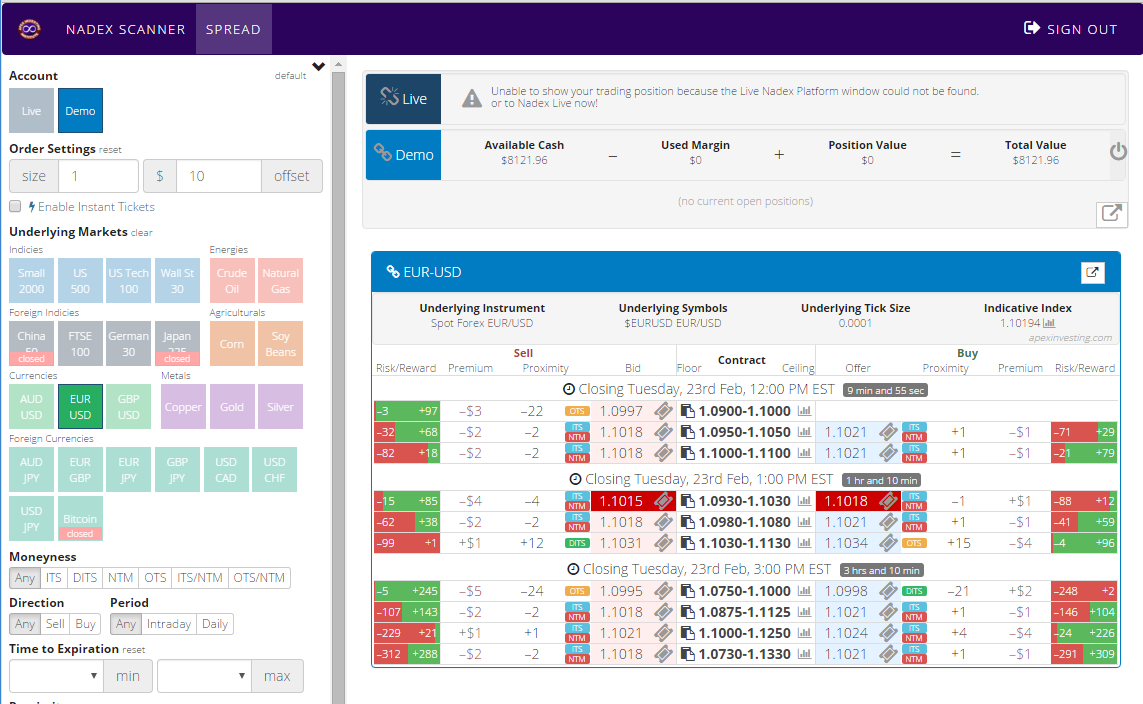

For the Iron Condor strategy, the risk/reward ratio will be 1:1, risking approximately $30 to make approximately $30. Buy a Nadex EUR/USD spread below the market and sell a Nadex EUR/USD spread above the market. The ceiling of the bought spread should meet the floor of the sold spread and be close to, if not exactly where the market is trading at the time. The fastest way to find the spreads for the strategy is to look for a Nadex EUR/USD spread with around a $15 or more reward potential on the sold side, and a Nadex EUR/USD spread with around a $15 or more reward potential on the buy side.

Learn Quickly With The Spread Scanner

Looking in the spread scanner designed to easily trade Nadex spreads, you can do learn quickly. Just choose your market, then look at the red and green risk/reward bars located on the left side of the window to sell the spread and the right side to buy the spread. You will find that the spreads that meet the reward minimum criteria on both sides should meet the floor and ceiling parameters necessary as well. Click the ticket icon and you are ready to enter your order info and click submit. You will also need to be logged into a Nadex demo or live account, which takes only moments to open. Be sure to demo any trade first.

To view a larger image click HERE.

Place stop limit orders to keep your risk to a 1:1 ratio. The strategy buys below the market and sells above the market and max profit is when the market, back from any movement, is right between the two spreads at expiration. For every pip away from the center the market is at expiration, it is only $1 off of profit. Where the market really moves up or down by 60 pips, is where you would want to exit to manage risk and keep it to around $30. That gives the market 120 pips to move around in. At expiration, if the market is within approximately 30 pips above or below the center between the two spreads, you will have made some profit. After the trade, be sure to cancel your stop orders if they were not hit.

For more news trades and strategies to trade them, as well as access to the spread scanner, available free to all traders, visit www.apexinvesting.com. Nadex is a CFTC regulated exchange located in the US and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.