The Capacity Utilization Rate and Industrial Production numbers will be out Tuesday at 9:15 AM ET. The two reports can cause the EUR/USD market to move, making a trade opportunity.

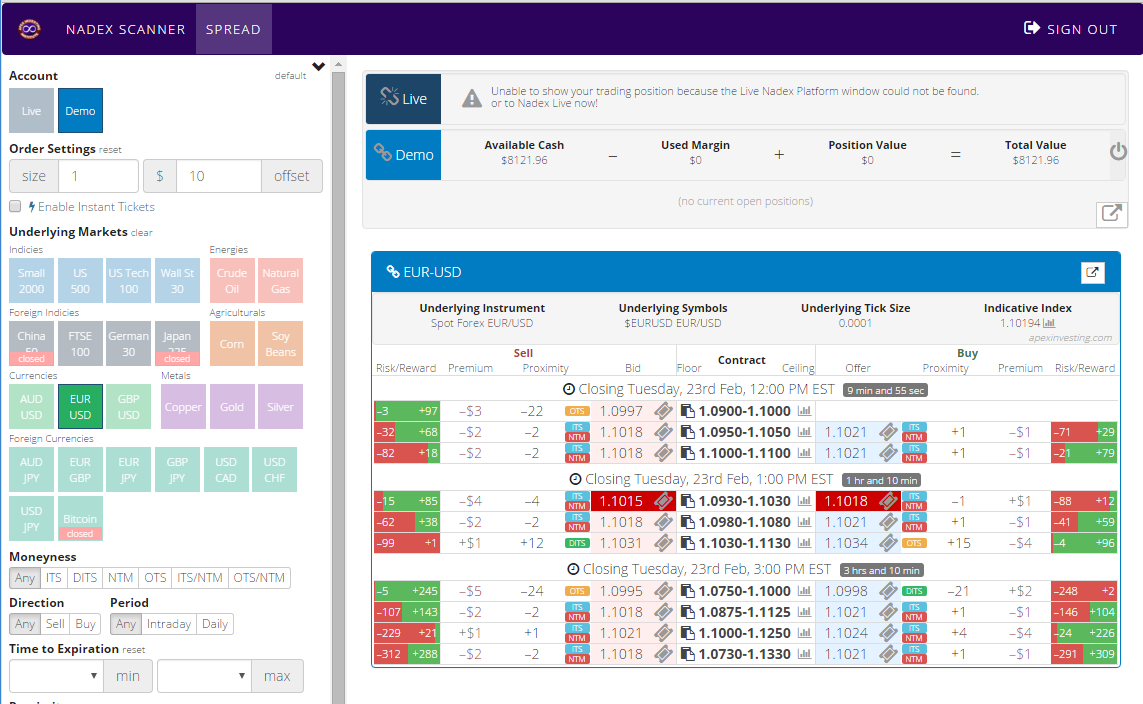

The Iron Condor strategy can work here by trading two Nadex EUR/USD spreads, buying one and selling another. One could buy a spread below the market but with the ceiling where the EUR/USD market is trading at the time. One could also sell a spread above the market but with the floor where the EUR/USD market is trading at the time. Entry can be as early as 8:00 AM ET for 10:00 AM ET expiration. This strategy is good for when it is anticipated the market being traded will make a move and then pull back. If the market pulls back to where it was when it started to move and when the trade was entered, that is ideal. The profit potential for this trade is $30 or more combined between the spreads. Each spread should have a profit potential of around $15 or more. To view a larger image click HERE. To manage risk, use stop limit orders. One could place one above where the market would hit 60 pips above and one 60 pips below from where it was when the trade was placed. Those points are the 1:1 risk/reward ratio points.

Always demo the trade first with a Nadex demo account. The spread scanner can be found at www.apexinvesting.com along with free education.

To manage risk, use stop limit orders. One could place one above where the market would hit 60 pips above and one 60 pips below from where it was when the trade was placed. Those points are the 1:1 risk/reward ratio points.

Always demo the trade first with a Nadex demo account. The spread scanner can be found at www.apexinvesting.com along with free education.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In:

Binary OptionsNewsEducationEurozoneFuturesCommoditiesOptionsForexMarketsGeneralbinarybinary chartsbinary optionsbinary scannerbinary signalsBZ Sponsored; apexinvestingdarrell martinday tradinghow to tradenadex binariesnews release trades EUR/USDnews trading ideasnorth american derivative exchangepost newspremium collectionprenewsscalpingspike strikerspread optionsspread scannerThe Better Betweekly options

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in